Options are a type of investment that is used for a variety of reasons. Whether you're interested in making a profit, protecting your existing portfolio or simply hoping to stay out of the market altogether, options are a great way to do so.

When people buy options, they typically do so with a specific time frame in mind. Options have an expiration date, unlike stocks that can be held for longer periods of time before being sold. This will allow you to see how long your profits can be held before they are sold. Furthermore, tax-loss harvesting can help you minimize or offset any tax due.

Options can be a great option for someone who is new to trading. They offer a higher return rate than other investment options. But they are also extremely risky.

To begin with, you'll need to understand what an option is and how it works. Calls and puts are the two main options. If you believe a stock will rise, the call type will be used. The put type will be used if you believe it will decline in value.

It is important to understand that options are derivatives. That means their value is dependent upon another asset. In particular, the price of the underlying stock determines the premium that you'll pay to purchase the option.

Remember that the option price will rise as you near its expiration. This is called the "premium" because it is based on the price and value of the underlying security, along with other factors that may influence it.

How to Buy Options

When you're ready to start trading, make sure that you have the funds needed to cover your losses if something goes wrong. A reliable broker will be able to help you navigate this maze of options.

Hedging can be done by purchasing options

Purchase a protective stock put to protect your portfolio. This is a great way of avoiding a large loss in the unlikely event that the stock's price drops suddenly.

You should be aware that there are many options available and that you could lose your entire money. This is why you need an expert financial advisor to help guide you in choosing the right option for your circumstances.

How to Profit from Options

By buying puts and calling at the same strike, you can make a profit. This strategy is known as a synthetic trade, and it's a great way to take advantage of volatility in the stock market.

Knowing how to properly build trades is the key to this strategy's success. This includes knowing the strike price and how much money you will need to cover losses in the event that the underlying stock falls in value. It also means understanding the time frame for holding your position. These are the basics to generate consistent income with options.

FAQ

What is the best forex trading system or crypto trading system?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both instances, it is crucial to do your research prior to making any investments. Diversification of assets and managing your risk will make trading easier.

It is important that you understand the different trading strategies available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Which is the best trading platform?

For many traders, choosing the best platform to trade on can be difficult. It can be confusing to choose the right one, with so many options.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. This information will help you narrow down your search and find the best trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Where can I earn daily and invest my money?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many options.

One option is to buy real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which trading site is best suited for beginners?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

How do I invest in Bitcoin

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need is the right knowledge and tools to get started.

You need to be aware that there are many investment options. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. It is important to trade only with money you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Statistics

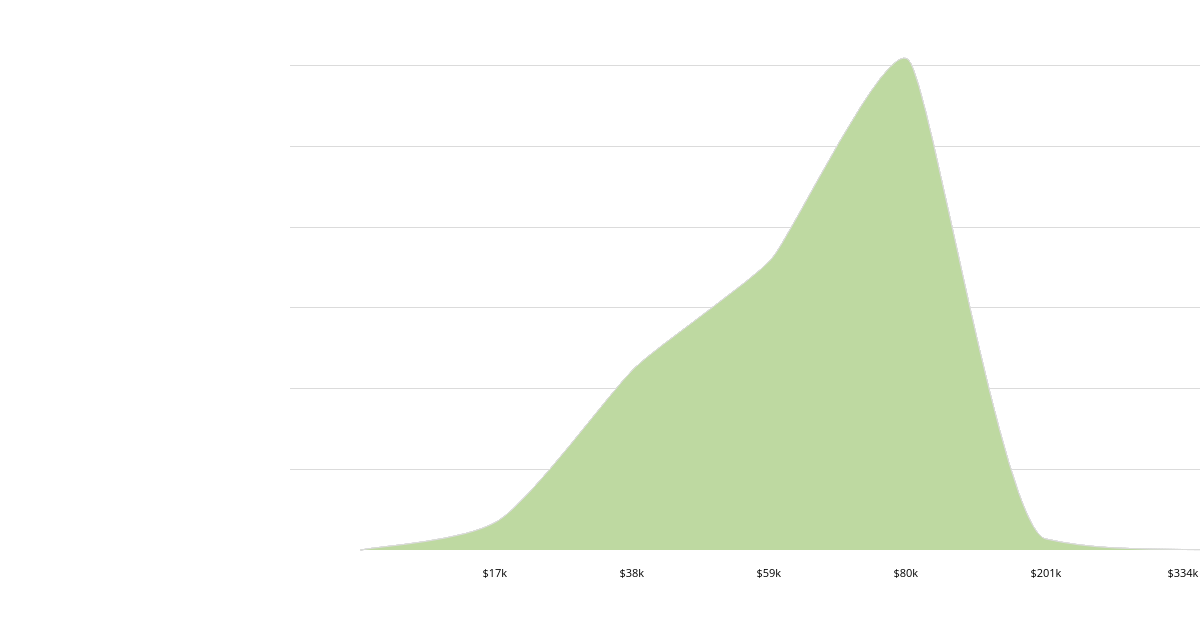

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

When you invest online, it is crucial to do your homework. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. Be skeptical of promises of substantial future returns or future results.

You should understand the investment risk profile and be familiar with the terms. Before you open an account, check what fees and commissions might be taxed. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.