The cryptocurrency industry is rapidly expanding and investors are eager to find the next Coinbase. MoonPay is one startup looking to tap into the billions in venture capital. It's a global B2B firm that helps many exchanges and wallets transact on all major crypto networks.

Celebrity investors back the company. It focuses on DeFi and NFTs, Web3, as well as the metaverse. Its platform is accessible across 160 countries and is used by celebrities, companies, and organizations to make purchases.

Safemoon Investment

It is risky to make your first crypto investments. You can avoid making costly mistakes and avoid falling for scams.

Buying cryptocurrency with MoonPay is easy and secure. MoonPay offers customers privacy and security with AES256 blocklevel storage encryption.

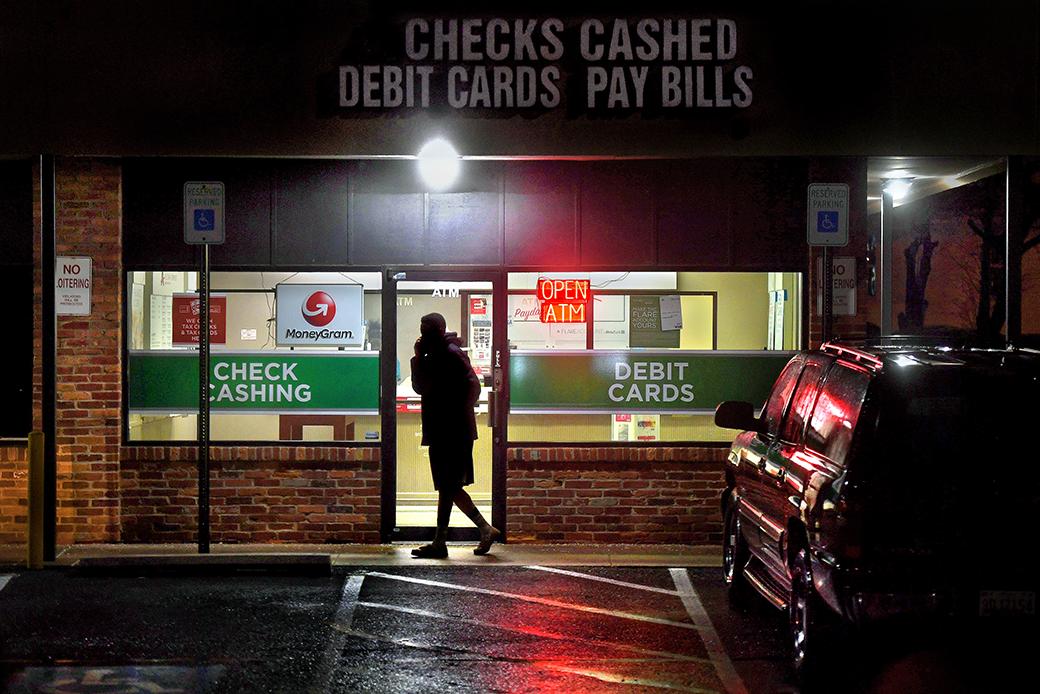

You can purchase cryptocurrency with your debit or credit cards, or you may deposit cash to your account. Some credit cards may not allow you to purchase crypto. To withdraw crypto balances safely, you should check with your bank.

MoonPay makes it easy to sell cryptocurrencies. You can also enter how much crypto and which currency you'd prefer to receive in exchange. Next, you will be able to choose from a range of payment options, including credit cards or bank accounts in the United States. The selling process takes about three to four days.

MoonPay is a reliable, simple-to-use platform for crypto payments around the world. It's available in 160 countries, and it supports most major crypto currencies.

The company employs a security team that works closely with law enforcement in order to prevent money laundering. Support tickets can be used to help customers with problems.

MoonPay closed its $555 million Series B round of funding in November 2021. It was the largest and most highly-valued Series C for any bootstrapped bitcoin startup. MoonPay was valued at $3.4 billion and is one of the most valuable startups in the sector.

MoonPay, founded in Miami by Victor Fara and Ivan Soto-Wright as Chief Engineers in 2016, was founded. Inspired by PayPal, and other digital payments systems, they created MoonPay.

Soto Wright explained that they were creating a simple and reliable gateway to digital assets for everyday consumers. The platform currently serves more than 160 countries, with tens of million of users.

Its core products include a crypto-on-ramp and off-ramp for dozens of exchanges, wallets, and other partners. It also offers NFT checkout for creators and NFT platforms.

Token burning can be manually controlled by the company. The company claims this is done to help control token circulation while rewarding holders. To inform the public about the token's supply and burn rate, the token has a public tracker.

FAQ

Which is the best trading platform?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It must also be easy to use and intuitive.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? This will help you narrow your search for the right trading platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Frequently Asked questions

Which are the 4 types that you should invest in?

Investing can be a great way to build your finances and earn long-term income. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Which is harder crypto or forex?

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Which trading website is best for beginners

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Forex and Cryptocurrencies are great investments.

Yes, you can get rich trading crypto and forex if you use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can my online account be secured?

Safety is a must when it comes to online investment accounts. It's essential to protect your data and assets from any unwanted intrusion.

You must first ensure that the platform you're using has security. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

Thirdly, make sure you understand your investment platform's terms and conditions. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. Look at user reviews to get a feel for how the platform works. Finally, make sure you are aware of any tax implications associated with investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.