Wheat futures are contracts under which a buyer agrees not to accept delivery of a quantity of wheat, at a predetermined price, on a date and time. Weather and global trade patterns can influence the price of the wheat futures contracts.

Chicago SRW Wheat contract is the world's largest, most liquid wheat futures market. It traded the equivalent of over 15 million tonnes daily in 2013, and it continues to trade at a record high. It is highly competitive with other wheat futures due to its large liquidity.

This liquidity has made it possible to create a range of spreads that are both hedging and trading opportunities. Spreads are usually based on price differences between nearby futures contracts and those that expire after them.

Spreads can trade on multiple trading platforms, including CME Globex (CME ClearPort) and CME Globex (CME Globex). This gives traders access the full range of domestic as well as global futures products.

Traders use Chicago Wheat and KC Wheat futures in order to spread risk within the larger grain market as well as to hedge their physical exposure. CME Group supports these contracts and provides market participants with the assurance of a stable and secure environment.

Several times a year, the USDA issues reports containing information on crop supply and demand. These reports can have a direct impact on wheat and corn prices, especially when they are released early in the morning.

These reports may not be accessible at all times. This can cause price volatility to the markets while they wait for these reports to be made.

Therefore, trading in wheat and corn futures may not be as efficient as it could. As the market might over-or under-estimate production or demand, price movements can affect traders.

Additionally, many factors can influence the price for wheat and corn futures. This includes harvest conditions and climatic changes. Weather and competition from other commodity derivatives products. As they seek to protect their profit margins, corn and wheat prices will likely rise if there is an unusual drought or flood.

It is essential that traders understand the differences between a long or short position in wheat futures. The buyer agrees to buy the wheat at a set price from the seller on a specific date.

The short position, on the other hand, is a contract in which the buyer agrees not to buy wheat from the seller at that price. This is commonly referred to as "hedging" and it is the most common type of market position in wheat futures.

CME Group's Agriculture futures and options are used worldwide by more than 90% of the world's agriculture markets to manage risk as well as effectuating real-time prices discovery. These markets have developed over the years to assist traders in managing their risk while maximising their profitability.

FAQ

How can I invest bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You just need the right knowledge, tools, and resources to get started.

First, you need to know that there are many ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. You may choose one option or another depending on your goals and risk appetite.

Next, gather any additional information to help you feel confident about your investment decision. It is essential to understand the basics of cryptocurrency and their workings before you dive in. Keep an eye on market developments and news to stay current with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Is Cryptocurrency an Investment Worth It?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

What are the disadvantages and advantages of online investing?

Online investing is convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading is a great way to get real-time market data. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, there are some drawbacks to online investing. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Some investments may also require a minimum investment or other restrictions.

How do forex traders make their money?

Forex traders can make good money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Which is harder forex or crypto?

Both forex and crypto have their own levels of complexity and difficulty. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

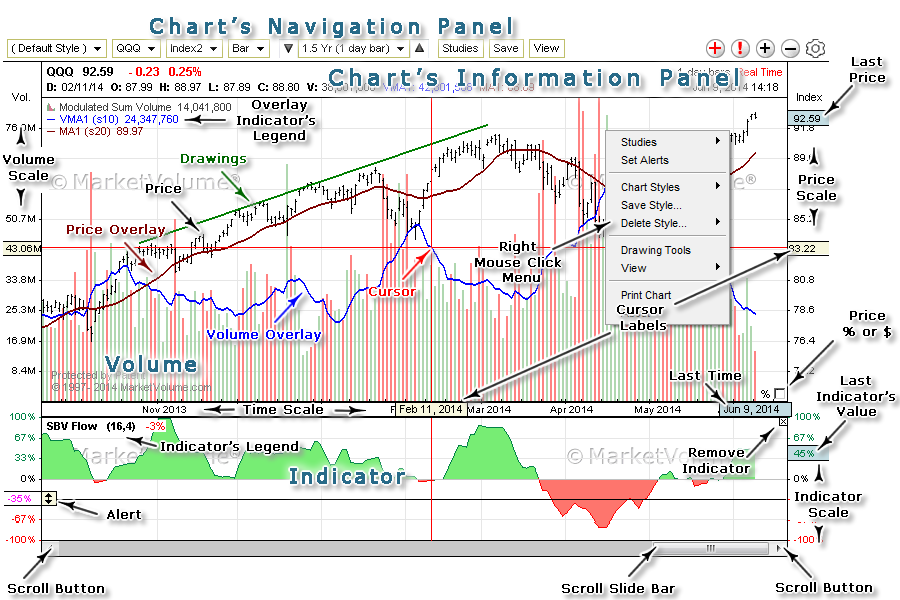

What is the best trading platform for you?

For many traders, choosing the best platform to trade on can be difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

When you invest online, it is crucial to do your homework. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Know the risks associated with your investment and the terms and conditions. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Conduct due diligence checks to make sure that you're receiving what you paid for. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!