Forex, also known as foreign exchange, is an international market where buyers and vendors trade currencies at a set price. This market is complex and very large, but can be very lucrative for those who understand how to trade it.

The best way to succeed as a forex trader is to develop a strategy that is based on your knowledge and understanding of the market. This will increase the chances that you make a profit and will keep you within your budget.

Traders should never start trading without a clear plan of action and strategy in place. This is important because if you don't know what you are doing, it can be very easy to lose money in the forex market.

Forex is volatile, so be mindful of your capital allocation and risk tolerance. This is especially important if you're trading short-term. You could lose more if you don’t manage risk properly.

If you don't have any experience with forex markets, it's best to start small and move up to bigger trades as you gain more experience. This will allow you to practice your strategy and learn the market before you invest any real money in it.

Most forex traders don't realize the importance of patience and discipline. Forex trading is highly dynamic and traders can easily get caught up with emotions and hunches. This can lead to loss.

You can keep your head sane and logical by asking questions about your strategy, the market, and how it affects you. This will help you think of scenarios that might not have occurred to you before and can make you a better forex Trader.

Don't stare at your charts throughout the day. It will only make things more volatile and won't give you accurate information. It is important to take breaks from the trading terminal so that you can concentrate on the task.

Using range trading strategies is a great way to identify areas where the currency prices are likely to stall, which can be used to generate profits. You should remember, however, that the price could reverse before reaching these levels. Therefore, focusing on these areas may not guarantee you win every single time.

Before you trade, it is important to have a stop-loss in place. This is crucial for all traders, and it will help limit your losses if the result you are looking for doesn't come out.

A lot of people will use a stop-loss that is too high or that they think will be hit soon, which is a bad idea and can lead to massive losses. This is especially true if forex traders are using leverage in order to increase their profit potential.

FAQ

How can I invest bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. You just need the right knowledge, tools, and resources to get started.

There are many options for investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. Keep an eye on market developments and news to stay current with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Can forex traders make any money?

Forex traders can make a lot of money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

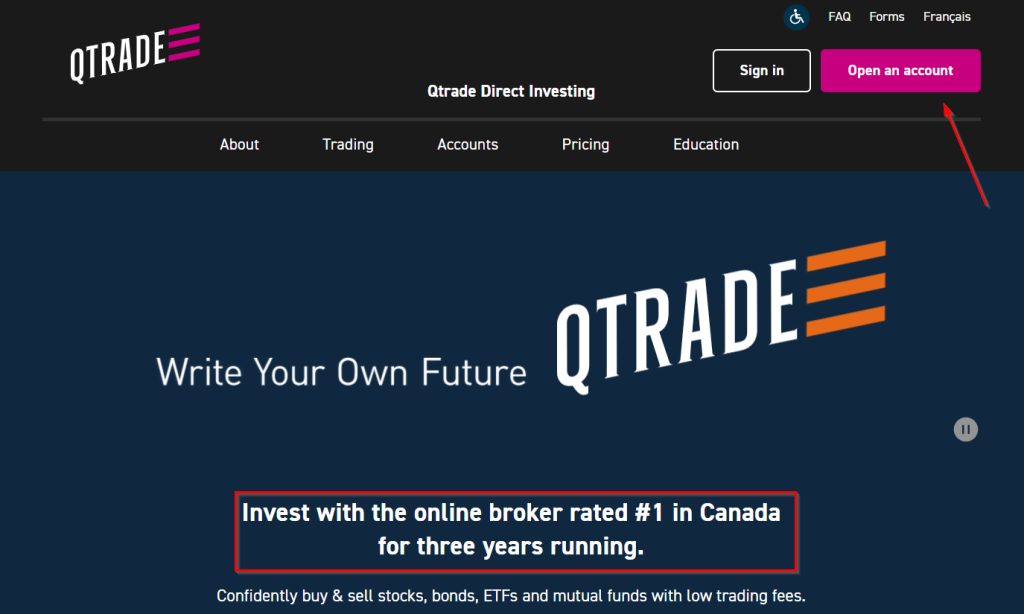

What are the pros and cons of investing online?

Online investing is convenient. You can manage your investments online, from anywhere you have an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment comes with its own risks. You should research all options before you decide on the right one. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Forex and Cryptocurrencies are great investments.

If you have a strategy, it is possible to make a lot of money trading forex and crypto. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. It is important to trade only with money you can afford to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Which is harder crypto or forex?

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex is a well-established currency with a stable trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

Security is essential when investing online. Online investments are a risky way to protect your financial and personal information.

Begin by paying attention to who you are dealing on investment platforms and apps. You want to work with a company that has positive customer reviews and ratings. Before you transfer funds to them or give out personal information, do your research.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. To ensure your account security, disable auto-login on all devices. You can protect yourself against phishing by not clicking on emails from unknown senders, never downloading attachments, and always checking the security certificate of a website before entering any private information.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. You should also use different passwords to protect each account from being compromised. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!