Ally Bank is a leading online bank. It has increased its consumer deposit base by 23% over the past year. In addition to its high level of consumer deposit growth, Ally Financial has also been growing its automotive loan portfolio. Ally increased its consumer originations by 9.6% during the 2nd quarter 2019. This compares to $9.6 Billion in the previous quarter. Net charges for retail auto loans decreased by nine bps in 2019 compared with the previous year.

While Ally's credit trends remain positive, the company has also been taking steps to reduce its long-term debt. Ally currently has $42.3 billion of total debt. This is a decrease from the record $66.2 billion set in 2012. This is a reduction from the amount of debt that the company has at the end of the third quarter of 2012, when it had a tangible book value of $3.7 billion.

Because of the restructuring of its debt, Ally now has a solid flow of cash to pay off its debt. While Ally has decreased its total debt, it is still very concerned about the overall level. Management is working to reduce the debt while increasing its dividend.

Ally's credit trend has shown strong credit management and underwriting, even though there have been some challenges. These factors have helped the company maintain its position as one of the largest and most profitable financial companies in the industry. However, the company could benefit from stronger growth.

Ally's years of profitability have paid off and the company is well positioned to continue its upward trajectory. A healthy balance sheet and solid reputation may allow the company to take on greater debts and offer higher rates for return on investments. Ally is a great option for those looking to invest in the stock exchange.

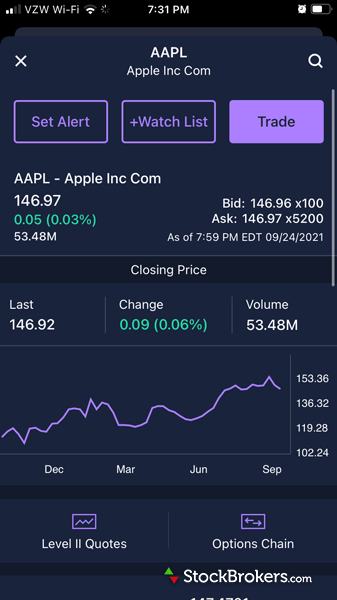

The first step in buying shares of Ally is to find out how valuable the company is. You can do this by evaluating its current Zacks Rank. It currently is a #2. It also holds an A rating for Value. Also, it offers a 4.7% yield.

The dividends of Ally have grown significantly over the past five year. Investors can expect to receive a quarterly distribution from the company. This dividend is currently paid out every three month to shareholders. During the second quarter of 2019, the company decided to offer a 3.3 million application pool for new business.

Ally, one of many banks with a large customer base, is growing as more people use the internet for their banking transactions. For the past two years, Ally grew its retail customer base from 1.10 million to 1.87 million. Additionally, Ally has grown its dealer relationships to 18,000 dealerships.

Ally offers a wide array of financial products including banking, credit card, loans and other services. It has announced that it will divest its lending operations across Latin America and Europe and sell 40% of its stake in a joint venture with China. The transaction will ultimately require regulatory approvals.

FAQ

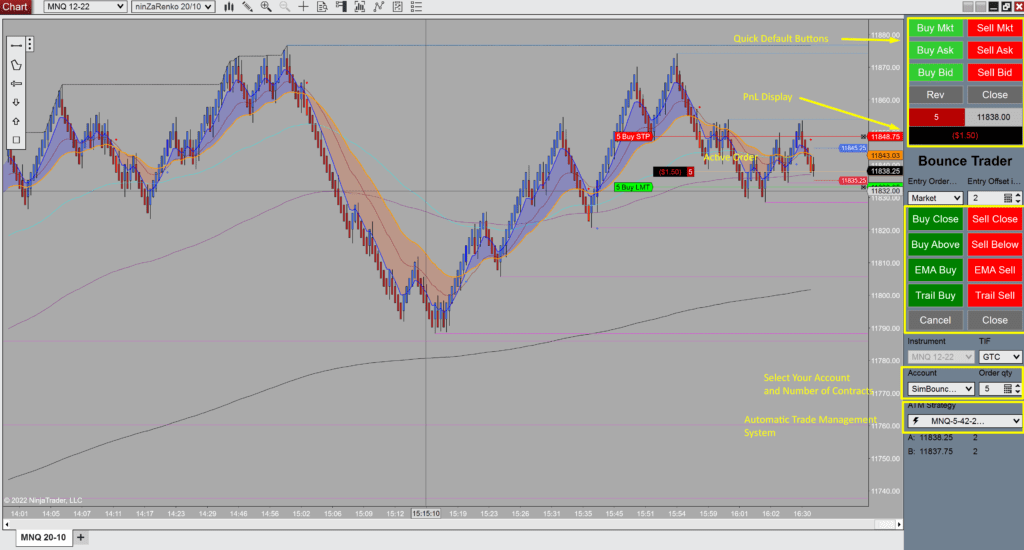

Which platform is the best for trading?

Many traders find it difficult to choose the right trading platform. It can be confusing to choose the right one, with so many options.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Can one get rich trading Cryptocurrencies or forex?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Trading with money you can afford is a good way to reduce your risk.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

What are the benefits and drawbacks of investing online?

Online investing offers convenience as its main benefit. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing comes with its own set of disadvantages. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important to understand the different types of investments available when considering online investing. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which trading site for beginners is the best?

Your level of experience with online trading will determine your ability to trade. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Where can you invest and make daily income?

Although investing can be a great investment, it's important that you know your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

How can I invest bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. You just need the right knowledge, tools, and resources to get started.

You need to be aware that there are many investment options. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Some options may be better suited than others depending on your risk tolerance and goals.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investment is not without risk. Online investments pose risks to your financial and personal data. Take steps to reduce them.

Start by being mindful of who you're dealing with on any investment app or platform. You want to work with a company that has positive customer reviews and ratings. Before you transfer funds to them or give out personal information, do your research.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. You should also use different passwords to protect each account from being compromised. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!