You should be looking for certain traits in day trading stocks, regardless of whether you're a novice investor or an experienced one. These include price volatility, liquidity and trends.

Volatility describes the degree of risk that is associated with changes in a security’s value. Having a high degree of volatility can spread the value of a stock over a large range of values, which creates an opportunity for day traders. Consider your needs when choosing a stock.

Traders may take advantage of price fluctuations by buying volatile stocks at a lower price and selling as the stock's value rises. This strategy allows you to generate a higher profit per share than long-term traders while also reducing your risk.

There are many stocks that you can choose from. The following day trading picks, however, are suited for each trader. These stocks have three traits in common: they have been trending at least for a year, they are well-known worldwide, and they provide substantial value for your investment. These characteristics will give your company an edge over your competition.

Tesla is a solid stock as one of America's largest electric vehicle producers. The company operates several divisions that concentrate on autonomous vehicles, and sustainable energy. It's also frequently featured in the news. Tweets by Elon Musk could have an impact on the stock's performance.

AMC Networks, a global entertainment group, is another stock that has been gaining attention. Its share price has increased by 2000% in a little over a year. This is impressive considering the company started with $2 in 2021. This company is very well-positioned with a market valuation exceeding $24 billion.

Netflix is another company that has enjoyed great popularity in the streaming market. With more than 200,000,000 subscribers, Netflix offers a range of award-winning TV and movie shows. Netflix has a large global reach because it is available in a number of languages. Netflix's market share is expected to increase with the increased demand for streaming services.

Finally, Nektar Therapeutics is high-volatility and can see price spikes. Even though the company makes many types of options its stock fluctuates regularly. In fact, this stock is great for trader's portfolios.

As one of the best day trading stocks, NIO is a company that is accelerating product development to meet the peak of the EV industry. They're working with partners to expand their supply chain, and they're launching new vehicles next year. NIO's growth plan includes increasing sales coverage.

DocuSign is a new company that develops solutions for different industries. Their software helps users electronically sign agreements. They also produce lightweight materials to aid corporations. In recent years, the company has seen its profits rise and continues to innovate its products. DocuSign can be a great addition to your portfolio and provide a good return over time.

FAQ

Do forex traders make money?

Forex traders can make good money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

What are the benefits and drawbacks of investing online?

Online investing is convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing is not without its challenges. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment comes with its own risks. You should research all options before you decide on the right one. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is investing in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is better forex trading or crypto trading.

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading is easier than investing in foreign currencies upfront.

However, crypto trading can offer a very immediate return due to the volatility of prices. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

It is important to research both sides of the coin before you make any investment. Any type of trading can be managed by diversifying your assets.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Which trading platform is best?

Many traders find it difficult to choose the right trading platform. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

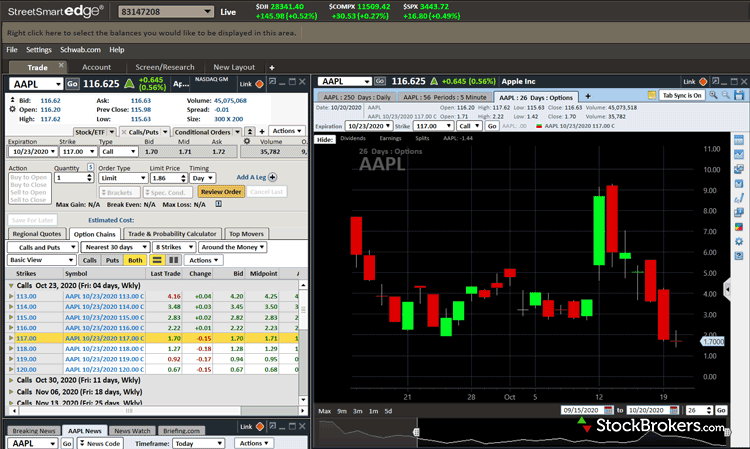

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This information will help you narrow down your search and find the best trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

It is important to do your research before investing online. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

You should understand the investment risk profile and be familiar with the terms. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Do your due diligence and make sure you get what you pay for. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.