Discover bank cd is an internet-only bank offering a wide variety of savings options. It offers competitive interest rates on its CDs and money market accounts that combine the best of both a checking and savings account. You can also get a variety of credit cards from the bank including one that comes with excellent cashback.

Discover Bank offers certificates for deposit (CDs), with a range of terms and ownership types. They are available from three months up to 10 years. These CDs can be an excellent choice for savings for a long term goal as they pay higher rates of interest than savings and money markets accounts.

Discover's CD rates compare to those offered by other online banks. These savings accounts do not have a monthly maintenance fee. However, Discover's high minimum deposit requirement can be a barrier for some people.

CDs typically pay a fixed, or sometimes a higher than average, interest rate over the term of the account. This is generally between six and ten monthly. The interest is paid until the term ends or you decide to sell the CD before then. You can then withdraw any of the funds accumulated during the term without paying a penalty.

The term length will determine the early withdrawal penalty. These penalties can vary from a few month's simple interest for a shorter term to 24 months' interest if the term is longer. You should compare the early withdrawal penalties of CDs with other savings accounts before you sign up for one.

CDs are safe places to save money and earn interest. However, they can be difficult to understand. Compare CD comparisons to make sure that you're getting the most value from your investment.

A CD offers a higher interest rate than savings accounts, and a lower chance of losing your money. FDIC-insured CDs ensure that your money is protected in the event of a bank shutdown.

Discover Bank has a variety of CDs that will suit your needs. These include traditional and IRA CDs. These types of CDs offer tax benefits that can be particularly useful for retirees.

The Discover Bank CD is a great way to lock in a low rate of interest for a specific time. You can build a CD ladder with these accounts, which will allow you to earn more interest over time.

Discover Bank's CDs offer competitive APYs, some even offering rates that are better than those offered by other online banks. The wide selection of terms available means that you can find the right CD to suit your needs, whether they are short-term or longer-term.

Daily compounding boosts growth on these CDs, so you can see more of your money grow faster than with monthly compounding. These amounts are possible final earnings at each term's end. Your actual earnings could be lower or greater.

Despite the high minimum deposit requirement, Discover Bank's CDs are an attractive option for those looking to save for a specific financial goal. These accounts are also flexible, making them convenient for people who want to save money for a big purchase or vacation.

FAQ

Which is better, safe crypto or Forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Where can I find ways to earn daily, and invest?

While investing can be a great way of making money, it is important to understand your options. There are many options.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

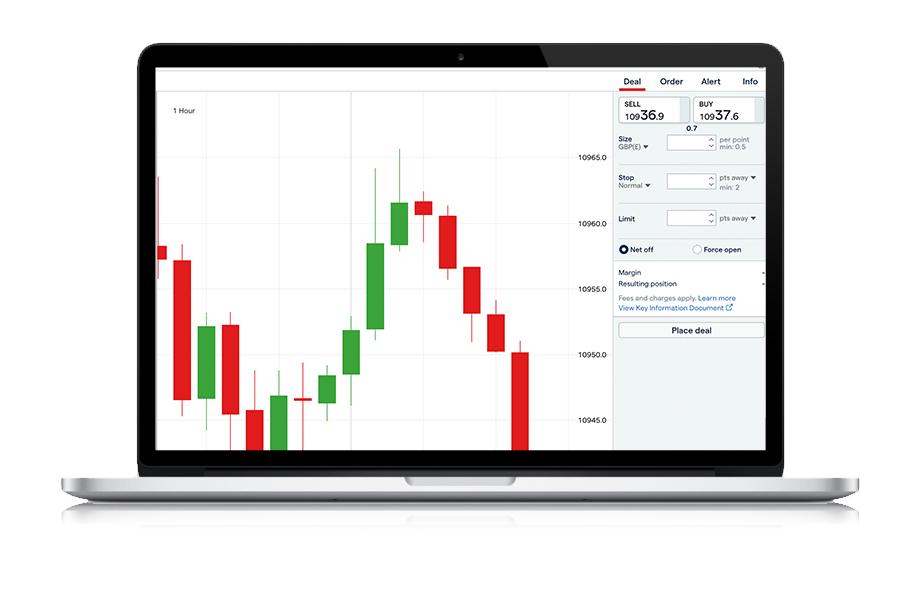

Which trading website is best for beginners

All depends on your comfort level with online trades. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

You can also trade independently if your knowledge is good enough. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Can forex traders make any money?

Yes, forex traders can earn money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

What are the benefits and drawbacks of investing online?

Online investing is convenient. You can manage your investments online, from anywhere you have an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, online investing does have its downsides. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

You should also be aware of the different investment options available to you when investing online. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

Understanding the various trading strategies for different types of trading is important. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

Is it safe to store my investment assets online, or should I consider other options?

The decision about where to store your money can be complicated. A strong security system is essential for your valuable assets. There are several options.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. Yet, there are risks involved when using a digital option since electronic breaches may occur.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, you may consider looking into specialized investment firms that offer secure custody services specifically designed for protecting sizeable asset portfolios.

Ultimately the decision is yours--what works best for you and provides the security and safety necessary to protect your investments?