It can be a great way for you to become involved in the cryptocurrency world by buying and trading nfts. This can be risky as it's not well-regulated and isn't as popular as trading other digital assets. So before you start, it's important to know how to buy and sell NFTs, what their trading meaning is, and which are the best places to buy them.

NFT trading is selling non-fungible tokens. These digital assets don't exist physically. These include emojis. music tracks. game items. even basketball cards.

NFT marketplaces enable people to purchase and sell NFTs. These assets form part of a digital investment portfolio that can also be used for other purposes. NFTs are used to support artists or musicians, access Discord servers and make purchases at gaming sites or other online stores.

There are many options for buying and selling NFTs. However, the most popular is to use a cryptocurrency exchange. These exchanges accept multiple types of cryptocurrencies, including Bitcoin and Ethereum.

Some exchanges will only show you NFTs that are backed by certain types of currency, while others allow you to trade with all kinds of cryptos. To avoid getting scammed and having your money stolen, it's important that you understand which coin your NFT is backed.

Before purchasing an NFT, you should read the terms of the seller. These terms may vary from one exchange to another, so make sure you understand them.

NFT trading is a huge business. Celebrities and brands are now entering the market to make money. Some are even using NFTs to promote their products and services.

Taco Bell, Coca-Cola and others have created NFTs in an effort to increase their sales. They also have NFT marketplaces as partners to help their customers locate the NFTs they need and to collect them.

These NFTs are very popular and can fetch a lot of money. These NFTs are likely to sell for five to ten times their initial price, but they can also be resold over time.

These NFTs may be created by the original artist or by licensed companies. These NFTs can be extremely valuable. But you should ensure you're dealing only with a licensed artist or company before purchasing an NFT.

Buying NFTs is simple, but it's important to remember that they're not the same as a physical artwork. They're not tangible, and once they're on the Internet, they're free to be used by anyone. So if you're looking to buy an NFT, it's a good idea to look at the artist's website or social media pages and see how they're promoting their NFTs.

FAQ

What are the pros and cons of investing online?

Online investing offers convenience as its main benefit. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online trading is a great way to get real-time market data. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, there are some drawbacks to online investing. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

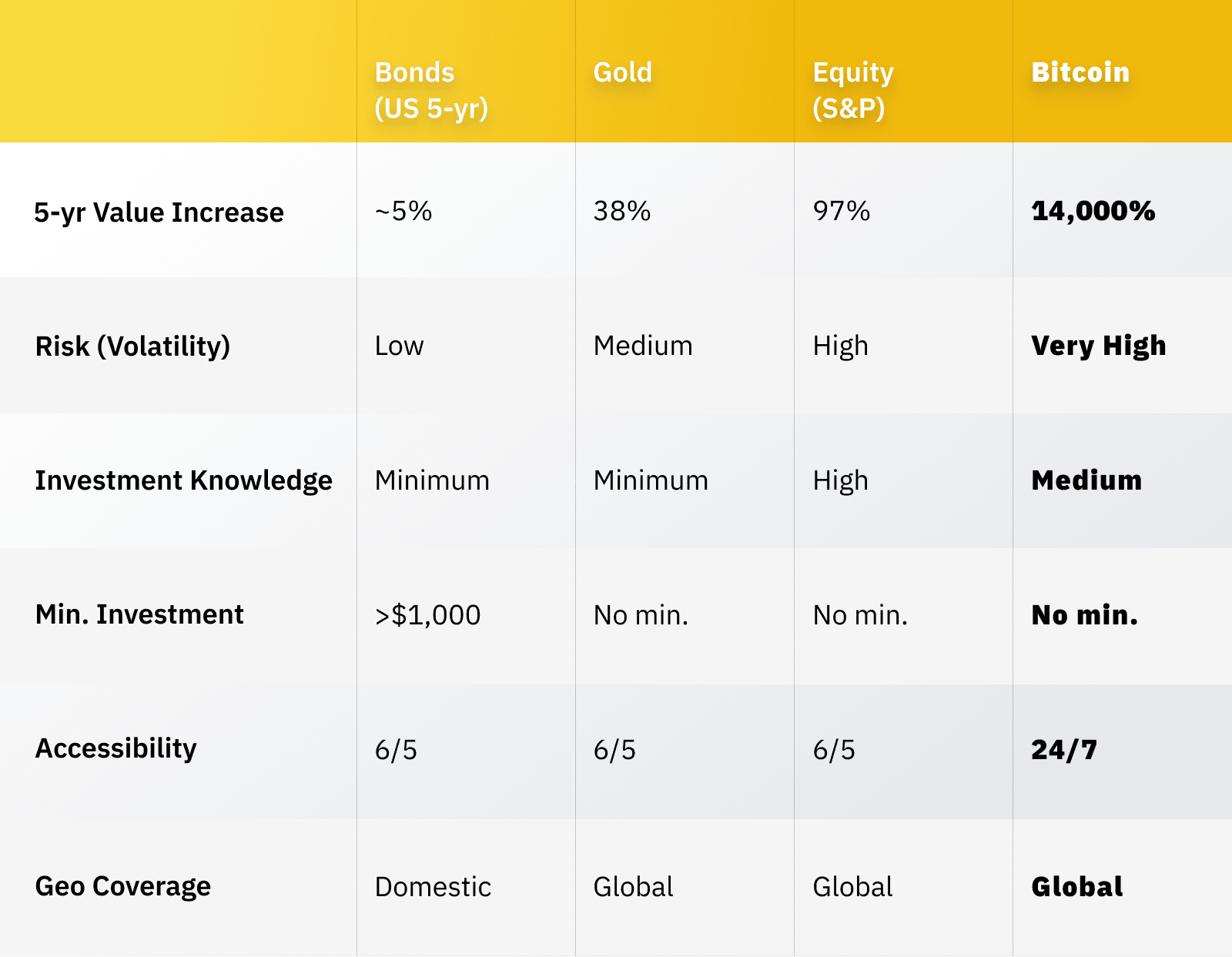

You should also be aware of the different investment options available to you when investing online. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. Some investments may also require a minimum investment or other restrictions.

Trading forex or Cryptocurrencies can make you rich.

Trading forex and crypto can be lucrative if you are strategic. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. You should also trade with only the money you have the ability to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

What is the best forex trading system or crypto trading system?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to know the types of trading strategies you can use for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which is more safe, crypto or forex

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Frequently Asked questions

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four main types of investing: stocks, bonds and mutual funds.

There are two kinds of stock: common stock and preferred stocks. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Are my investments safe online? Or should I look into other options?

Money can be complex but so can the decisions about how to store it. There are many options to protect your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?