Cryptocurrency (or crypto) is a digital asset that you can purchase and trade just like stocks. However unlike stock, crypto doesn't give you legal ownership. Instead, you invest in cryptocurrency to bet on its future value.

For anyone looking to diversify their portfolios and spread their risk among a variety assets, cryptocurrency investing is a good option. It's important that you know that cryptocurrency investments can be extremely volatile and could lead to severe losses.

You can invest in cryptocurrency by using a broker or cryptocurrency exchange that offers transparency, security, and transparency. A wide variety of payment options are offered by some brokers. You can deposit money from your bank account or wire transfer money.

Before purchasing cryptocurrency, make sure you read the terms of every brokerage or cryptocurrency exchange. It is also important to be aware of any fees these companies might charge. Often, these fees can add up to 5% of your total transaction amount.

Avoid investing in crypto unless you have a clear exit strategy. Also, be prepared to lose it all if price drops. This is because cryptocurrency aren't backed either by government or precious materials. It can lose a lot of their value quickly and you might end up losing money if your portfolio contains too much.

It is best to buy a crypto ETF. These products provide exposure to companies that can benefit from the growing popularity of cryptocurrencies, and the blockchain technology. These ETFs have a higher level of regulation than actual cryptocurrencies. This makes them safer to invest in.

It's best if you only choose a handful of cryptocurrencies that you will stick with for the long term. You can either buy them or store them in a crypto wallet and trade them with other people.

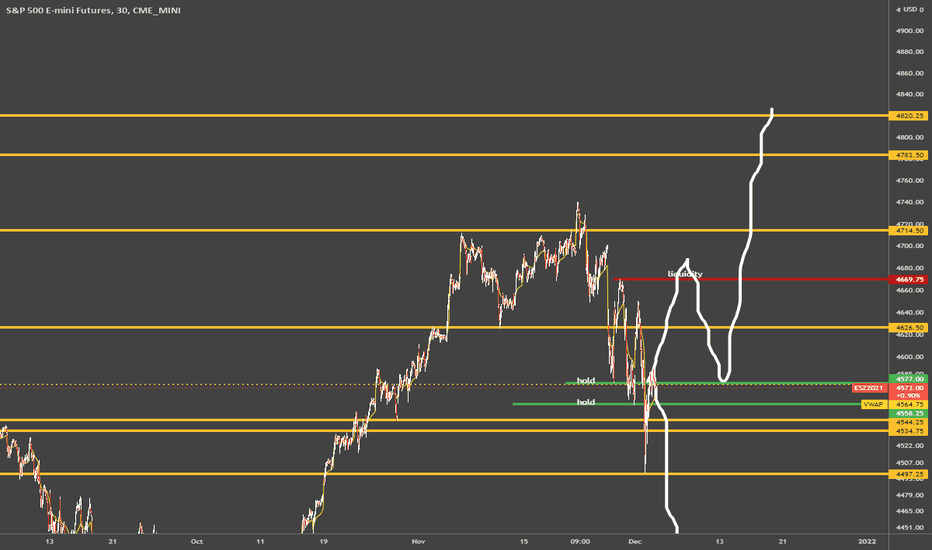

Futures can be used to place wagers on the price movements of specific crypto currencies. Bitcoin futures are perhaps the most well-known. They allow you to wager on Bitcoin's future value.

Despite its volatility, cryptocurrency has the potential for huge returns in the near future. It is still unclear which currencies are the best investments.

Start with the larger cryptocurrencies, such as Ethereum or Bitcoin. They have a proven track record and are widely accepted in crypto-world. Even the most powerful cryptos can see huge swings in their value so it's important to research your options before you make a decision on which one to invest in.

It's a good idea to set aside a portion of your profits each month so you don't become emotionally attached to your investment. This will keep you from selling too soon when prices are high, only to regret it later.

FAQ

How can I invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need are the right tools and knowledge to get started.

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. To stay on top of crypto trends, keep an eye out for market developments and news.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading is easier than investing in foreign currencies upfront.

However, crypto trading can offer a very immediate return due to the volatility of prices. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases, it's important to do your research before making any investments. Any type of trading can be managed by diversifying your assets.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it's important to understand both the risks and the benefits.

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Can forex traders make any money?

Yes, forex traders can earn money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Which trading site is best for beginners?

It all depends on your level of comfort with online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

Should I store my investment assets online or do I have other options?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. You have many options for protecting your valuable assets.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. Yet, there are risks involved when using a digital option since electronic breaches may occur.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

Ultimately the decision is yours--what works best for you and provides the security and safety necessary to protect your investments?