Forex leverage can be a great tool for traders, but it can also lead to losses. There are many factors that determine whether or not you'll make a profit, and using high leverage can increase your risk significantly.

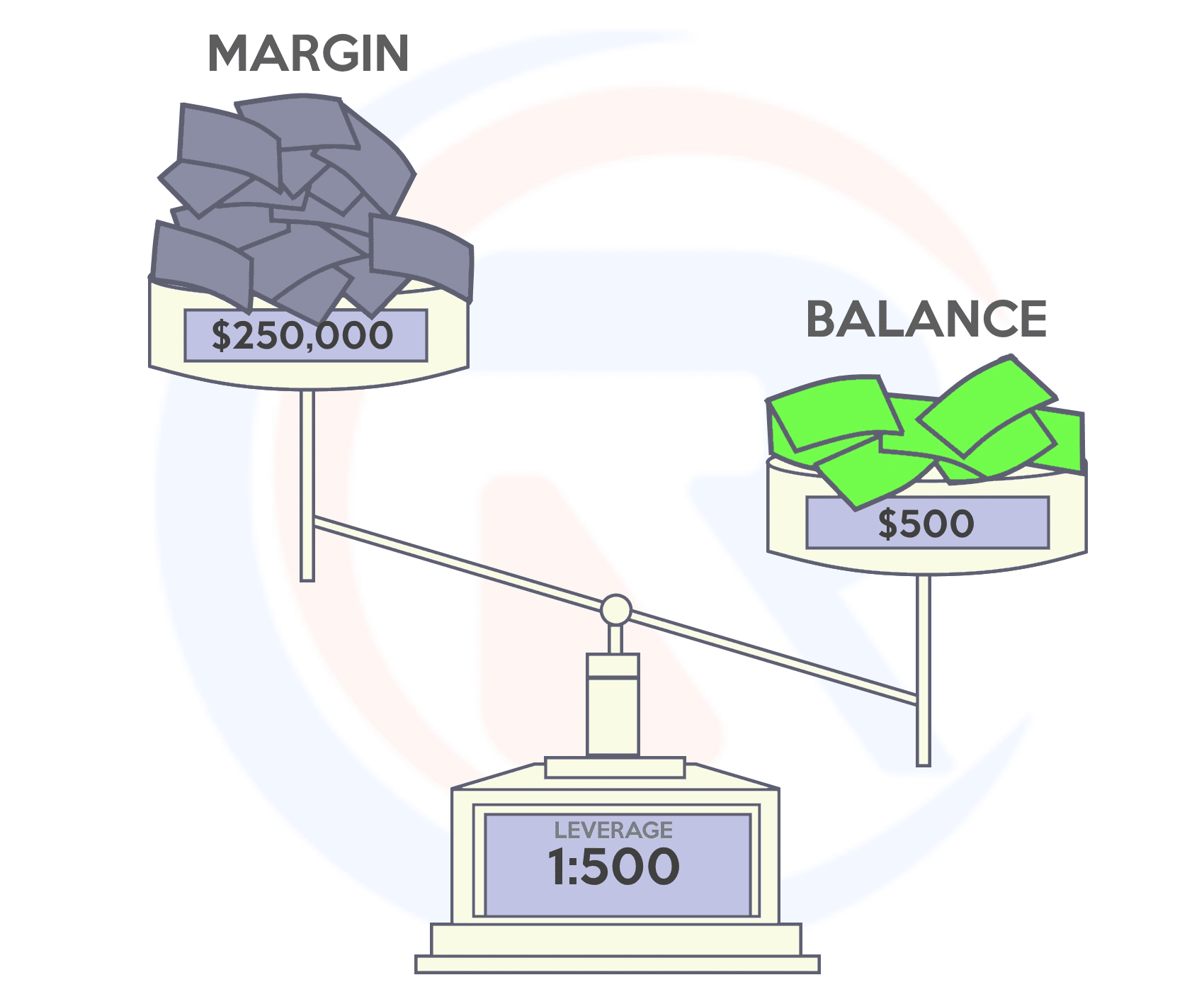

Leverage is the ability to borrow money from a forex broker in order to open trades. The amount of leverage you can use depends on the broker and the type of trading you do, but typically brokers offer between 10:1 and 400 times your total capital.

High leverage can lead to higher profits for traders who are tempted by the lure of high leverage. It can also lead to traders losing a lot of money in a short time.

The downside to forex leverage is the increased risk of losing your entire investment and additional capital if it doesn't have negative balance protection. This is particularly true for traders new to the forex market, as they may not have any experience and not be able manage their risks.

Forex leverage has its advantages, however. These include the ability to diversify your portfolio and make margin adjustments. They also allow for greater capital efficiency. However, high leverage does not come without risks. If you want to trade with real money, make sure that you only open a demo account and work with a high risk broker.

High-Leverage Forex Brokers

To take advantage of the leverage in forex markets, it is important to choose a trusted broker with a solid reputation. You can check reviews online to find out the best way. It is also important to verify the minimum investment required in order to trade, and the maximum leverage offered from each broker.

Check out the customer support provided by each broker to learn how they deal with customers. Many brokers have customer support teams that can adjust your leverage and help keep your trading account secure.

TD Ameritrade Forex Leverage

TD Ameritrade offers high leverage with a maximum of 1000 to 1. They offer trading sizes and minimum deposits that are low. There are a number of account types available, including demo and real money.

Forex Leverage Explained

In the forex market, there are many different ways to increase your investment potential and profits, but leverage is one of the most popular methods. It can help you buy larger quantities than you could normally afford.

This allows you to profit from small price changes, 'gear’ your portfolio for greater exposure, or simply boost your profits quicker than is otherwise possible.

You can also leverage your funds to avoid making margin calls. Margin calls can force you into selling securities purchased from borrowed funds. This can happen when a currency is too low in value or transaction costs are high and consume your profits.

High leverage can have its risks. Therefore, you should make sure to find a broker who offers great customer service and zero balance protection before trading. Before you decide to invest real money, make sure that you check out the demo account offered by each broker.

FAQ

Can you make it big trading Forex or Cryptocurrencies?

Yes, you can get rich trading crypto and forex if you use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Also, you should only trade with money that is within your means.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

What is the best trading platform for you?

Many traders can find choosing the best trading platform difficult. It can be confusing to choose the right one, with so many options.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This information will help you narrow down your search and find the best trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Which trading website is best for beginners

All depends on your comfort level with online trades. You can start by going through an experienced broker with advisors if this is your first time.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Most Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing is a way to grow your finances while potentially earning money over the long term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

What are the benefits and drawbacks of investing online?

Online investing has one major advantage: convenience. Online investing allows you to manage your investments anywhere with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, there are some drawbacks to online investing. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important to understand the different types of investments available when considering online investing. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There may be restrictions on investments such as minimum deposits or other requirements.

How do I invest in Bitcoin

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need is the right knowledge and tools to get started.

The first thing to understand is that there are different ways of investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, find any additional information that may be necessary to make confident investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can my online account be secured?

Online investment accounts must be secure. It is vital to secure your assets and data against any unwelcome intrusions.

You must first ensure that the platform you're using has security. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

Thirdly, it's important to understand the terms and conditions of your online investment platform. Make sure you are familiar with the fees associated with investing, as well as any restrictions or limitations on how you can use your account.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Finally, be sure to know about any tax implications that investing online can have.

These steps will ensure your online investment account is protected against any possible threats.