Alpari is the most popular forex broker in the world. It is a well-known forex broker that has been around for over 20 years. They offer a wide range of trading instruments. You can also choose to trade crypto currencies using a trading service.

Alpari is licensed in Russia as well as the UK. The company is also a member of the Financial Commission, which is based in Hong Kong. These regulatory bodies are not required to register the broker with any government agency or have capital buffers. Investors should ensure that the broker they choose to work with is legitimate and trustworthy.

Alpari allows customers to trade cryptocurrencies in addition to Forex. The company's leverage ratio is one of the highest in the industry. Trader can open an account and start trading immediately without spending a lot. Additionally, traders can receive points for trading which can be used for getting money back on a swap or for a commission.

The company offers MT4 as well as MT5 trading platforms. They can be used on any device. Demo accounts are also available to allow new users to test the platform before opening a real account.

Alpari's customer service is available 24/7. The team can be reached via email, chat, or phone. Agents are responsive and can provide quick answers and helpful information. Customers can also benefit from dispute resolution mechanisms.

Alpari offers a large range of assets. These include currencies, stocks futures options and indices. It's easy to navigate the website and you can access all of its main functions. For instance, the trading page is automatically opened when you log onto the site. You can then choose the type of account you would like to open. Alpari offers a variety of deposit and withdrawal options, including bank transfers, credit and debit cards, as well as digital payment systems.

Alpari is well-known for offering a reliable service. The company has built a solid relationship with banks in order to ensure a swift transfer of funds. The company offers a variety of protections to its clients, including segregated funds. Signing up for a premium account will get you free deposits and commission-free. Alpari offers services in more than 10 languages.

Alpari requires visitors to complete a form. This information includes financial details, employment details and details about personal financial accounts. During the registration process, Alpari will ask for a copy of a utility bill as proof of residence. Traders then will receive an email confirming their account.

Alpari's website is easy to navigate and the live chat is clearly visible on the page. All questions are answered within 30 second. Alpari clients can contact them via email and phone. Alpari has received a double AA service rating and has been recognized for their customer service.

FAQ

Trading forex or Cryptocurrencies can make you rich.

You can make a fortune trading forex and crypto if you take a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. It is important to trade only with money you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Which trading platform is the best for beginners?

All depends on your comfort level with online trades. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

What are the pros and cons of investing online?

Online investing has the main advantage of being convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

What is the best forex trading system or crypto trading system?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading is easier than investing in foreign currencies upfront.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

It is important to research both sides of the coin before you make any investment. Diversification of assets and managing your risk will make trading easier.

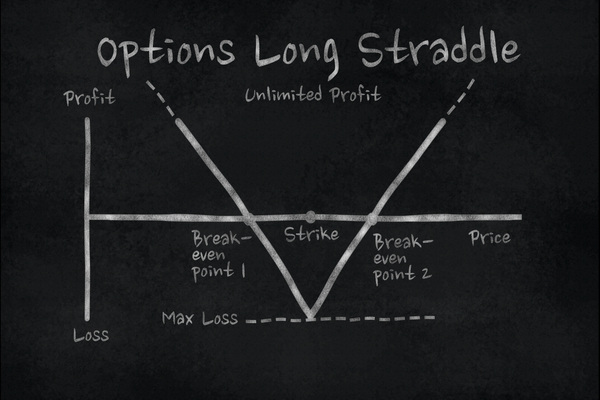

It is important to know the types of trading strategies you can use for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

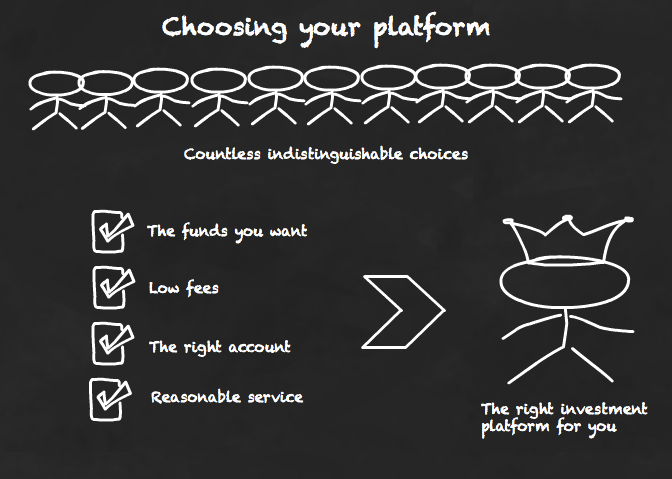

Which platform is the best for trading?

Many traders can find choosing the best trading platform difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down your search to find the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protection starts with yourself. You can prevent yourself from being duped by learning how to spot scams, and how fraudsters work.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Unsolicited email or phone calls should not be answered. Fraudsters often use fake names, so never trust someone just based on their name alone. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Keep in mind that fraudsters will try everything to get your personal details. Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

Secure online investment platforms are also essential. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before you make any investment, read and understand the terms of any website or app that you use.