Axie Infinity is an emerging crypto game which has made its presence known in the past few months. The game is based on Ethereum and uses a Ronin Ethereum sidechain. It also features a non-fungible token (NFT), called Smooth Love Potion. Although it's not a full-featured cryptogame, it does offer trading and staking options and a robust community. This is an exciting new entry in the crypto gaming world, with huge potential growth.

Smooth Love Potion, Axie Infinity Shards and Smooth Love Potion are the currencies available in the game. Small Love Potion (Non-fungible Token - NFT) is also included in the game. These are used to reward players for completing level-related achievements. They do not have a direct connection to the Axie Infinity Shards' cost, but they are an excellent way to earn currency.

Aleksander Larsen (a Norwegian hacker and enthusiast for games) founded Axie Infinity in late 2017. His previous experience as a programmer with the Norwegian Government Security Organization was also a part of Lozi and Sky Mavis. The game is rapidly growing in popularity, with more than 1,000,000 users. The main draw is the possibility to both play and make passive income. As of this writing, the game's monetary rewards have topped out at over a million dollars a month.

AxieInfinity features a range of technologies and features including an XP Hub, automated orders, token staking, and a mating Hub. To maximize your chances of winning, you can join the game's network via several payment methods. A wallet is not required. You can also use PayPal or Visa. You can store your coins in a digital wallet like MetaMask.

Axie Infinity isn't the only crypto game available, but it's definitely the most innovative. CryptoKitties (War Riders), and Chainmonsters are all notable crypto-games. Some of these games are browser based, while others are mobile. However, all of them are worth a look. Axie Infinity, with its patented Ronin Ethereum Sidechain and its native token Smooth Love Potion, is truly the way to go.

Having said that, the Axie Infinity is just one part of a larger ecosystem which also includes a mobile version of the game, as well as an NFT-based staking and trading system. Axie Infinity also has an interactive website where users can view the game's stats and other features. This is just for entertainment purposes, however, since the actual Axie Infinity gaming experience is still in beta. It will be released later this year. Axie Infinity can be enjoyed by anyone who is interested, whether they are playing the game, or purchasing or staking the tokens. A good cryptocurrency wallet is required if you are to maximize your Axie Infinity shards. While Ledger is the most popular option, you can also choose Trezor.

FAQ

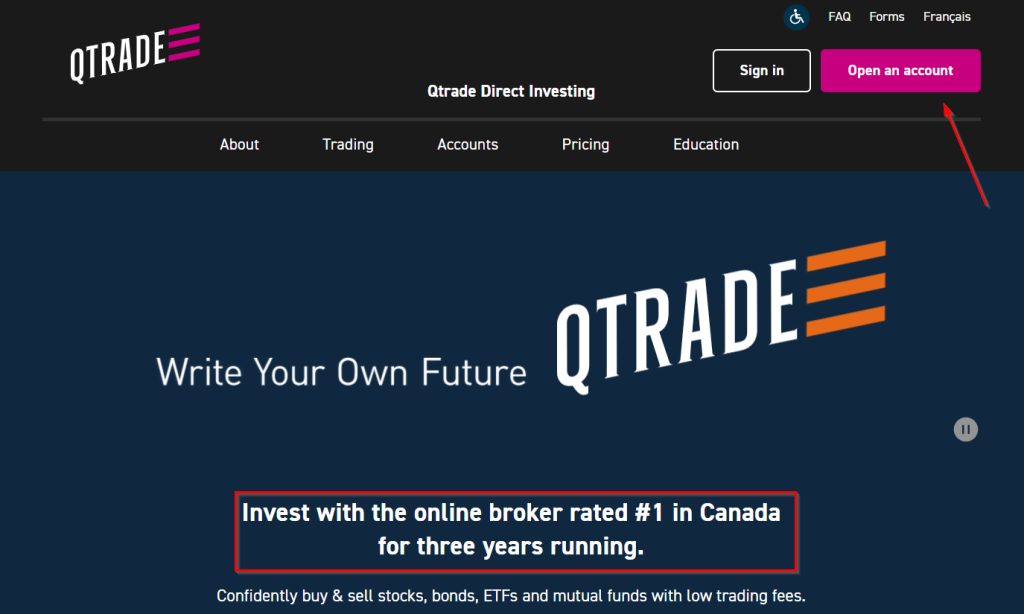

Which trading site for beginners is the best?

Your level of experience with online trading will determine your ability to trade. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

You can also trade independently if your knowledge is good enough. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which is better forex trading or crypto trading.

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Where can you invest and make daily income?

Investing can be a great way to make some money, but it's important to know what your options are. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

What are the disadvantages and advantages of online investing?

Online investing offers convenience as its main benefit. You can access your investments online from any location with an internet connection. Online trading is a great way to get real-time market data. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing comes with its own set of disadvantages. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment comes with its own risks. You should research all options before you decide on the right one. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

How do forex traders make their money?

Yes, forex traders can earn money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts should be safe. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, you want to make sure the platform you're using is secure. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. You should also regularly review your account activity to ensure you are aware of any suspicious links or downloading unfamiliar software. This will allow you to quickly detect possible threats and take appropriate action.

It is important to be familiar with the terms and conditions of any online investment platform. Make sure you are familiar with the fees associated with investing, as well as any restrictions or limitations on how you can use your account.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Finally, make sure you are aware of any tax implications associated with investing online.

Follow these steps to ensure your online account is protected from potential threats.