Trade Desk stock was up 6% in premarket on Wednesday following strong quarter 4 results by the advertising technology company and an outlook that beat analysts' expectations. The company is expecting to post a 2.82% year-over-year profit margin and 0.20% for the entire year.

The company also indicated that revenue growth will be around 13%. This is well ahead of the expectations. It should be driven by an increase in demand for its cloud-based technology that ad buyers use across multiple devices to create and optimize digital advertisements.

The technology platform allows advertisers to optimize their advertising spend and place the right ads in front the right buyers at the right times. This company's technology can be used to run digital advertising campaigns that include native, audio, and display.

E*TRADE: This brokerage company is well-known for its excellent trading technology. It also offers a wide range of options analysis tools. You can also trade journal and use automated trading strategies.

TD Ameritrade: This broker is known for its outstanding trading platform, and it offers excellent market commentary and analysis. In addition, it has an expansive portfolio of educational content, including a quarterly print magazine, thinkMoney.

Ticker Tape Portal: The Ticker Tape Portal is a rich source of information on daily markets, savings, retirement and trader education. Its articles cover a wide array of topics, and are largely sourced via the TD Ameritrade Network.

Mobile: TD Ameritrade Mobile has all the features you would expect of an online broker. Chat with a live trader or place orders from your tablet or phone.

Quote Overview: The quote overview page provides a snapshot view of the symbol's current price and new trades. It also displays historical prices, news, and real-time Cboe BZX pricing.

Desktop Charting: Thinkorswim desktop charts are so sophisticated that they rival TradeStation. With dozens of charts streaming real time data, Thinkorswim desktop charts is extremely advanced. Traders can even overlay economic events and company news to model the future.

Research: Thoughtorswim’s comprehensive research library includes hundreds of technical articles. This database is based upon proprietary algorithms and is regularly updated. It is supported by leading academic journals that have independent research.

Stock Advisor: The Stock Advisor service is a popular investment advisory and research firm that specializes in market-beating stock picks. Its recommendations are based on a rigorous research process and have outperformed the market by an average of 10% per year since inception.

Public: The Public App is a great option for new investors. It's easy and straightforward to get started. The interface is easy to use and has a buy button for adding shares of your favorite businesses to your account.

Trade Desk is a company that is very popular in the digital ads market. It has a strong growth outlook for the future. The company's strong ad sales growth and strong financial performance should help to drive share price higher in the long run. The company is also a leader in programmatic advertising, which means it has a unique position in the rapidly growing digital ad industry.

FAQ

Which trading site is best for beginners?

Your level of experience with online trading will determine your ability to trade. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which platform is the best for trading?

For many traders, choosing the best platform to trade on can be difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Can one get rich trading Cryptocurrencies or forex?

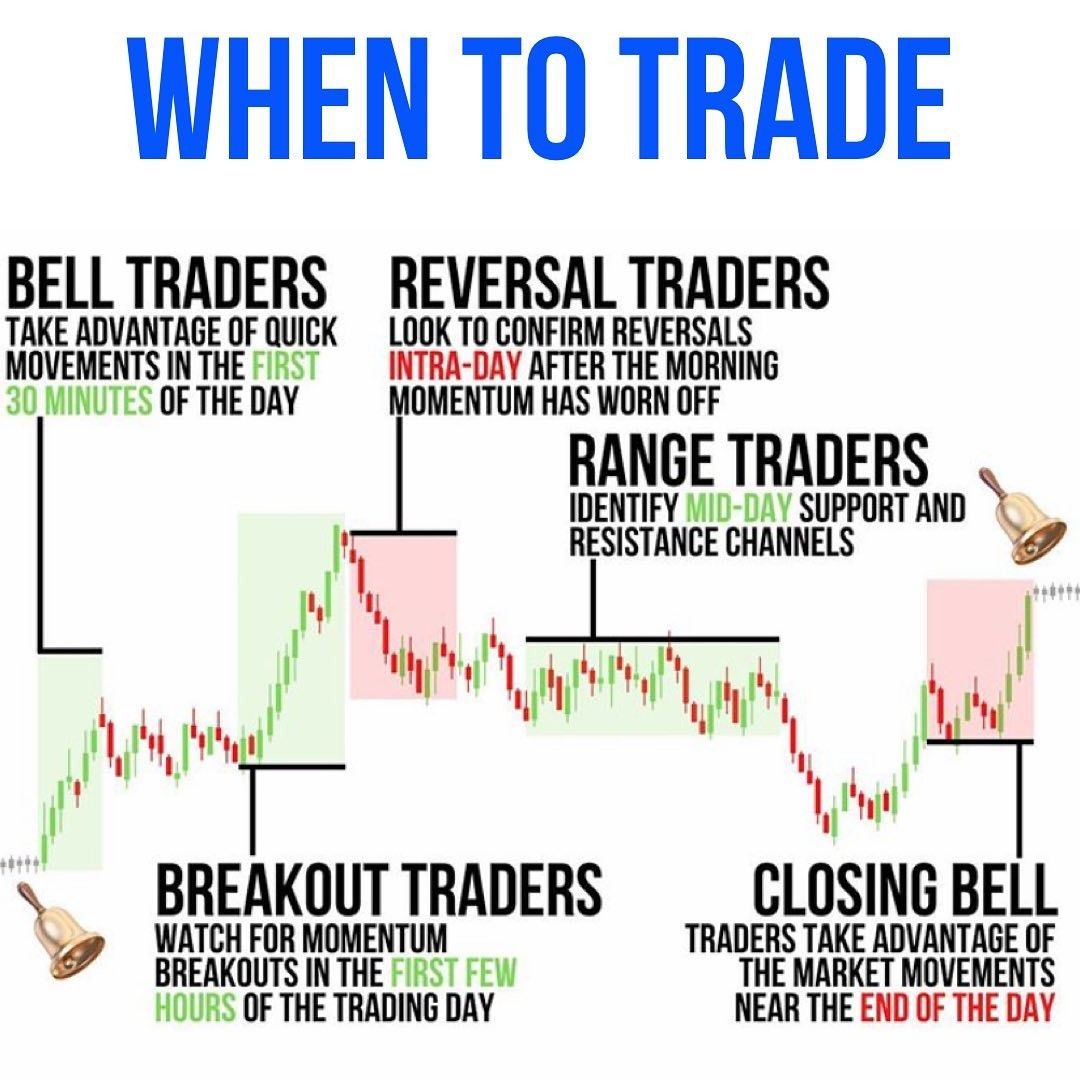

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Trading with money you can afford is a good way to reduce your risk.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is better forex trading or crypto trading.

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

It is important to research both sides of the coin before you make any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

How Can I Invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. To get started, you only need to have the right knowledge and tools.

The first thing to understand is that there are different ways of investing. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

The next step is to research additional information you might need in order to be confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Where can I invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is to invest in real property. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Online trading is possible if you're comfortable with the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

Money can be complex but so can the decisions about how to store it. Your valuable assets require a strong security system and you have a few options.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.