DappRadar enables users explore and track decentralized application applications. It provides a variety of useful functions, including portfolio management, payment options and stake-taking. The company claims that it supports over 8,000 apps and has approximately four million unique users annually.

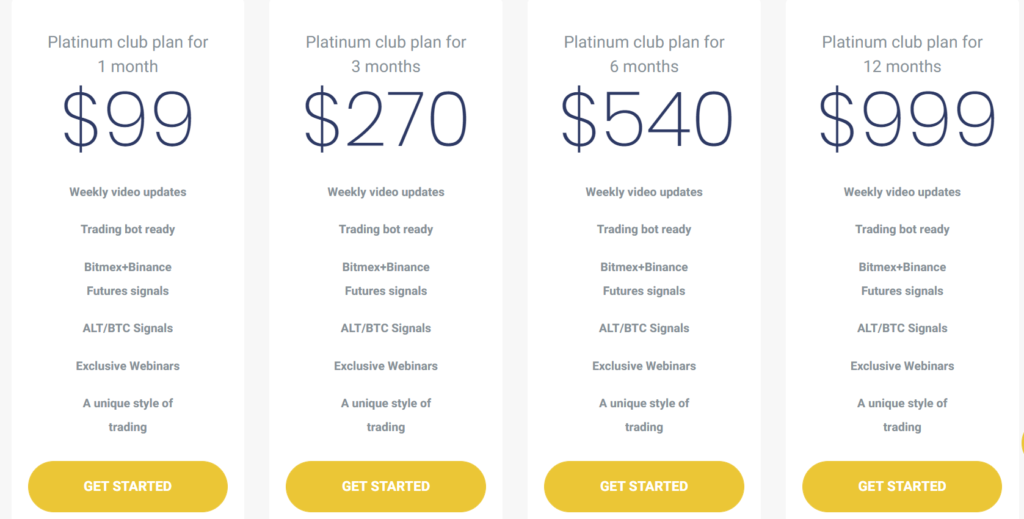

DappRadar will launch a native token called RADAR. This token, called RADAR, will be based upon the Ethereum blockchain. It will be used as a payment method for the service. RADAR token holders will have access to DappRadar's PRO section. This section offers exclusive analysis, new collections, and early access. RADAR holders are eligible to participate in the staking process and receive rewards.

The primary purpose of RADAR token is to reward its users. However, the token can also be used as an incentive to DappRadar members to contribute. This includes staking, voting, and proposing recommendations. Additionally, RADAR holders can be a part of product decision making.

RADAR is a staker that can be used to support the Ethereum network's dapps. In the same way, DappRadar members can vote on projects and take part in DappRadar's community. This token can also be used to manage the governance token for DappRadar DAO. RADAR is a token that will enable the platform's portfolio tools to be improved and its coverage expanded.

DappRadar, an open source project, is DappRadar. It has partnered to the LayerZero protocol to enable smart contract communication across chains. DappRadar will be able to eliminate gas fees from the Ethereum blockchain through this protocol.

According to the recent DappRadar industry report, the total number of dapps on the platform has increased 396% from the first quarter of 2021. Furthermore, 2.4 million unique wallets are interacting with Dapps daily. The company believes the multichain blockchain industry will be the future. Therefore, the company strives to create an ecosystem which benefits both developers as well as users.

Currently, the total RADAR coin supply is 10 million. DappRadar has plans to expand the token’s use and is currently developing a second phase. RADAR can also easily be traded over the Web3 network.

DappRadar provides four utility tokens as well. These include Contribute2Earn, Boosts, Portfolio, and Polygon. These services can be obtained by users either by purchasing them from the marketplace or by airdropping them.

DappRadar's recently announced cross-chain token staking mechanism is a groundbreaking innovation. It eliminates the need to bridge assets, thus drastically reducing staking fees. The protocol guarantees a smooth user experience across all chains.

DappRadar was a pioneer within the multichain Blockchain sector. In addition, the company aims to be a leading platform for users to discover and analyze decentralized applications. The company is committed to offering the world's largest app store.

DappRadar has been working on the development a full-scale Dapp Store. With a boosted community, dapps can gain additional power and unlock various possibilities.

