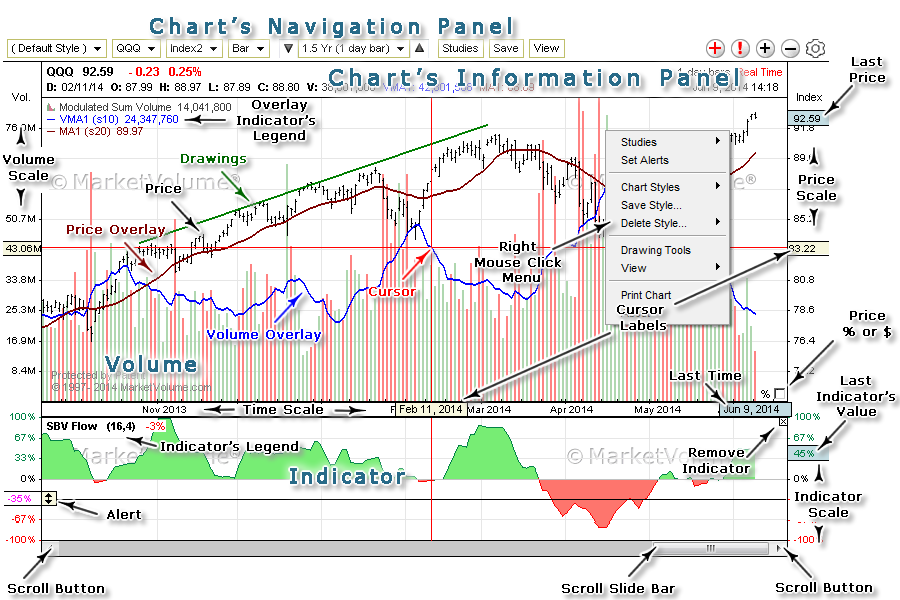

Stock charts can be a useful tool for traders. These charts can provide traders with a wealth of market information including peak and trough levels, key entry/exit points, and much more. These charts can also be used to help you decide when to sell or buy. Reliable stock charting software is necessary to accurately analyze your stocks. Learn more about the best stock charting software packages.

Sierra Chart provides a wide range of analysis and charting tools. It's a versatile piece of software that can generate a wide variety of visualizations. From simple OHLC charts to complicated mountain and candlestick maps, it is very flexible. Sierra Chart is also capable of detecting trendlines and Fibonacci patterns. The company also provides a variety of chart overlays, including charts on DOM execution windows, and it can be used in a variety of chart layouts.

The Market screener is another piece that will assist you in trading. This feature allows you to set up a screening strategy with a number of templates, from a basic screen to a more sophisticated method. You can also personalize your view to highlight specific securities. However, the real power of this product is its ability to scan the entire stock market and display critical trading information in a streamlined and user-friendly way.

ChartNexus, which plots key stock price levels automatically, is another useful tool. You can also set up your own templates, and download up five years worth of historical data.

Additionally, the platform offers an automated indicator called Trading Magnet. It helps you to identify the signals that are suitable for a buy/sell. The indicator can scan through many symbols to identify the most suitable price triggers.

You will also find an advanced scouting system and a customizable interface. DXcharts can be a great choice for anyone looking for robust charting solutions with premium features.

Interactive Brokers offers the Multichart package, which allows you to trade with multiple charts. This platform offers 15 different layouts which can be customized to suit your trading style. For example, you can have four charts displayed at once and synchronize your crosshairs. You will need the appropriate symbols to use this feature.

Finally, the YChart Software is a powerful and comprehensive tool that can help you communicate your investment strategy to your clients and explain your investment plans. Using this software, you can generate compelling visuals, analyze the market, and educate your prospects. Its powerful tools and customizable options allow you to make informed investment decisions and build a strong portfolio.

You must ultimately decide which stock charts software you want. It all depends on your requirements and your budget.

FAQ

Are forex traders able to make a living?

Yes, forex traders can make money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading is not an easy task, but it can be done with the right knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which is harder crypto or forex?

Different levels of difficulty and complexity exist for forex and crypto. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

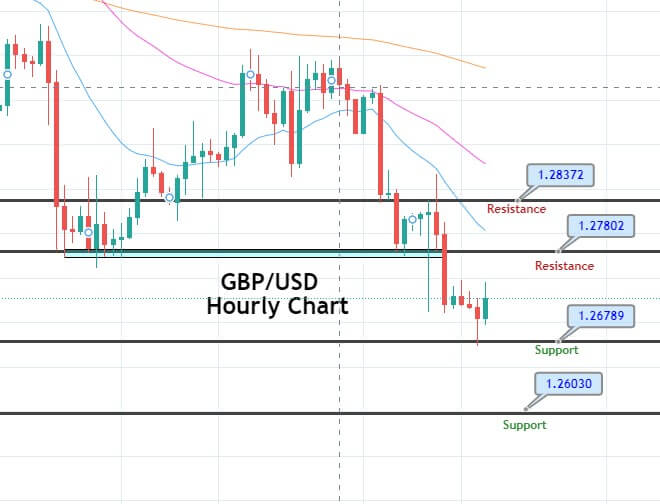

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Which trading site is best suited for beginners?

It all depends on your level of comfort with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Can you make it big trading Forex or Cryptocurrencies?

Yes, you can get rich trading crypto and forex if you use a strategic approach. You need to be aware of the market trends so you can make the most of them.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Also, you should only trade with money that is within your means.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Understanding the different currency conditions is crucial.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which forex or crypto trading strategy is best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it's important to understand both the risks and the benefits.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

Research is critical when investing online. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. Be skeptical of promises of substantial future returns or future results.

Know the risks associated with your investment and the terms and conditions. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.