The Motley Fool provides a variety of services to help investors, including guidance on crypto-currency and other new technologies. From the "Dividend Stock Alert" newsletter to the "Rule Breakers" portfolio service, you can find a variety of options to help you invest wisely.

Dividend Stock Alarm is a monthly newsletter. It focuses on finding high-growth businesses that pay high dividends. The newsletter also contains a stock watchlist, buy-and-sell suggestions, and a stock-watch list. A quarterly recommendation can be received, along with precise advice on portfolio allocation. Access to interviews with Fool analysts is another benefit. A subscription to Everlasting microcap stock advisor is available for those who are interested in investing in microcaps. This service provides advice on small-cap stocks.

Next Gen is another service that provides guidance on new innovations in technology. Its portfolio of stocks is based around a theme, such as self-driving cars or "cord cutting" stocks. The company is currently offering this service only in the US but plans to expand it to Canada and other countries.

Motley Fool Market Pass is a higher-end portfolio service that features four analyst teams. Each team is unique and sends out one recommendation each month to subscribers. For example, the "Rule Breakers" team focuses on cannabis-related companies, and the "Next Gen" team aims to find new tech-driven companies with a 40x growth potential.

Motley Fool's Everlasting service is the final in a series of services. These services promote innovation and growth. Some of the other services in this group include the "IPO Trailblazers" portfolio service and the "Everlasting Stocks Upgrade" service.

The company has introduced an AR trading service called Extreme Opportunities. The service used to previously be known as Discovery: IPO-Trailblazers. Since its launch, the portfolio's value has steadily increased, reaching over 120% in January. The portfolio is currently worth $8,700. However, the price will drop as speculators burn through their money in the next months.

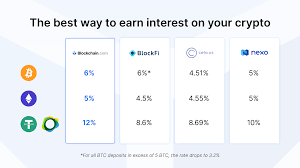

Although crypto currencies are a hot topic in recent news, it's important that you remember that investing in them is not a smart investment. The purchase of crypto currencies is gambling. There are no guarantees of profits. However, it's becoming increasingly popular and there are a few options you can try out. Before you make a decision, it's always best to speak with an independent financial adviser to ensure your decision is a good one.

FAQ

Which is safe crypto or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. It can be confusing to choose the right one, with so many options.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It must also be easy to use and intuitive.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Demo accounts and free trials are a great way to test virtual money before investing any real money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. This information will help you narrow down your search and find the best trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Which trading site for beginners is the best?

Your level of experience with online trading will determine your ability to trade. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

You can also trade independently if your knowledge is good enough. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Frequently Asked Fragen

What are the 4 types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be divided into preferred and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

You can also make a profit if your risk is taken and you do your research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Where can you invest and make daily income?

However, investing can be an excellent way to make money. It's important to know all of your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Safety is a must when it comes to online investment accounts. Protecting your assets and data from unwanted intrusion is essential.

You must first ensure that the platform you're using has security. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

It is important to be familiar with the terms and conditions of any online investment platform. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, be sure to research the company where you plan on investing. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Finally, be sure to know about any tax implications that investing online can have.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.