Online stock trading platforms enable you to purchase stocks, ETFs, or bonds. These platforms can help to get you started in trading and increase your wealth. Some offer online tutorials and educational materials. Others include stock screeners.

Interactive Brokers has access to 140 exchanges worldwide. Its fees structure is affordable. They offer a first withdrawal free of cost each month and do not require a minimum deposit. The mobile app is also available.

The easiest way to trade stock online is through an intuitive interface. They almost all have integrated research tools. In addition, most offer a range of trading orders, including limit and stop-loss orders. It is important to choose the right platform in order to maximize your investments.

Robinhood is a popular online stock trading platform that offers zero commissions. However, there are no advanced features like social trades and customizable orders. Robinhood recently took steps to address these issues.

The US has access to eToro’s trading platform. The platform lets users trade stocks and mutual funds. The platform offers a user-friendly interface and is customizable.

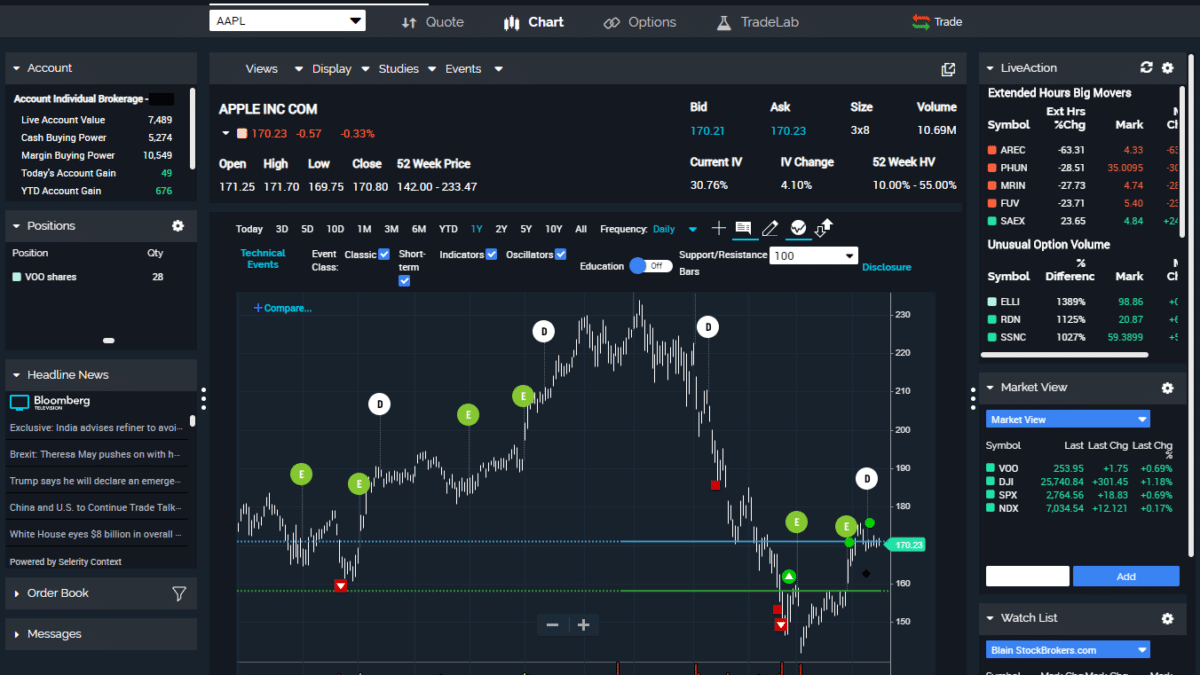

TD Ameritrade is one of the largest online stock trading platforms. The main website trading platform features a simple to use investing dashboard. You will also find a lot of tutorials and videos. Recent updates to the mobile app have made it easier to search.

Pepperstone is another popular online trading platform. Founded in 2010, the Australian firm offers a wide variety of financial assets through CFDs and Metatrader 4. There are no deposits fees and credit card deposits can be accepted. However, this platform is designed for clients who have high net worth.

Zacks Trade is another platform which has low fees and is well-suited if you are an active trader. The $2,500 minimum deposit required to open a trading account is high. This is a drawback for a lot of traders. The trading platform does NOT support fractional share.

Sign up for a course if your goal is to learn how investment works. Udemy, a leader in investing courses, has many that are geared towards beginners. YouTube is another great place to search for videos and tutorials.

Investors Underground provides a complete course in stock trading. Members can access over 1,000 video lessons, and it has a clear educational path. With a membership, you can also enjoy a live trading floor and trade recaps. Ally Invest offers another option, but does not provide all options. It offers topics that are related to experience levels.

AvaTrade offers a great option for beginners. They offer a demo trading account, which is different from other apps. They have also recently reduced their fees. You can also trade stocks, bonds and currencies. A mobile app is also available for iOS and Android.

If you are looking for investment opportunities online, it is important that you choose the right platform to meet your needs. You need to decide if you are looking to become a long-term trader or an investor.

FAQ

Which trading platform is best?

Many traders can find choosing the best trading platform difficult. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. This will help you narrow your search for the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure your platform has the right security protocols to protect your data against theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

How can I invest Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need is the right knowledge and tools to get started.

First, you need to know that there are many ways to invest. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, find any additional information that may be necessary to make confident investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Do forex traders make money?

Yes, forex traders are able to make money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading is not an easy task, but it can be done with the right knowledge. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Where can i invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading is easier than investing in foreign currencies upfront.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases it's crucial to do your research before making any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is also important to understand the different types of trading strategies available for each type of trading. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading systems and bots may also be used by some traders to help them manage investments. Before you invest, make sure to understand the risks associated with each strategy.

Which trading site is best suited for beginners?

It all depends on your level of comfort with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Should I store my investment assets online or do I have other options?

It is easy to lose your money, but it can also be difficult to decide where to keep it. A strong security system is essential for your valuable assets. There are several options.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

Alternately, you can keep your money in physical forms such as cash or gold. However, it is less secure and more difficult to track and requires more maintenance for storage and protection.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

Ultimately the decision is yours--what works best for you and provides the security and safety necessary to protect your investments?