Stocks that have significant price movements per day are the best to trade. They have sufficient volume for large-scale trading.

Stocks that trade on a daily basis

Stocks must have high volume, high volatility, solid fundamental analysis, and strong long-term trading. This will ensure that the stock is capable of generating large profits in the future.

It must also have a liquidity stock with low impact cost and the ability respond to newsflows proactively. The company must be transparent in its operations and give the public important information.

Best intraday stocks for 2022

Volatility is one of the most important factors to consider when choosing stocks that can be traded intraday. Volatility is a measure of the amount of risk/unpredictability associated with a stock's value. The greater the potential for price swings, the higher the volatility.

Trend is another thing you should look for in an intraday stock. A trending stock will move upwards. It will show a clear pattern which is easy for people to understand and extrapolate.

This means that a stock that is trending strongly will tend not to move out of its range as often as a stock that is less trending. This is a great way to maximize your returns while keeping your risk low.

Nike is a great example of a stock that is gaining popularity. It has a proven track record of innovation and is committed to connecting with customers. Its Nike Direct business has seen strong performance and international growth is strong.

Tesla, an American multinational electric vehicle (EV), company, makes a variety products including batteries for your home. It is valued at over $950 billion, and it is growing rapidly as the world shifts to renewable energy.

Its constant media coverage, as well as the eccentric personality of its CEO Elon Musk, make it a popular topic for speculation. As such, the stock can easily be triggered by a single news event that is positive or negative.

It doesn’t matter whether you want to trade full time or for side income, it is crucial to choose the best stocks for trading that match your investment style. These tips will help you make an informed decision about which stocks are the best investments.