FAQ

Frequently Asked questions

What are the four types of investing?

Investing is a way for you to grow your money and possibly make more long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into two groups: common stock and preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Where can I earn daily and invest my money?

Investing can be a great way to make some money, but it's important to know what your options are. There are many options.

One option is to invest in real property. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

What is the best trading platform for you?

Choosing the best trading platform can be a daunting task for many traders. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down your search to find the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

What are the benefits and drawbacks of investing online?

Online investing is convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online trading is a great way to get real-time market data. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing is not without its challenges. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. Some investments may also require a minimum investment or other restrictions.

Do forex traders make money?

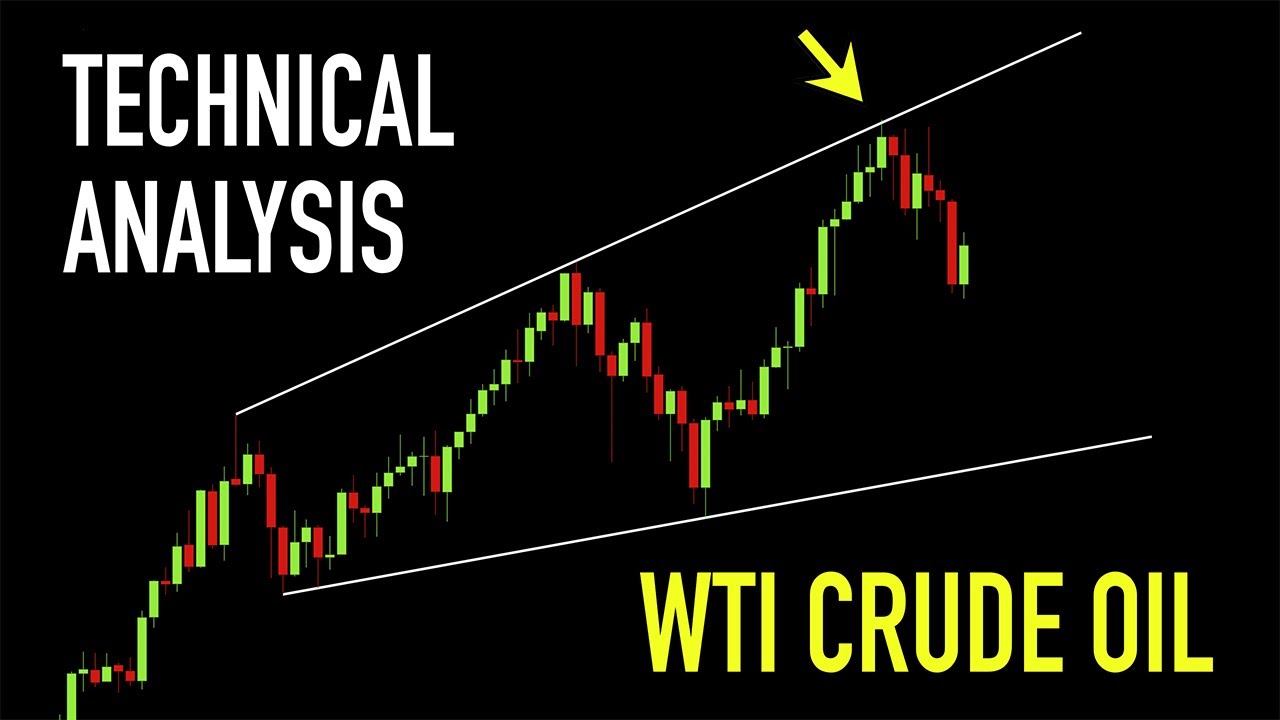

Forex traders can make good money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

How can I invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need is the right knowledge and tools to get started.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, gather any additional information to help you feel confident about your investment decision. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Online investment accounts should be safe. It's vital that you protect your data, assets and information from unwelcome intrusion.

You want to ensure that the platform you use is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Thirdly, it's important to understand the terms and conditions of your online investment platform. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, make sure you do thorough research about the company before investing. Look at user reviews to get a feel for how the platform works. Make sure to understand the tax implications of investing online.

Follow these steps to ensure your online account is protected from potential threats.