Crude oil trading refers to the buying and selling of crude oil. If you do it correctly, this kind of trading can make you a lot of money. But, there are also risks that could make your investment irrevocable. You need to be careful before entering this market.

Understanding what oil is and how to trade it is essential. This will help you to know the best ways to profit from crude oil prices.

There are many options for trading oil. These include futures contracts and CFDs. Futures contracts are the most popular way to trade oil. They allow you to purchase and sell a specific amount of oil at a set price at a future date. This is useful for those who want to speculate about future volatility.

CFDs let you speculate on the oil price. This strategy is ideal because it allows you profit from short term price movements without having to own the commodity.

Day trading, a short-term strategy, aims to make money from rapid price movements on the crude oil market. This strategy is especially helpful when price swings are driven by major economic data announcements or geopolitical developments.

Scalping is another strategy that involves opening and closing positions in a shorter period of time to speculate on price volatility. While this strategy is great for profiting from quick market moves, it's not recommended.

Trend trading is another method of trading crude oil. This allows you profit from short term price movements. This is achieved by using technical analysis tools that identify short and long-term price trends. The trader will then open a new position when they see that the trend is ending. At this point, they can close it and make profits.

Momentum oscillators are an important strategy for crude oil trading because they can help you quantify the strength price trends. They can also be used to identify reversal points or exhaustion levels within the market.

The momentum oscillators are a way to evaluate the WTI crude-oil futures price over any period of time. These indicators can be used together with other technical analysis tools in order to develop a solid crude oils trading strategy.

A combination of technical and fundamental analysis is the best strategy for trading crude oil. This means you will be looking at the supply and demand for crude oil, as well as other factors like global growth and alternative energy sources.

You should also consider seasonality when trading this commodity. This is because crude oil can fluctuate throughout the year.

There are many options for trading crude oil. However, it is important to pick a strategy you can keep with over time. You should be aware of the risks associated with this type of trading, but if you do your research and follow your strategy, you'll be able to make good money in the long run.

FAQ

Which is harder forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

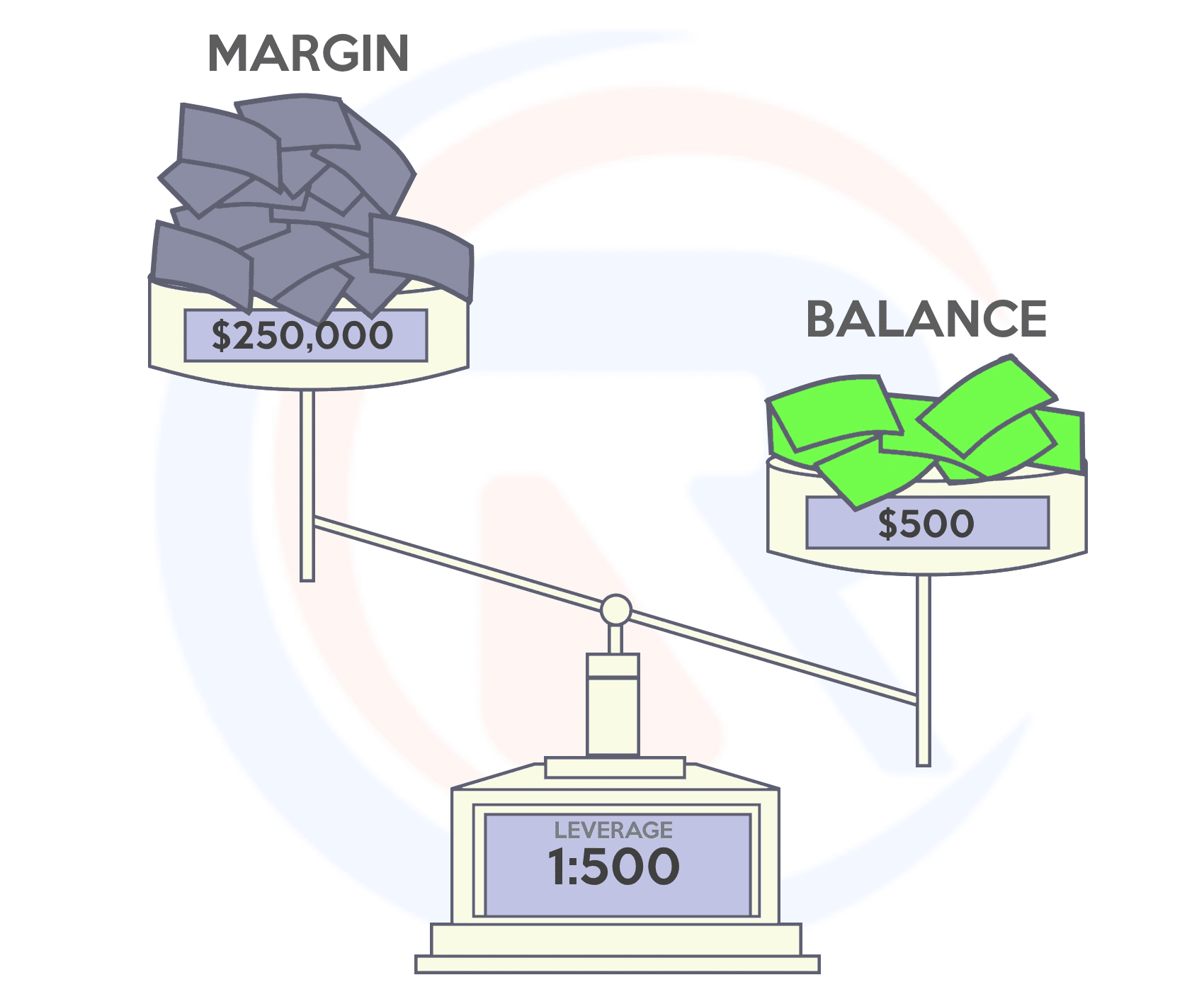

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Forex traders can make money

Yes, forex traders can earn money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading is not an easy task, but it can be done with the right knowledge. It is crucial to find an educated mentor before you take on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which is better forex trading or crypto trading.

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

Both cases require that you do extensive research before investing. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

Where can I earn daily and invest my money?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to invest in real property. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

How do I invest in Bitcoin

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need are the right tools and knowledge to get started.

The first thing to understand is that there are different ways of investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. You may choose one option or another depending on your goals and risk appetite.

Next, research any additional information you may need to feel confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

Should I store my investment assets online or do I have other options?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. There are many options to protect your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. The downside is that there may be electronic thefts.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

You make the final decision.