The most lucrative way to make money is by buying and selling interchangeable material, or commodities, in bulk. They are often the raw materials used to produce manufactured products and represent a wide range of currencies, from grain, oil, metals, and other base commodities to more exotic ones like gold, silver, and rare minerals.

To hedge against fluctuations in prices of the commodities they trade, traders often buy or sell futures or contracts for difference. They also use them in order to speculate on future price movements.

A commodity exchange is a place for members to trade a particular commodity, usually via an electronic platform. These exchanges typically have well-established rules that govern the trading of commodities.

These rules are set by law and enforced through a market regulator to ensure that goods flow smoothly and that members do not suffer from the actions of others. They are also important in order to ensure fairness, integrity and fair trading.

Due to changes in the global economy and volatility in commodity markets, commodities trading firms have developed. They have begun to expand their trading operations to other areas, such as the agricultural and industrial sectors. They are also setting up completely new trading systems.

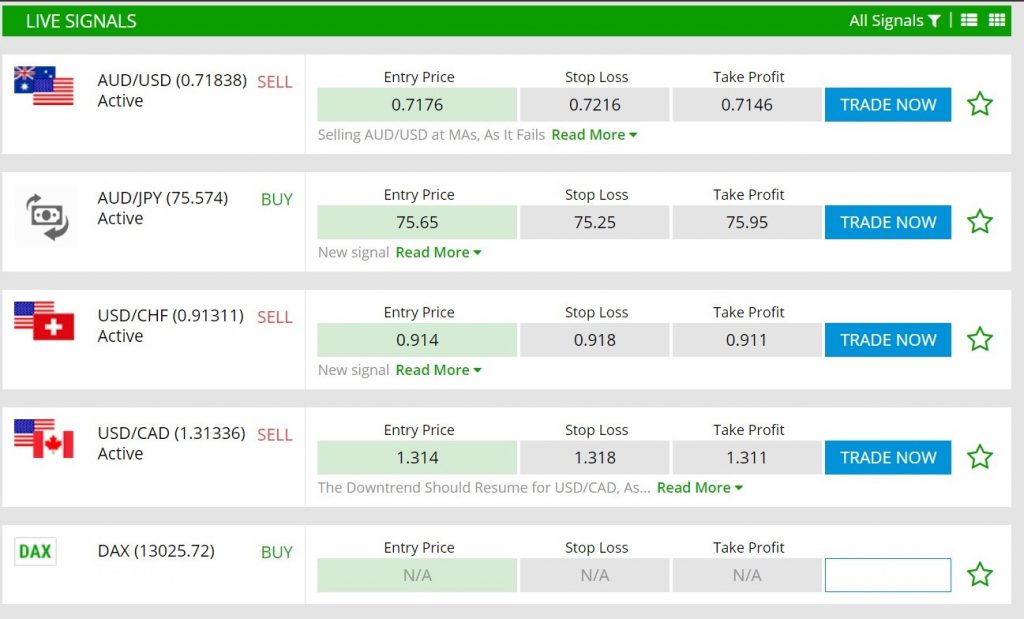

Many commodity trading businesses have invested in sophisticated data and model feeds to increase their trading team's growth. These subscription feeds provide traders with the ability to view product details, such as prices and logistics. They can also prepare forward curves that identify arbitrage opportunities and maximize portfolio returns.

In order to protect profitability and ensure long-term high performance, traders need to have one perspective on the risks they take from daily trades. Hedging needs to be a key part of their execution strategy, and they must understand the regulatory requirements and how to integrate hedging into the overall commodity trading risk management system.

They must have adequate capital for margin calls and maintain sufficient working capital. Due to the speed of trading transactions, it is important that the firm has an accurate and fast financial system that can deal with the unique business requirements.

The economics and business of commodity trading firms

A commodity trading firm must have a strong balance-sheet and a low ratio of debt-to-equity in order to be successful. Independent traders may find it difficult to raise capital from traditional sources.

An independent trader could also be a partner of a large trading house, providing the firm with flexible financing and higher returns on equity. But this comes at a price in terms management bandwidth and operational efficiency.

In order to get the best results, commodities trading firms need to create a culture that aligns well with their business objectives. To attract the best talent, they must reward traders who deliver high performance and provide generous compensation. They should use best-practice procedures to monitor performance, manage risks and reward key metrics.

FAQ

Which is better forex trading or crypto trading.

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. Diversification of assets and managing your risk will make trading easier.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Do forex traders make money?

Forex traders can make good money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which is more difficult forex or crypto currency?

Each currency and crypto are different in their difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

What is the best trading platform for you?

Many traders may find it challenging to choose the best trading platform. It can be confusing to choose the right one, with so many options.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also offer an intuitive and user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This information will help you narrow down your search and find the best trading platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Which is safe crypto or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Where can I earn daily and invest my money?

Although investing can be a great investment, it's important that you know your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to invest in real property. Investing property can bring steady returns as well as long-term appreciation. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions can I take to avoid investment scams online?

Protect yourself. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Unsolicited email or phone calls should not be answered. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Remember that scammers will do anything to obtain your personal information. You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

It is also important that you use secure online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.