Financial options give investors the ability to sell or buy an underlying financial asset at a given price at a designated time. The underlying asset is what determines the value of an option. This could be stocks bonds currencies or commodities. Options can protect an equity portfolio against price falls or increase the return of investment. These options allow you to speculate on the financial markets and reduce the risk of losing your money. It is important to be aware of the risks involved in investing in these instruments.

Options are not for everyone but they can make a good part of a portfolio. Some investors even try options writing. For example, a grower who wants to sell his corn may purchase a put option, which is not a legal contract but an arrangement to sell his crops. This allows him to take advantage of favorable interest rate movements.

In general, an option's price fluctuates continuously. The premium paid for an option can be affected by transaction costs. However, the overall value of the option will usually exceed its pure value. Volatility in the underlying market can also affect option prices.

Call and put options are two of the most popular types of financial options. Call options offer the possibility to sell or buy an underlying asset for a fixed price. Call option holders are not required to buy an asset unlike other types of options. An investor who buys a call option expects that the underlying asset will rise or fall in value, which limits his loss. A put option, on the other hand, gives the option holder the ability to sell the underlying asset at either a fixed or rising price.

A futures option is another form of financial choice. A futures agreement is a derivative that is determined by the value of an underlying commodities. These contracts are usually written by major financial institutions. The interest rate option's writer is responsible for paying the difference between the actual rate of the cap and the rate. He is responsible for paying a cash sum if the rate exceeds the cap.

Real options are a rarer type of financial instrument. Real options give the company's management more flexibility than other types of financial options. They give management the ability to reject a decision and make an investment.

A collar is another type of option. Collars can protect investments from negative movements. The collar's buyer can choose to purchase a second, cheaper option. However, leverage can magnify the premium's value but also can result in large financial losses.

Finally, there are spreads. Spreads enable you to buy and sell several options contracts simultaneously. Options cannot be traded on any open exchanges. They are therefore considered to be "over-the-counter". Brokerage firms must approve traders.

FAQ

What are the pros and cons of investing online?

The main advantage of online investing is convenience. Online investing allows you to manage your investments anywhere with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

You should also be aware of the different investment options available to you when investing online. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Is Cryptocurrency Good for Investment?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Do forex traders make money?

Yes, forex traders can make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading is not an easy task, but it can be done with the right knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which trading site is best suited for beginners?

It all depends upon your comfort level in online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

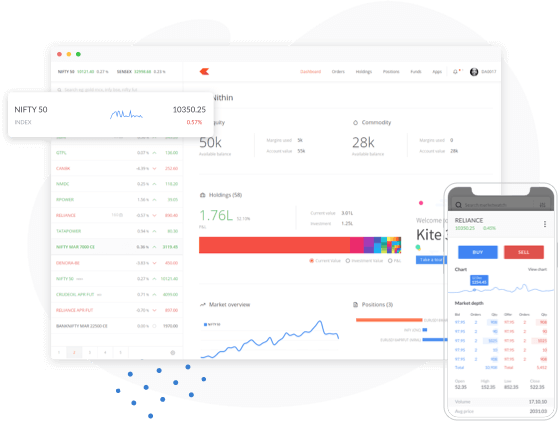

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protection begins with you. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Be wary of offers that seem too good to be true, of high-pressure sales tactics and promises of guaranteed returns. Do not answer unsolicited emails and phone calls. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Remember that scammers will do anything to obtain your personal information. Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

It's also important to use secure online investment platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before you make any investment, read and understand the terms of any website or app that you use.