The Best Blockchain Stocks To Buy Now

In a world where blockchain technology is becoming increasingly popular, there's no shortage of opportunities for investors. But just as with any new investment, you need to understand what you're buying before you invest your hard-earned money.

Companies that have strong business models around blockchain technology and are using it to drive growth are the best Blockchain stocks. Some companies are already established and well-positioned to profit from the sector’s long-term boom. While others are still young and may not be able to achieve success immediately,

International Business Machines

IBM is a long-standing name in the computer industry. Its blockchain enterprise can be a great starting point if you are looking for a company that has already harnessed the potential of this technology. The company is currently working with clients to create a range blockchain applications. These include supply chain management as well as health records.

Mastercard Incorporated

Mastercard Incorporated, a leader in blockchain technology, provides a platform for companies that helps them streamline and secure business-to–business transactions and trade finance. It also provides a robust Blockchain API that makes it easy to integrate your business processes in a blockchain-based system.

Taiwan Semiconductor Corporation

This semiconductor manufacturer is a leader in high-performance chips and has several applications in the blockchain space. Its chips are efficient and highly scalable. The company's application-specific integrated circuits (ASICs) are especially popular among miners, who want chips that are more powerful and efficient than the competition.

Coinbase Global, Inc

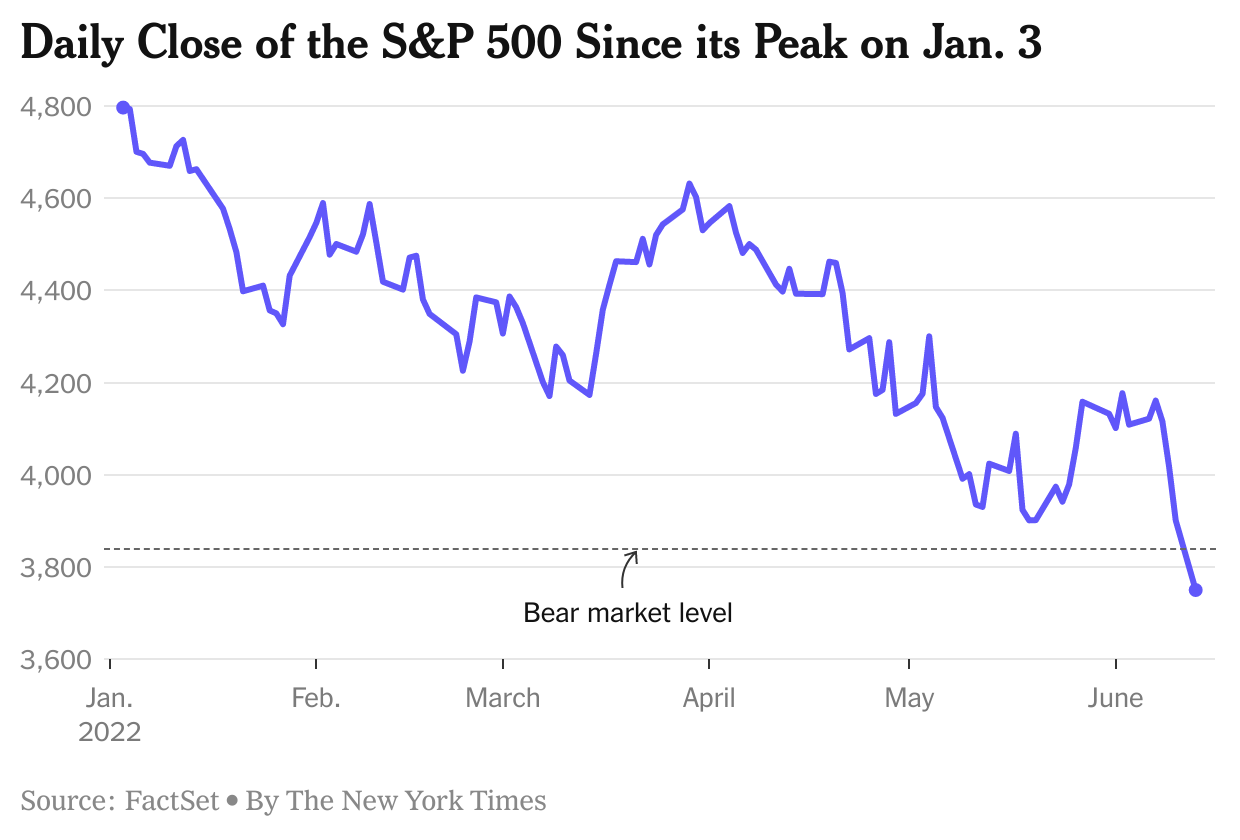

Cryptocurrency storage and trading company Coinbase is one of the most popular blockchain stocks to invest in today. Although the stock took a significant hit due to the drop in digital asset prices, it should rebound strongly if the cryptocurrency market recovers.