FAQ

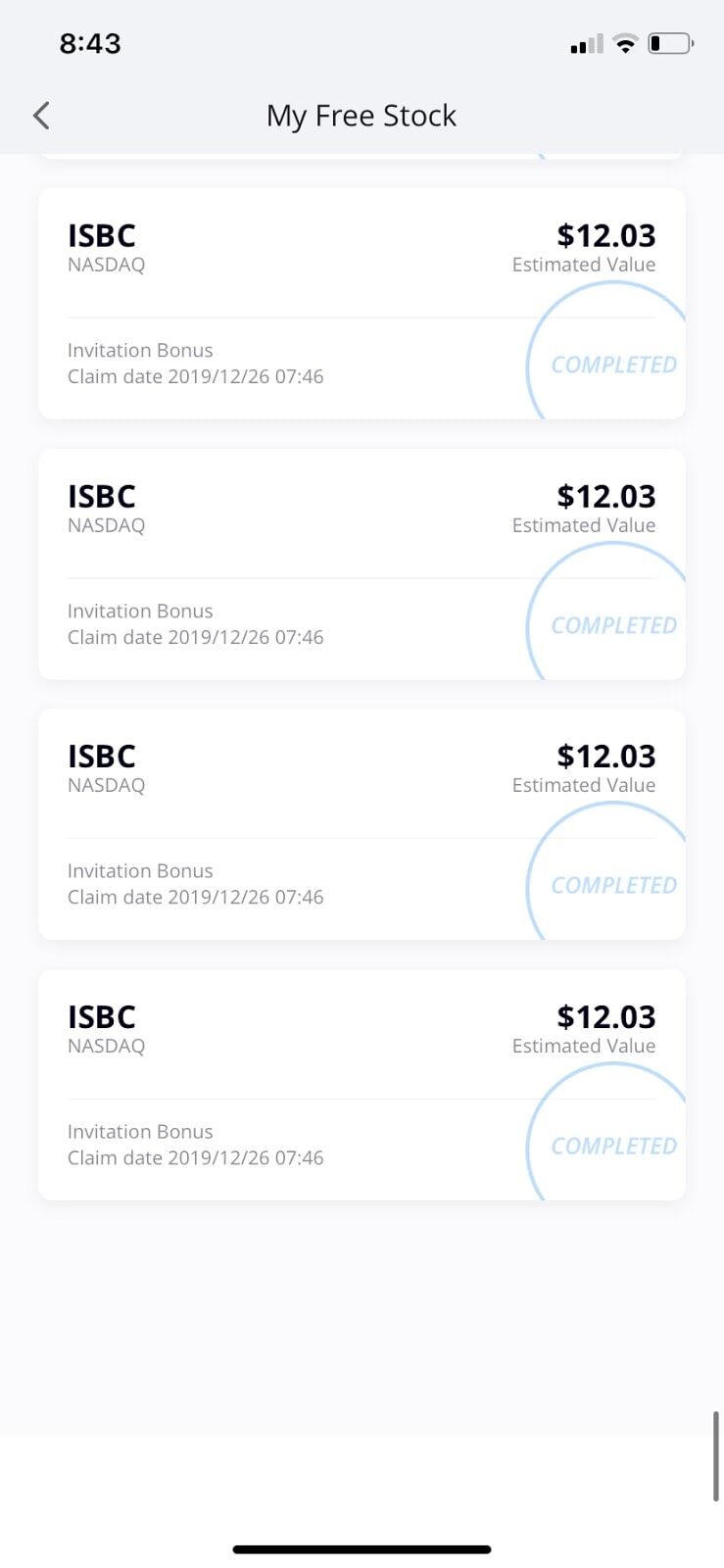

Which trading platform is best?

Choosing the best trading platform can be a daunting task for many traders. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It must also be easy to use and intuitive.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Demo accounts and free trials are a great way to test virtual money before investing any real money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Which trading site is best for beginners?

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

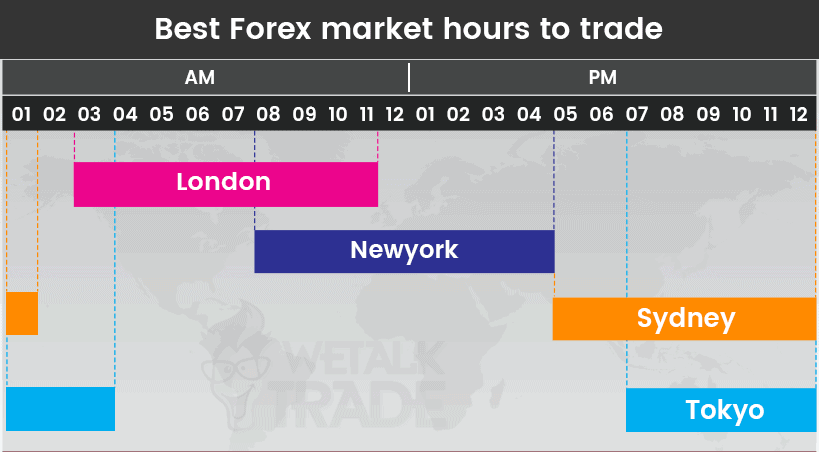

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

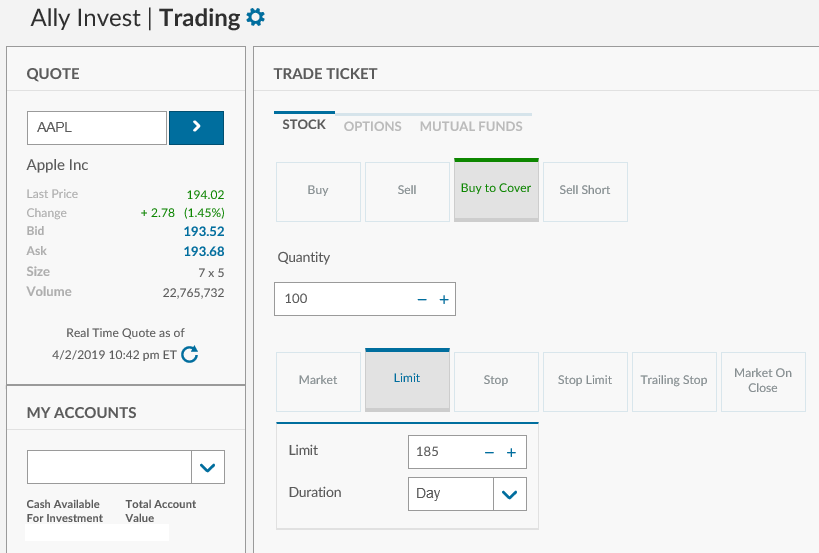

Where can I earn daily and invest my money?

Although investing can be a great investment, it's important that you know your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. Investing in property can provide steady returns with long-term appreciation and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Can forex traders make any money?

Yes, forex traders can earn money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Is Cryptocurrency Good for Investment?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I protect my financial and personal information when I invest online?

Online investments require security. Protecting your financial and personal information online is essential.

Begin by paying attention to who you are dealing on investment platforms and apps. You want to work with a company that has positive customer reviews and ratings. Before you transfer funds or provide any personal information, it is important to check the background of each company or individual that you are considering.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. Also, you should use different passwords on each account to ensure that any breach in one doesn't cause others to be compromised. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!