GBP to USD, also known as British Pounds to US Dollar, is one the oldest and most frequently traded pairs on the FX market. It is often referred to simply as Cable. However, it is also one of the most liquid currency pairs, making it a valuable trading option. It has been a profitable currency pairing for forex traders in the past.

The United Kingdom (UK) and the United States (USA) are the two largest economies in this world. Both countries have large exchange currency needs. In recent years, the European debt crisis has added to this demand. These countries also have a large trade agreement with each other. These countries should therefore exchange their currencies often.

While there are many reasons why a pound sterling to dollar exchange rate could fluctuate, the most important factor is monetary policies. Monetary policies are the processes of setting interest rates in order to influence the currency's worth. This could cause extreme fluctuations in the GBP/USD exchange rate.

The UK's monetary policies are managed by the Bank of England. It issues the currency and acts as the lender of last resort. To inform the market, the BoE issues a statement whenever it increases or decreases rates. During steady monetary policy, however it doesn't issue rate statements.

While the British pound and US dollar have a strong economic relationship, they are not necessarily correlated. Monetary policy and economic indicators are the main drivers of the GBP/USD currency pair.

Non-farm employment figures, for instance, can provide a useful indicator of the economic health. In the UK, the Office of National Statistics publishes monthly employment statistics. Because these figures can be affected differently, they are crucial in analysing the economy.

The Federal Reserve on the other side plays a significant role in influencing U.S.monetary policy. Eight interest rate announcements are made annually by the Fed. In the event that the Fed raises rates, it can result in violent movements in the GBP/USD rate. Equally, lower rates can lead to a drop in the value for the pound.

The British pound has historically held an advantage over the US dollar. The Great Recession saw the UK's currency fall sharply. In 2008, the GBP/USD was at a low point of $1.40. The pound traded at 1.6 against the dollar after the recession ended.

Today, the USdollar is the most widely traded foreign currency. It is the most traded currency, with the largest reserves. This reserve can be used by oil-producing countries to make a petrodollar. The United Kingdom is third in reserve currency.

The United Kingdom has a close relationship with the United States on both an economic and political level. Both countries have the ability to exchange currencies and they share a common language. The EU referendum and European debt crisis have made the pair more volatile.

It is important to stay informed about the developments in both the UK and US, regardless of what factors may affect their value. It is also important to use the live currency convertor to ensure that you receive the best price for buying and selling foreign currencies.

FAQ

What are the advantages and disadvantages of online investing?

Online investing has the main advantage of being convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

When considering investing online, it is also important that you understand the types of investments available. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which platform is the best for trading?

Choosing the best trading platform can be a daunting task for many traders. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? These factors will help you narrow down your search to find the right trading platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Make sure your platform has the right security protocols to protect your data against theft or breaches.

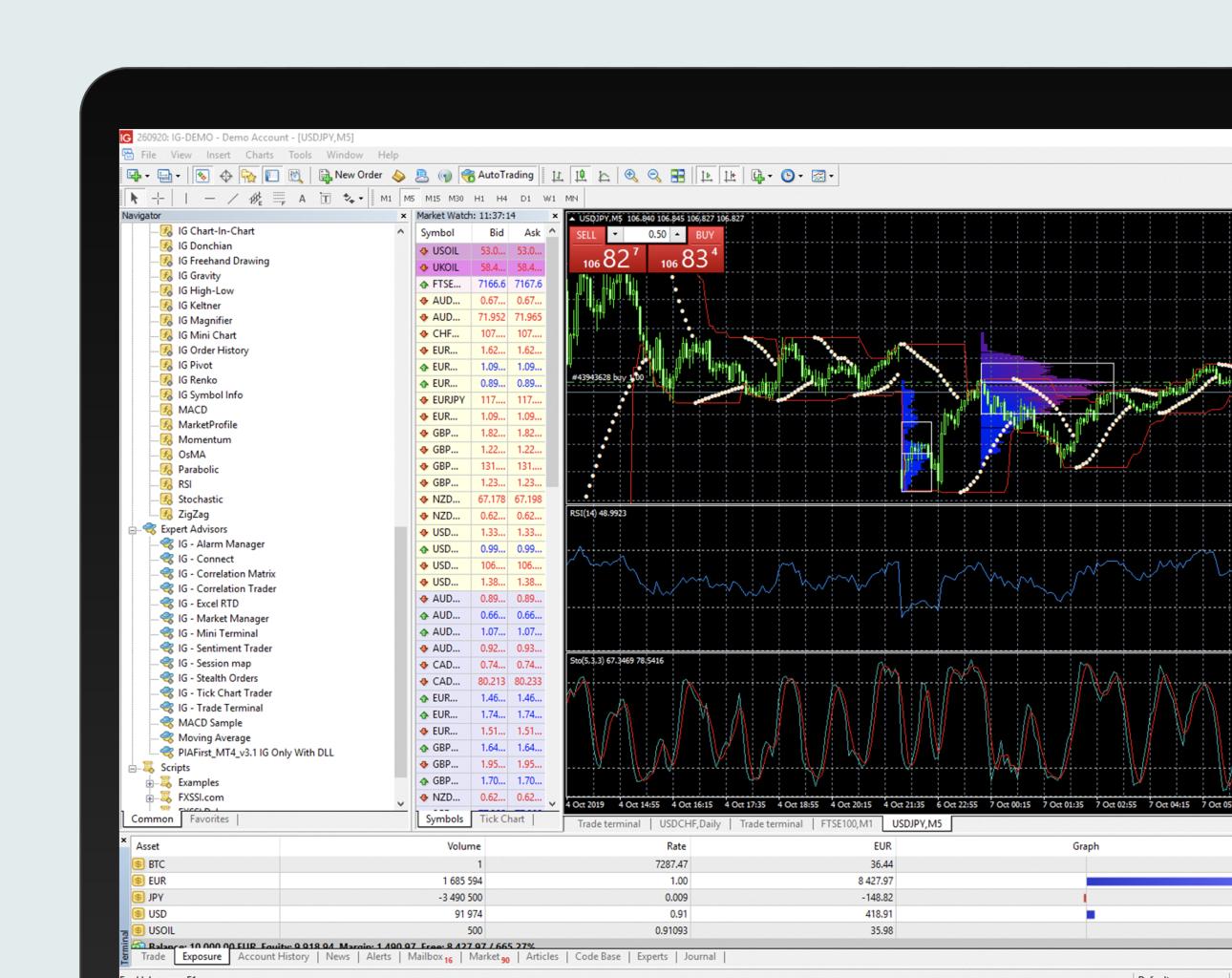

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is more secure, forex or crypto?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

How can I invest bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

There are many options for investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

What is the best forex trading system or crypto trading system?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important that you understand the different trading strategies available for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Where can i invest and earn daily?

Although investing can be a great investment, it's important that you know your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is to buy real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can my online account be secured?

Safety is a must when it comes to online investment accounts. Protecting your assets and data from unwanted intrusion is essential.

First, ensure the platform you are using is secure. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Thirdly, it's important to understand the terms and conditions of your online investment platform. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, be sure to research the company where you plan on investing. Look at user reviews to get a feel for how the platform works. Finally, make sure you are aware of any tax implications associated with investing online.

These steps will ensure your online investment account is protected against any possible threats.