It is a major player in the cryptocurrency market, with a user base of nearly 90 million. Its Coinbase Exchange allows you to trade over 10,000 cryptocurrency on the platform.

Robinhood Markets, Inc

In addition to providing a popular stock trading platform, Robinhood Markets also offers trading services for cryptocurrencies and other digital currencies. The company is rapidly growing in popularity in the crypto market, and its userbase has grown substantially over the past months.

eToro, LLC

eToro is the most popular online brokerage, specializing in crypto and forex. This allows you to make investment in the cryptocurrency markets without paying commission fees. You can also store your cryptocurrency wealth in a safe and secure location.

Metacade

Metacade token can be used to reward players through a game-based platform. It's designed to provide big benefits unlike any other. This token was launched relatively recently and has not yet been affected by the law of diminishing returns. It offers huge upside potential.

Riot Blockchain

Riot Blockchain (Nasdaq. RIOT), is an option for anyone interested in bitcoin mining. This company is focusing on mining and intends to be the largest and lowest-cost producer of the cryptocurrency in the United States. It also enjoys a strong reputation and a reliable management team.

FAQ

Cryptocurrency: Is it a good investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Forex traders can make money

Yes, forex traders are able to make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Which is harder, forex or crypto.

Different levels of difficulty and complexity exist for forex and crypto. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Where can I invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Online trading is possible if you're comfortable with the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

What are the advantages and drawbacks to online investing?

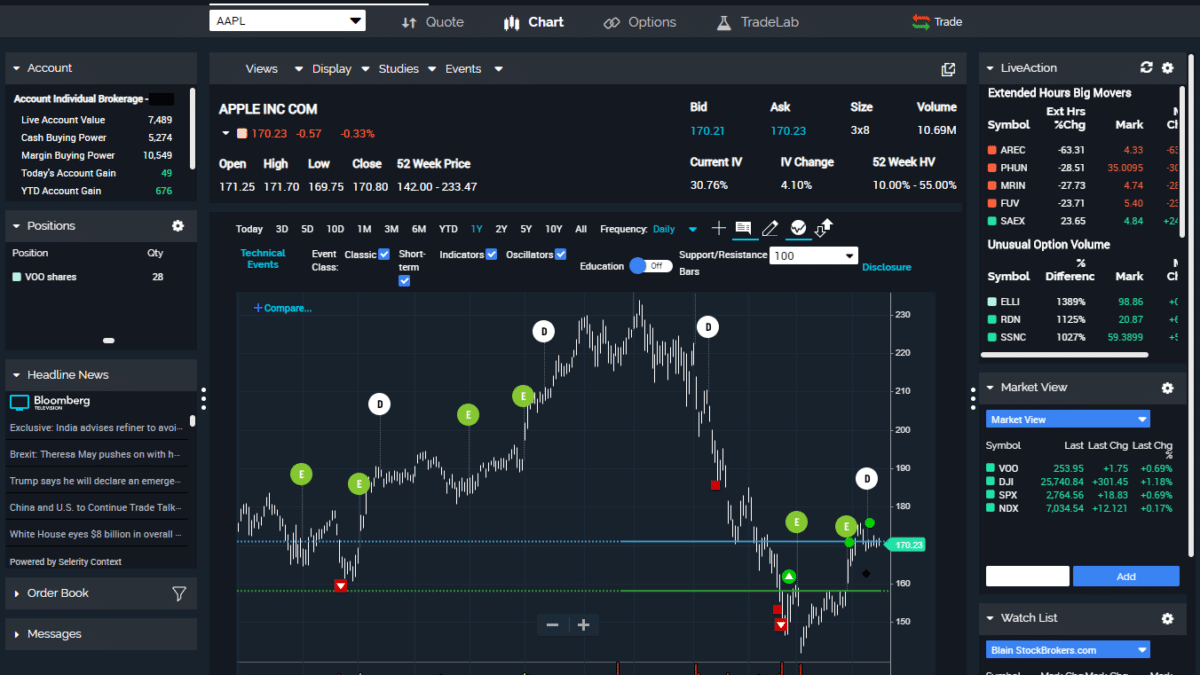

The main advantage of online investing is convenience. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, online investing does have its downsides. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

You should also be aware of the different investment options available to you when investing online. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protect yourself. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Never respond to unsolicited phone calls or emails. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Remember that scammers will do anything to obtain your personal information. Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It's also important to use secure online investment platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.