If you're looking to make money trading the UK markets, you need a reliable and trustworthy trading platform. You want a broker that is able to manage your investments safely.

There are many UK-based trading platforms that you can choose from. Make sure to do your research before choosing one. There are a few things to consider before deciding on which one is right for you:

Best Trading App Uk

A platform that is user-friendly and offers low fees is essential if you are looking to invest in the UK stock markets. If you travel for work or pleasure, you will want to ensure that your account is accessible from anywhere in the world.

eToro

If you want to get started with trading the UK markets, eToro is an excellent choice. It is simple to use and offers many features that make it a great trading app.

It's both available for Android as well as iOS. Plus, eToro allows you to deposit funds using credit/debit cards or e-wallets.

IG

IG has a good share charting package and low share dealing fees for moderately active traders. The charting software, which is available in 22 languages, is especially useful for technical analysis. It's an excellent choice for investors of all types, especially those who trade currencies.

Pepperstone

Pepperstone offers many products and a great stock-dealing service in the UK. These include options trading, currency trading, and forex. Its MT4 platform is compatible with a number of third-party social-copy-trading apps as well as research tools.

Skilling

Skilling is an excellent choice for anyone who wants to learn to trade stocks. This site has a lot of educational material and will teach you how manage risk and set stoploss. It also provides 1000+ trading strategies that you can copy to maximize your profits.

CMC Markets

If you're looking for a reputable and dependable online broker in the UK, consider CMC Markets. This company is a pioneer in this industry, and it has been around since 1989. The Financial Conduct Authority (FCA) regulates UK-based operations. Its trading platform is easy to use and intuitive.

Interactive Brokers

This broker is well-respected and can help you trade stocks, commodities, and currencies in the UK. Its UK-based operations can be regulated and authorized by the Financial Conduct Authority (FCA), and offer excellent deposit and withdrawal options.

Interactive Brokers can also offer SIPP and ISA accounts. This will help you save even further on your trading costs. Investors who wish to have access to the US market can also use the broker.

FAQ

What are the advantages and drawbacks to online investing?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, online investing does have its downsides. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important for online investors to be aware of all the investment options. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Some investments may also require a minimum investment or other restrictions.

What is the best forex trading system or crypto trading system?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

Both cases require that you do extensive research before investing. With any type or trading, it is important to manage your risk with proper diversification.

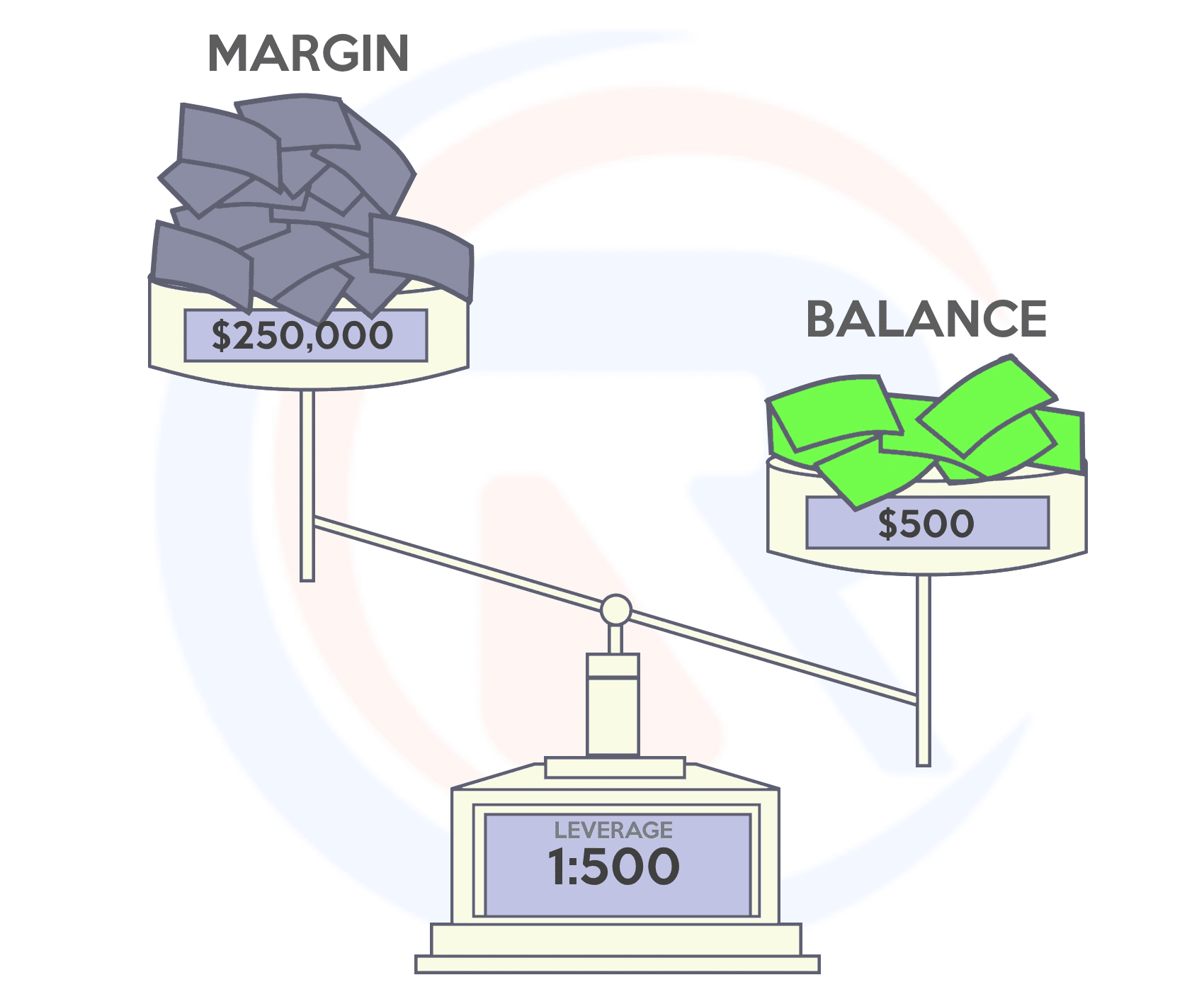

Understanding the various trading strategies for different types of trading is important. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Is Cryptocurrency a Good Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Trading forex or Cryptocurrencies can make you rich.

Trading forex and crypto can be lucrative if you are strategic. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. You should also trade with only the money you have the ability to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Which is the best trading platform?

Many traders find it difficult to choose the right trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down your search to find the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

How do forex traders make their money?

Forex traders can make a lot of money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can my online account be secured?

Online investment accounts require security. It is crucial to safeguard your data and assets against unwelcome intrusions.

You want to ensure that the platform you use is secure. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

Thirdly, make sure you understand your investment platform's terms and conditions. Make sure you are familiar with the fees associated with investing, as well as any restrictions or limitations on how you can use your account.

Fourth, make sure you do thorough research about the company before investing. Review and rate the platform and see what other users think. Make sure to understand the tax implications of investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.