The stock market is in turmoil today, with many investors worried about inflationary pressures. The sentiment is being weighed down by inflation fears and a deepening yield curve inversion. Traders anticipate a Federal Reserve interest rates increase in February.

The S&P 500 may be under pressure but the broader markets are also in danger of another bearish market. Investors are focused on the earnings reports of technology companies and the Federal Reserve's rate decision.

Stock markets are back in the red following a recent rebound. As the Dow Jones Industrial Average dropped more than 250points, a wide range stocks fell today. The blue chip index dropped for the first-time in six trading days. Consumer staples were the worst performing sector, while the materials and energy sectors did well.

The market was also under threat as the yield on 10-year Treasury bonds rose to a new four-year record. While the yield remains below the 3.5 percent level that marked the peak of the bull market, investors are still waiting to see if the Fed will move the federal funds rate to a quarter point.

Despite the selloff the Fed still indicated multiple interest rate increases in 2022. Although it seems likely that the Fed would eventually shift the rate to a quarter percent, this could take a while. Investors continue to place great importance on the Fed’s soft landing narrative.

Today's report revealed that the United States experienced much greater economic growth than anticipated. In the fourth quarter 2018, the economy grew by 4.2 percent annually. The market still needs to see data on manufacturing and job openings. Friday is the due date for the December jobs report. Investors will be able to get a clearer picture about the economy's performance.

The Fed's decision to reduce the Federal Reserve's stimulus program in 2013 began to show its teeth. The economic slowdown has put companies at risk of losing their margins. It's easy to see how the stock market is in slump these past months.

Among the biggest losses of the day were Tesla (TSLA) and Devon Energy (DEC), which reported lower-than-expected quarterly deliveries. Boeing (BA), on the other hand, posted its sixth consecutive quarter with money-losing results. Microsoft (MSFT), another major player, issued a dire warning about sales, as it is reporting softer cloud revenue. Spotify (SPOT) also announced layoffs.

The market's slide was reversed in the last hour. It mostly recovered. But the tech-heavy Nasdaq was under tremendous pressure. Several tech stocks, including Adobe and Apple (AAPL), were affected by the decline.

Walt Disney, (DIS), reported a disappointing start to 'Avatar The Way of Water. 3M (MMMM) and Nike(NKE) both rose. The communications services sector was also the best performer Monday, with Netflix (MMM) and Facebook reporting strong subscribers growth.

FAQ

Which trading site is best suited for beginners?

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is important to know the types of trading strategies you can use for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Where can I invest and earn daily?

It can be a great method to make money but it's important you understand all your options. There are many options.

One option is to invest in real property. Property investments can yield steady returns, long-term appreciation, and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Forex and Cryptocurrencies are great investments.

If you have a strategy, it is possible to make a lot of money trading forex and crypto. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Which trading platform is best?

Many traders can find choosing the best trading platform difficult. It can be overwhelming to pick the right platform for you when there are so many options.

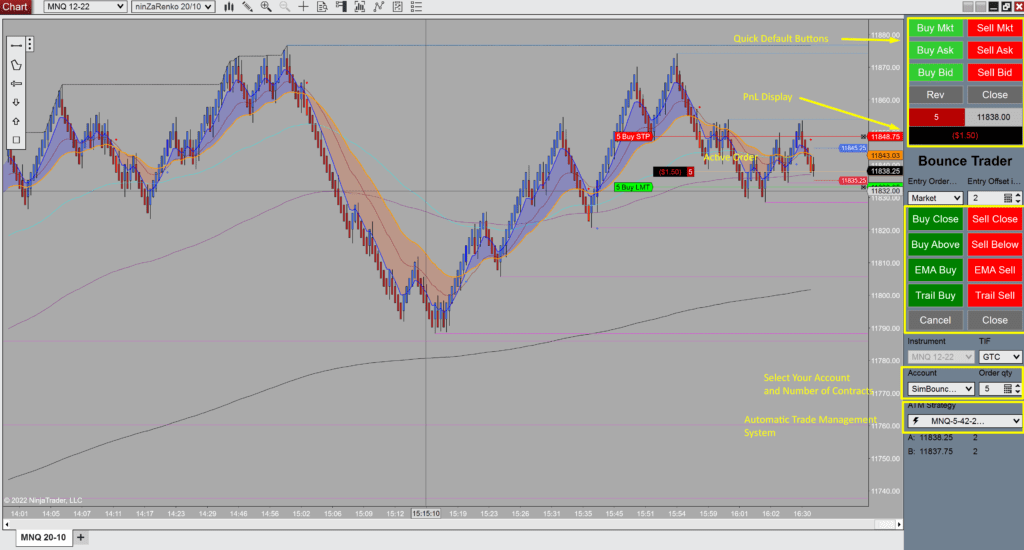

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down the search for the right platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

What are the advantages and drawbacks to online investing?

Online investing is convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important for online investors to be aware of all the investment options. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure security for my online investment accounts?

Online investment accounts must be secure. It's essential to protect your data and assets from any unwanted intrusion.

First, you want to make sure the platform you're using is secure. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

It is important to be familiar with the terms and conditions of any online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Finally, be sure to know about any tax implications that investing online can have.

These steps will ensure your online investment account is protected against any possible threats.