There are many options for investing in crypto currencies. But choosing the right crypto is not always easy. Do your research and make the best choices for your circumstances.

It is an excellent way to invest in cryptocurrency because it offers many advantages over other investments. It is also more cost-effective and easier to store. You can also sell and purchase it at a low cost. It can also be used directly as a method of payment. It can also serve as a portfolio asset. You can use cryptocurrencies to make an investment that will yield a high return, or to have something you can keep around.

The best thing about investing in crypto is the possibility to trade on over 1000 exchanges. There are over 10,000 different cryptocurrency options on the market, making it difficult to choose one that best suits your needs.

The best short term cryptos are those that are more than just an interesting novelty. These are usually digital currencies that have an established brand and are used by a significant number of people. These currencies may have higher upsides than less well-known counterparts. For example, XRP has seen a significant jump in value in recent months. This is due in large part to the growing popularity of the derivatives market.

Although the price of a single coin may not be worth a fortune, the opportunity to build a collection of these assets is certainly worthwhile. However, there is a lot at stake. As such, it is important to only invest what you can afford.

A solid foundation in technology and entrepreneurship is the best way to create crypto. It should be able to build innovative products and services and have a strong community. You should also consider the best exchanges as well as the market value for the cryptos that you are interested.

It is also important to understand that the best crypto may not be the one that you actually want to buy. However, there is no best option. Each investor has their own goals so it's important to make the best decision for you. These six cryptocurrencies are worth considering.

Of course, no one can predict what will happen in the future. You might be surprised at the opportunities that your favorite cryptocurrency has in store for you if you're willing and able to take the risks. As you build your portfolio, be careful of the scams that can leave you in the red.

Another interesting fact is that smart contracts can be used to control transactions. It is also worth considering whether your cryptocurrency is environmentally friendly. Hedera Hashgraph claims that their cryptocurrency has a zero carbon footprint, which is quite remarkable in the cryptocurrency world.

FAQ

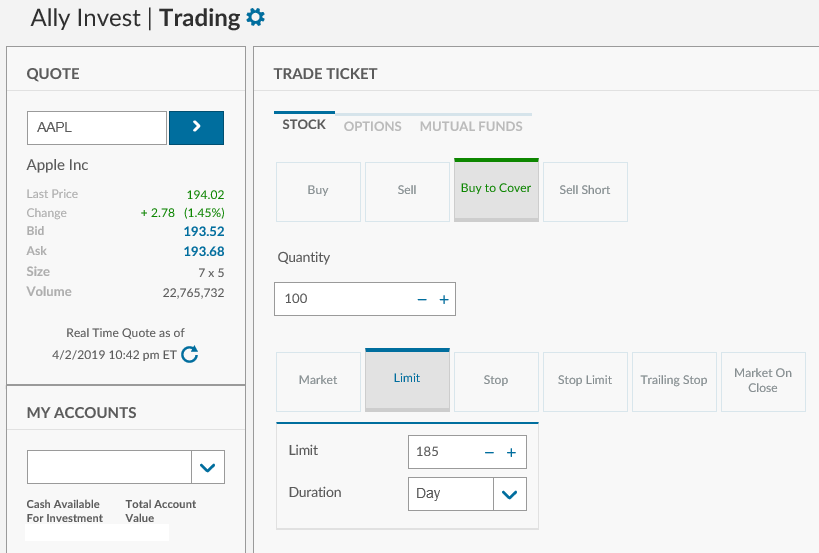

Which trading platform is the best for beginners?

It all depends on your level of comfort with online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

You can also trade independently if your knowledge is good enough. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Where can I invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are many options.

One option is to invest in real property. Investing in property can provide steady returns with long-term appreciation and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Frequently Asked questions

What are the different types of investing you can do?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two types of stock: preferred stock and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Trading forex or Cryptocurrencies can make you rich.

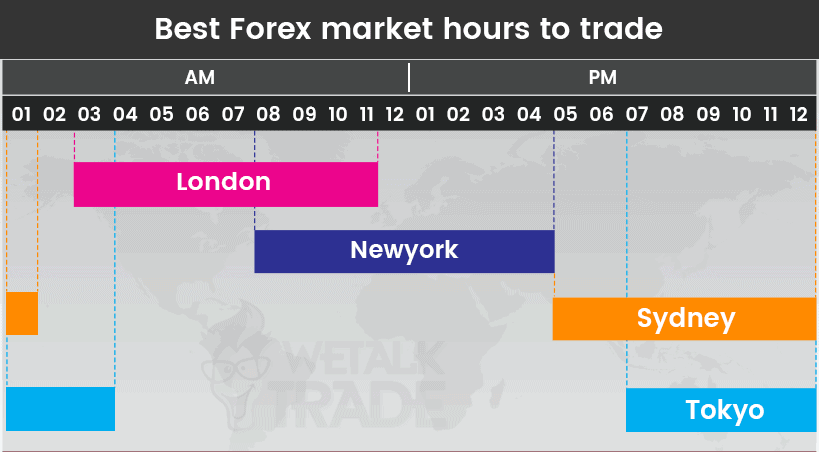

You can make a fortune trading forex and crypto if you take a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts are a matter of safety. It is vital to secure your assets and data against any unwelcome intrusions.

First, ensure the platform you are using is secure. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. Check your account activities regularly to be alert of any unusual activity.

Third, you need to know the terms of your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Make sure to understand the tax implications of investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.