Digital art trading involves the sale and purchase of digital art. These artworks can include paintings, GIFs or pictures of music. In the past, many artists had no way to sell their work without going through agents or auction houses. It meant they could only make a tiny fraction of the artwork's value.

Artists now have a new opportunity to earn resale royalty income from digital art thanks to non-fungible tokens (NFT), that trade on the blockchain. This allows artists to create a smart contract which triggers a royalty payment when their NFT artwork is sold on the secondary marketplace.

How to trade crypto art

First, you'll need to find a crypto wallet that supports NFTs. These wallets may be downloaded to your mobile device and can be used to connect to NFT platforms to sell and buy crypto assets. After that, upload your artwork on the NFT platform.

The blockchain is used to give digital objects uniqueness and digital scarcity. Crypto art is a new kind of digital art. This allows digital artists the ability to create works with a higher level of value than before. It's impossible to reproduce an NFT asset indefinitely.

NFTs have the primary benefit that artists can prove the authenticity and receive resale royalty payments from sales of digital art. This can increase an artist's ability to make a living through their art.

For digital artists who wish to make their work visible, curators of NFT marketplaces can be a great place. These platforms are subject to a lot more scrutiny in order to ensure only the best digital artists are listed.

Once you've signed up with one of these curated NFT marketplaces, you can start minting your artwork on their platform and sell it for an agreed upon price. You will also have to select how many copies to sell on NFT platform. This can affect the value of the work.

NFTs are able to be used for all types of digital commodities. These NFTs, digital assets that are used to represent the commodities, can be traded on blockchain.

How to trade NFTs

NFTs, a new type of speculative investing, allow investors to purchase and hold digital assets for a time with the hope that their future value will rise. These assets can also be used to diversify portfolios by crypto enthusiasts.

FAQ

What is the best trading platform for you?

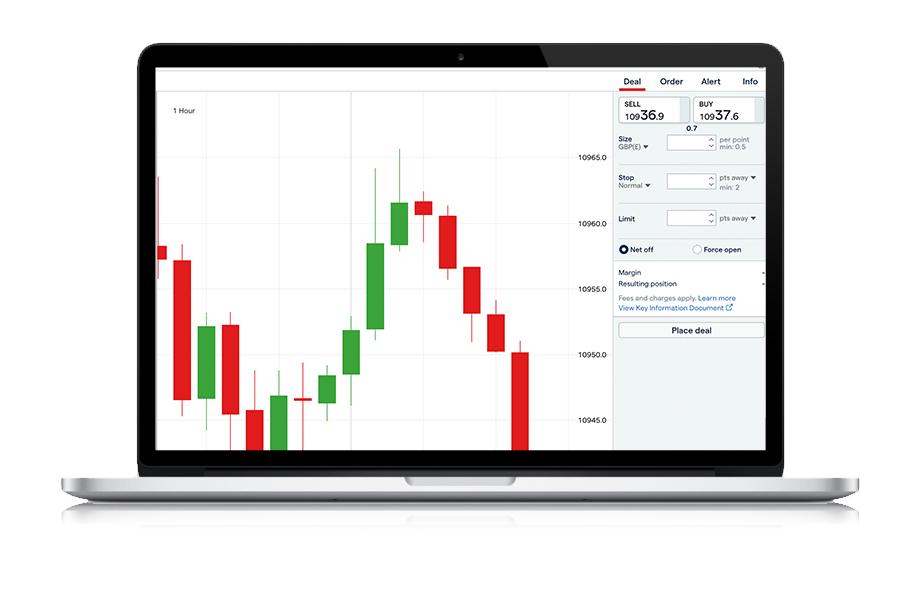

Many traders can find choosing the best trading platform difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

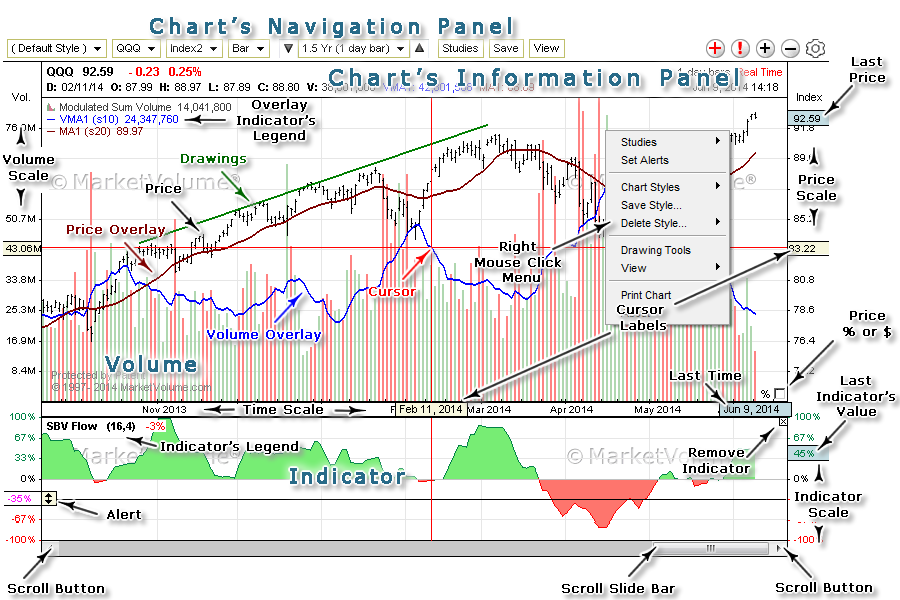

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. The interface should be intuitive and user-friendly.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. This will help you narrow your search for the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Which is harder forex or crypto?

Each currency and crypto are different in their difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. There are many other investment options available.

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

How can I invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need is the right knowledge and tools to get started.

The first thing to understand is that there are different ways of investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, research any additional information you may need to feel confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. Keep an eye on market developments and news to stay current with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Can forex traders make any money?

Yes, forex traders can earn money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investments require security. Online investments pose risks to your financial and personal data. Take steps to reduce them.

It's important to be aware of who you are dealing directly with on any investment platform or app. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer funds to them or give out personal information, do your research.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. You should also use different passwords to protect each account from being compromised. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!