There are many factors that determine the price of crude oil. However, the current price of crude oil is volatile. The West Texas Intermediate oil crude oil (WTI) has a direct correlation with the price of oil. The Middle East is home to a large portion of the oil used in the index. The price of oil plummeted due to US sanctions against Russia. It is crucial to understand how global markets are affected by the price of oil.

The escalation of trade tensions between the US and China could have a significant impact on traditional indices. As the trade war reaches its final stages, the potential to sabotage traditional indices is becoming an increasing concern for investors.

In an attempt to establish China as a superpower, China introduced a new oil benchmark in March 2018. China's attempt to become an economic superpower is part of this new oil benchmark. Despite the successes of the new index the market is still far away from being a global standard.

This study examines how the Chinese and international crude oils prices are dependent. It employs copula model to assess the effect of the global economic crisis on the structure and relationship between these two.

Results indicate that the relationship among the Chinese and international crude-oil price was endogenous. The transmission of prior volatility caused the current volatility. The fluctuations were not as severe. Positive news had a greater impact than negative news on current volatility.

Seven periodic shocks impacted the crude oil indices of China and international countries during the study period. Each shock had a different impact on the prices of the crude oil indices. The shocks were dissipated by the eighth period and the prices of both indices returned back to pre-shock levels.

Although the OPEC+ agreement that cut production by 2,000,000 barrels per hour in November lowered overall market supply, it also increased pump prices. The OPEC+ has predicted a tightening in world's oil market due to the diminishing supply. The reserve oil production capacity will drop to no more that 2-2.5 million barrels per hour. These changes can lead to an even greater global shortage ahead of the winter season.

China's crude oil prices are more vulnerable to external shocks than other markets. The crude oil price in China rose 0.19 dollars between the second and fifth months. The price fell by 4.77 and 1.08 respectively in the sixth- and seventh months. The price increase was nevertheless quite slow.

This study is the only to analyze the relationship between Chinese and international crude indices with an unstructured model of VAR. The article also explores the effect of the new index in the Middle East.

The results showed that prior conditional variance was the main factor affecting the volatility of both the Chinese as well as international crude oil prices. Additionally, stochastic terms over the past period affected the conditional variance. It was also shown that the Chinese oil prices and international crude oil price were mutually influencing.

FAQ

What are the benefits and drawbacks of investing online?

The main advantage of online investing is convenience. You can manage your investments online, from anywhere you have an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Can you make it big trading Forex or Cryptocurrencies?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Trading with money you can afford is a good way to reduce your risk.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

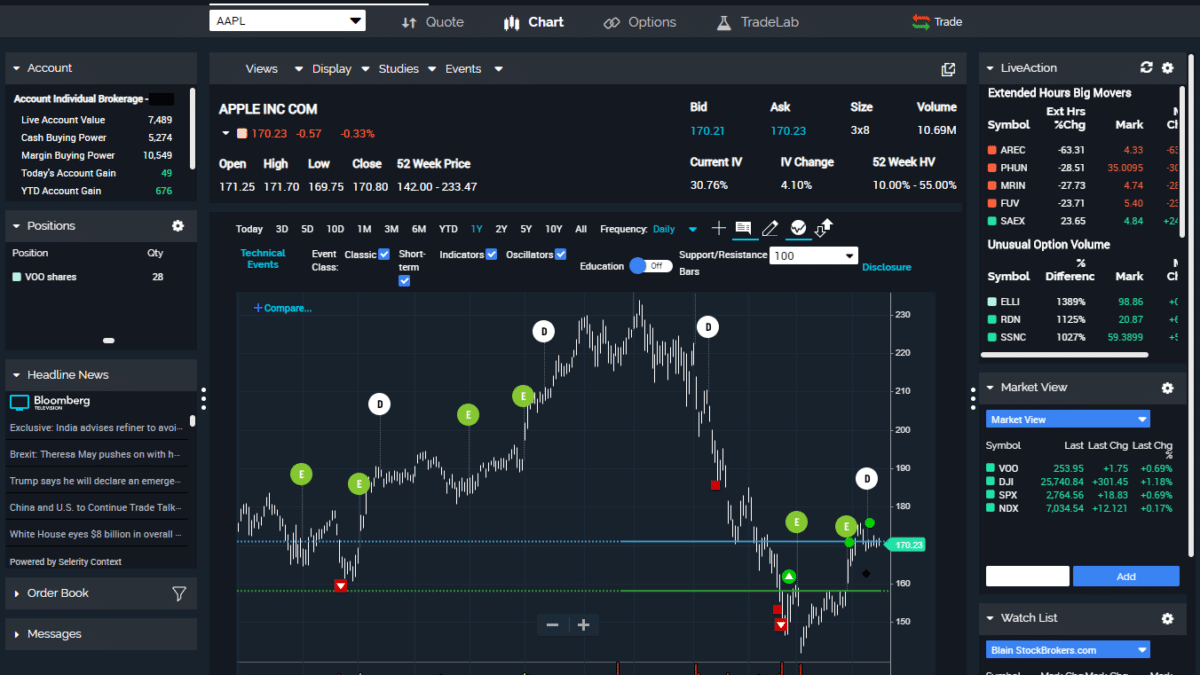

Which trading platform is the best for beginners?

All depends on your comfort level with online trades. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many offer interactive tools to help you understand how trades work.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which is harder crypto or forex?

Both forex and crypto have their own levels of complexity and difficulty. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Frequently Asked Questions

What are the four types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

There are two types of stock: preferred stock and common stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Are forex traders able to make a living?

Yes, forex traders can earn money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

Is it safe to store my investment assets online, or should I consider other options?

Money can be complex but so can the decisions about how to store it. You have many options for protecting your valuable assets.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. The downside is that there may be electronic thefts.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

You may also want to consider specialized investment firms offering secure custody services that are specifically designed to protect large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.