Wheat futures are contracts in which a buyer agrees on taking delivery of a set quantity of wheat at a predetermined cost and at a particular date. Many factors can affect the price of a Wheat Futures Contract, such as weather and global trade patterns.

Chicago SRW is the world's most liquid and largest wheat futures contract. In 2013, it traded more than 15 million tons. Because it is large in liquidity, it offers a competitive advantage over other futures.

This liquidity has allowed us to create spreads that can both be used for hedging or trading. These spreads are typically determined by price differences between the next futures contract and one that expires following the near futures contract.

These spreads can be traded on a number of different trading platforms, including CME Globex and the CME ClearPort exchange. This provides traders with access to a wide range of domestic and international wheat futures products.

Traders use Chicago Wheat and KC Wheat futures in order to spread risk within the larger grain market as well as to hedge their physical exposure. CME Group provides market participants with confidence in a stable, secure environment by backing these contracts.

Several times a year, the USDA issues reports containing information on crop supply and demand. These reports have a direct effect on the price of wheat and other crops, especially if released in the morning.

These reports are not always accessible on the date of their publication and can be delayed or moved at other times. This can cause an influx of price volatility in the markets until these reports are made available.

Therefore, trading in wheat and corn futures may not be as efficient as it could. Traders can be subject to price movements that are not based on their usual expectations, as the market may be over- or under-estimating production or demand.

Additionally, many factors can influence the price for wheat and corn futures. This includes harvest conditions and climatic changes. Weather and competition from other commodity derivatives products. For example, if an unusual drought or flood threatens to reduce production or increase demand, wheat and corn prices will likely rise as they try to protect their profit margins.

For these reasons, it is important for traders to understand the difference between a long and short position in wheat futures. A long position is a contract where the buyer agrees that he will buy wheat from the seller at a specified price and on a particular date.

The short position is on the other side a contract whereby the buyer does not agree to purchase wheat from the seller at this price. This is commonly referred to as "hedging" and it is the most common type of market position in wheat futures.

CME Group's Agricultural options and futures are used by over 90 percent of world's agricultural markets. They help manage risk and enable real-time price discovery. These markets were created to assist traders in managing their risk and maximising their profits over the last century.

FAQ

What are the advantages and drawbacks to online investing?

Online investing has the main advantage of being convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, there are some drawbacks to online investing. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

You should also be aware of the different investment options available to you when investing online. Investors have many choices: stocks, bonds or mutual funds. Each investment comes with its own risks. You should research all options before you decide on the right one. There may be restrictions on investments such as minimum deposits or other requirements.

How can I invest Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You only need the right information and tools to get started.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. Keep an eye on market developments and news to stay current with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is more difficult, forex or crypto?

Both forex and crypto have their own levels of complexity and difficulty. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Are forex traders able to make a living?

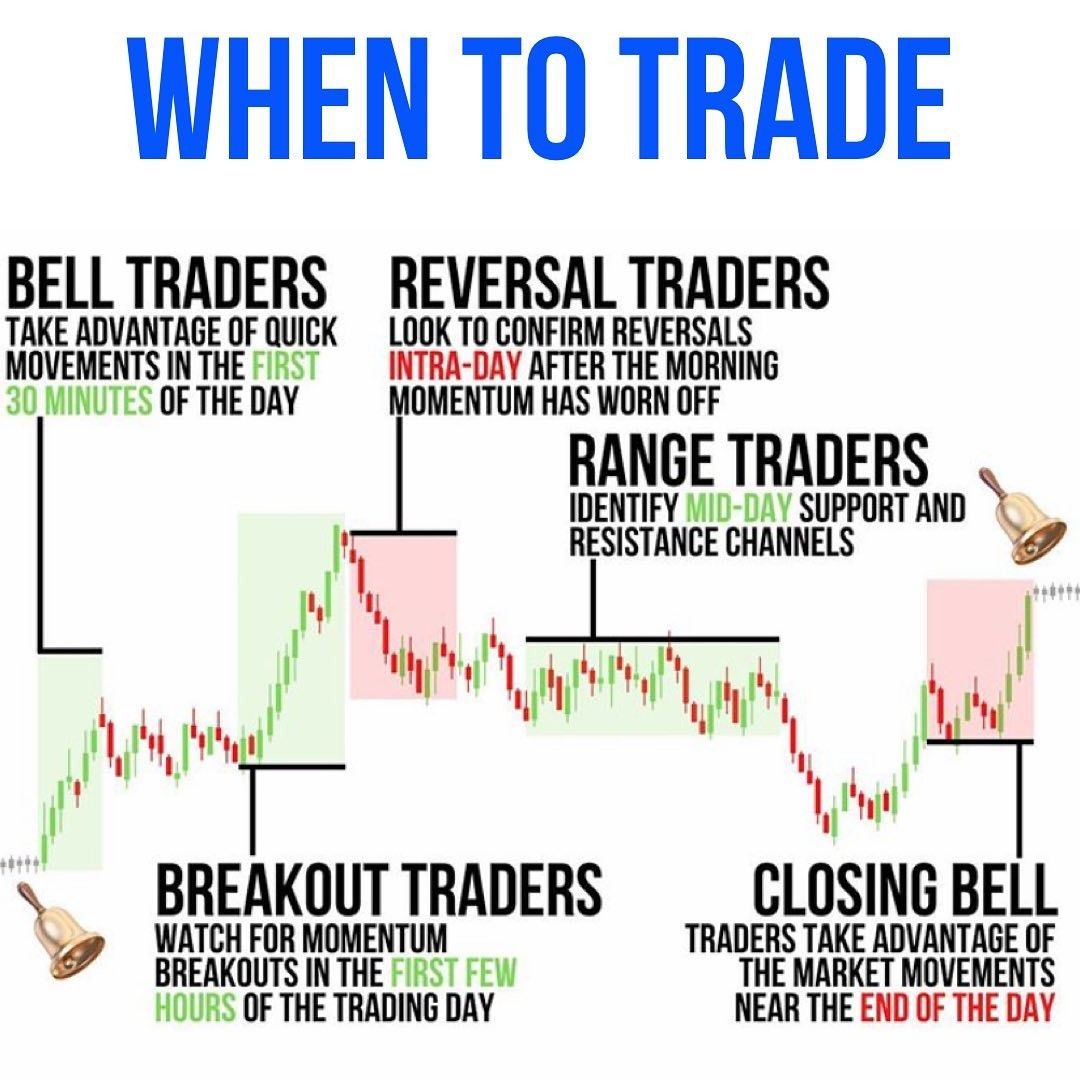

Yes, forex traders can make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

It is important to research both sides of the coin before you make any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I protect my financial and personal information when I invest online?

When investing online, security is crucial. Online investments pose risks to your financial and personal data. Take steps to reduce them.

You must be mindful of who your investment platform or app is dealing with. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. Auto-login settings should be disabled on all your devices to make sure that your accounts are protected from unauthorized access. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Last but not least, make sure to use VPNs when investing online. They're often free and easy!