In the world of trading, intraday trading is a term that describes strategies used by traders to exploit price movements on an intraday basis. These strategies include placing orders to buy or sell shares on a particular day. These trades are usually entered and completed within a very short timeframe, often before the market closes.

Intraday trades are highly volatile. It isn't for everyone. It requires a lot of patience, discipline, dedication, and patience.

An effective intraday trade requires a combination of technical analysis, fundamental research, and both. This approach is particularly helpful for stocks that are sensitive or dependent on news, such important earnings reports and economic reports.

You should also study the stock's history to identify patterns. This will help you determine if the stock is likely or not to follow a trend and which entry and exit points would be most appropriate.

Many traders use technical instruments to spot price trends and find support and opposition levels. The Relative Strength Index, (RSI), can be used for identifying if a stock may be overbought/oversold.

You can also trade based on news events, range-bound or scalping as intraday strategies. These strategies require understanding of market conditions (e.g. liquidity) and a broker that has access to many powerful tools.

Range-bound trades are an intraday strategy that capitalizes on small price fluctuations throughout the day to achieve small gains and profits. This strategy involves spotting threshold points at which share prices rise or fall, and entering long positions when stock prices reach those levels and selling them when they drop below them.

You must consider the size and liquidity, volatility, and market position when trading intraday. Liquidity matters because you can lose money on intraday trading if your stock lacks liquidity.

A second crucial factor when trading this way is to ensure that your trades are completed before the market closes. This helps you avoid being pulled into losing trades and keeps you safe from unmanageable risk.

Third, it is important to be able to control your emotions when trading intraday. It is easy to lose track of your emotions during intraday trades. This will help ensure that you set a clear profit goal, which you can stick to as your trades progress.

FAQ

How can I invest Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need are the right tools and knowledge to get started.

The first thing to understand is that there are different ways of investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. You may choose one option or another depending on your goals and risk appetite.

Next, gather any additional information to help you feel confident about your investment decision. Learning the basics of cryptocurrencies and how they work before diving in is important. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Trading with money you can afford is a good way to reduce your risk.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

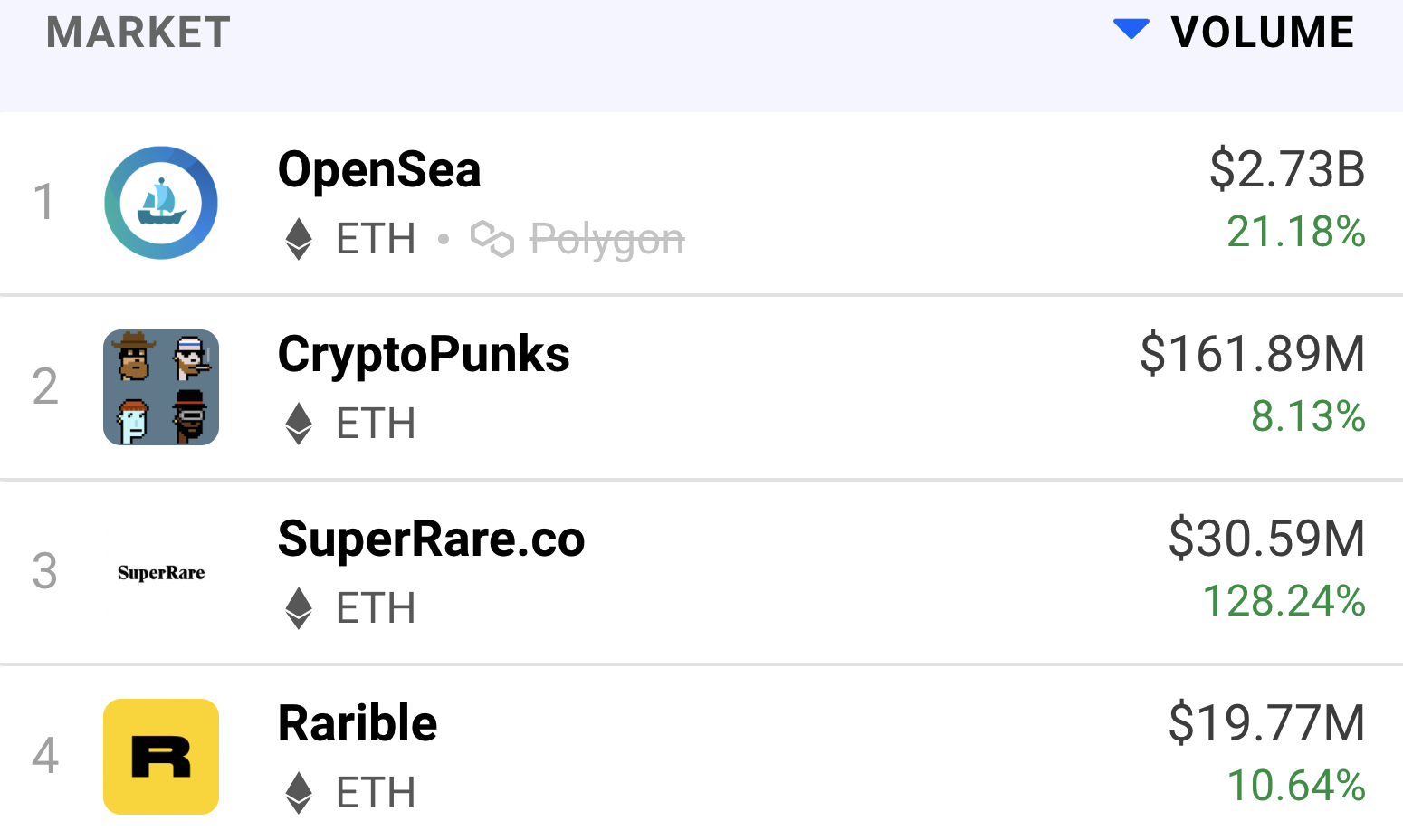

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

What are the benefits and drawbacks of investing online?

Online investing has the main advantage of being convenient. Online investing allows you to manage your investments anywhere with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing comes with its own set of disadvantages. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many choices: stocks, bonds or mutual funds. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which is best forex trading or crypto trading?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

Which is harder forex or crypto?

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex has been around since the beginning and has a solid trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I ensure security for my online investment accounts?

Online investment accounts are a matter of safety. Protecting your assets and data from unwanted intrusion is essential.

First, make sure that your platform is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Secondly, always choose strong passwords for account access and limit your log in sessions on public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. You should also regularly review your account activity to ensure you are aware of any suspicious links or downloading unfamiliar software. This will allow you to quickly detect possible threats and take appropriate action.

Third, you need to know the terms of your online investment platform. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, make sure you do thorough research about the company before investing. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Finally, you should be aware of tax implications for investing online.

Follow these steps to ensure your online account is protected from potential threats.