Currency futures are exchange-traded contracts that allow investors to profit from fluctuations in currency prices. These markets are often used to hedge against risks associated with foreign currencies or speculate about the price of a certain currency. They differ from currency forwards, which are traded over the counter. Due to currency futures being derivatives traders need to ensure sufficient capital to meet the margin and loss risk. There are exchange fees, which can vary depending on contract size or membership status.

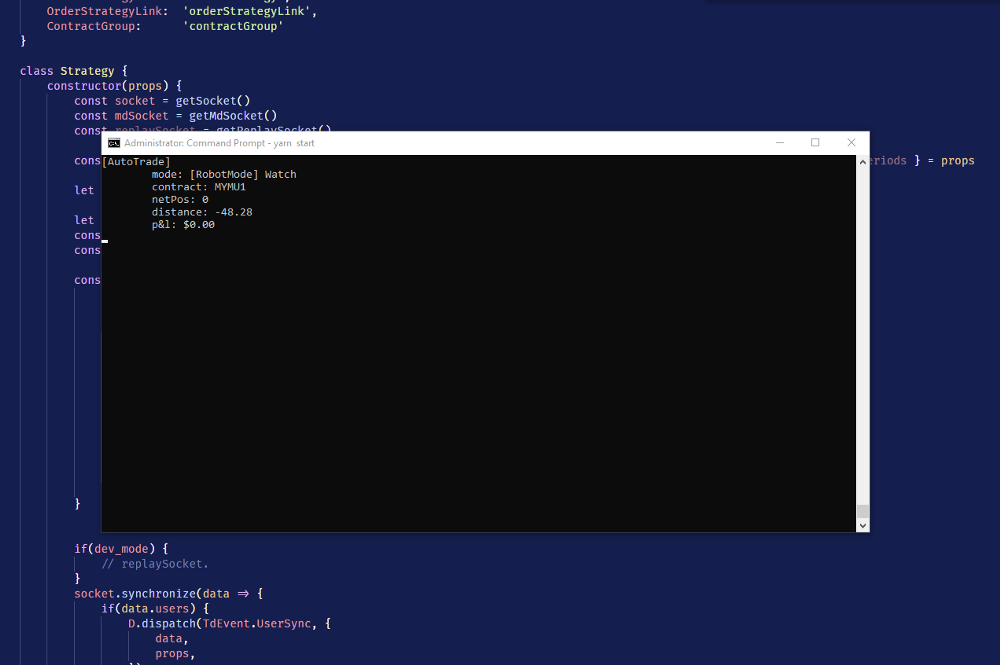

Currency futures are like options, in that they offer the buyer the ability to buy or sell a set amount of the underlying contract at a time. To exercise their call option, the call option holder does not have to purchase the underlying futures contracts. Profit is defined as the difference in settlement price and actual price.

The call option holder gets a profit if the underlying currency appreciates. Conversely, if the currency pair declines, the call holder loses money. In either case the call holder will have the option to choose a time to exercise their right and also the right sell the call at a profit.

The liquidity of currency futures is generally good, but they require larger transactions. Even though the spot rate may fluctuate, this does not necessarily affect the price for long-term futures. It is important to understand that a futures agreement is legally binding. This means that the buyer and seller have to fulfill their obligations on the futures expiration dates.

As with all derivatives currency futures market is susceptible to high risk. These risks can be mitigated by arbitrage transactions between the futures and over-the-counter markets. These risks are minimized by multinational corporations purchasing options directly from banks. The currency futures markets' relatively low daily turnover makes them attractive to those who can afford additional capital.

Currency futures contracts are calculated using the currency spot rate. This is the current quoted rate for a currency pair. However, this can change at any time. Money will flow into the US if the US savings rate increases. This would increase the value of the US dollar relative to the Australian currency.

Currency forwards, unlike futures that have fixed amounts and fixed maturity dates are contracts with variable terms. These products are available to MNCs for hedge purposes and to lock in an appropriate exchange rate for a specified time.

You can also use currency forwards or futures to hedge other trades. Trader must ensure that their position doesn't get liquidated. The minimum margin required is usually two percent of total contract amount. Depending on the size of the contract, the maximum leverage is either 30:1 or 20:1.

Currency futures are standardized and have standardized terms, although they have more risk than spot trades. Therefore, they tend to have larger lot sizes than spot trades.

FAQ

Where can I earn daily and invest my money?

While investing can be a great way of making money, it is important to understand your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. You should also trade with only the money you have the ability to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. A solid knowledge of the conditions that affect different currencies is essential.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is better forex trading or crypto trading.

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases, it's important to do your research before making any investments. Diversification of assets and managing your risk will make trading easier.

It is important to know the types of trading strategies you can use for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which is harder forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

How Can I Invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You just need the right knowledge, tools, and resources to get started.

First, you need to know that there are many ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. You may choose one option or another depending on your goals and risk appetite.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Is Cryptocurrency a Good Investing Option?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

Online investing requires research. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

You should understand the investment risk profile and be familiar with the terms. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Conduct due diligence checks to make sure that you're receiving what you paid for. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.