Although cryptocurrency is one the most popular assets currently on the market, it can be hard to decide which coins are worth your investment. There are many factors that you need to consider before making your investment decision.

Best Coin to Buy Now

It is a good idea to look at other cryptos to see how they compare. This will help you understand the risks and rewards of purchasing a specific token. It's also a good idea, to check for any information regarding the project that may impact its price.

For example, if a crypto is experiencing an extended period of price volatility, it may be time to consider selling or transferring the tokens to another coin. This strategy can be great for investors looking to get the best out of their investment.

Best Coin to Buy Right Now

Strong fundamental uses are the best reason to invest in cryptos right now. As long as a coin serves a purpose, its price will likely rise over time. Fight Out uses its token FGHT to access its rewards program for fitness.

Additionally, some coins may offer more privacy than others. This can be beneficial for investors who want protection of their assets as well as private information.

The best cryptocurrency you can buy right now should have stable prices and a strong support team. This will help it continue to rise in the long run, ensuring that your investments are secure.

FAQ

Which forex trading platform or crypto trading platform is the best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. Diversification of assets and managing your risk will make trading easier.

Understanding the various trading strategies for different types of trading is important. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it is important that you understand the risks as well as the rewards.

Which trading platform is the best?

Many traders can find choosing the best trading platform difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This will help you narrow your search for the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading is a great way to get real-time market data. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, there are some drawbacks to online investing. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

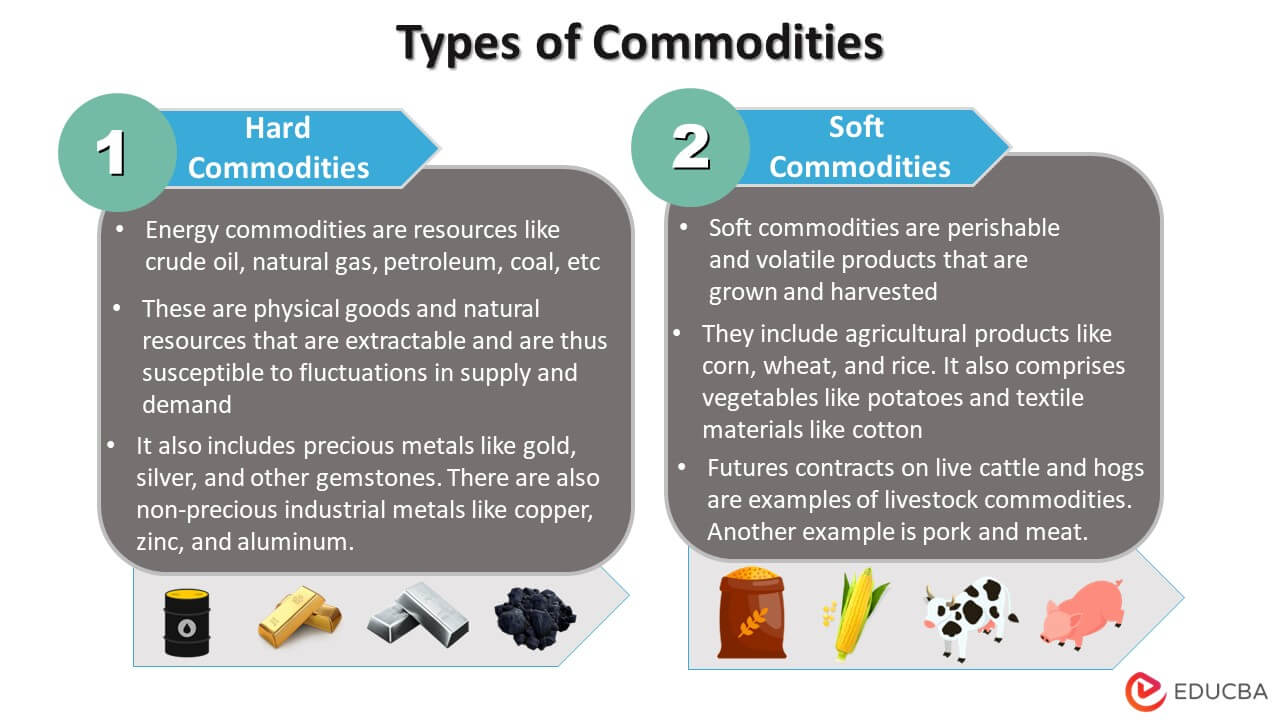

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Forex and Cryptocurrencies are great investments.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Knowing how to spot price patterns can help you predict where the market will go. It is important to trade only with money you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Forex traders can make money

Yes, forex traders can earn money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. There are many other investment options available.

One option is investing in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

When investing online, research is essential. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

You should understand the investment risk profile and be familiar with the terms. Verify exactly what fees and commissions you may be taxed on before signing up for an account. Do your due diligence and make sure you get what you pay for. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!