Cryptocurrency (or crypto) is a digital asset that you can purchase and trade just like stocks. However unlike stock, crypto doesn't give you legal ownership. It is an investment that you make in hopes that it will grow in value.

For anyone looking to diversify their portfolios and spread their risk among a variety assets, cryptocurrency investing is a good option. It is important to remember that cryptocurrency investing can be highly volatile and could result in serious losses.

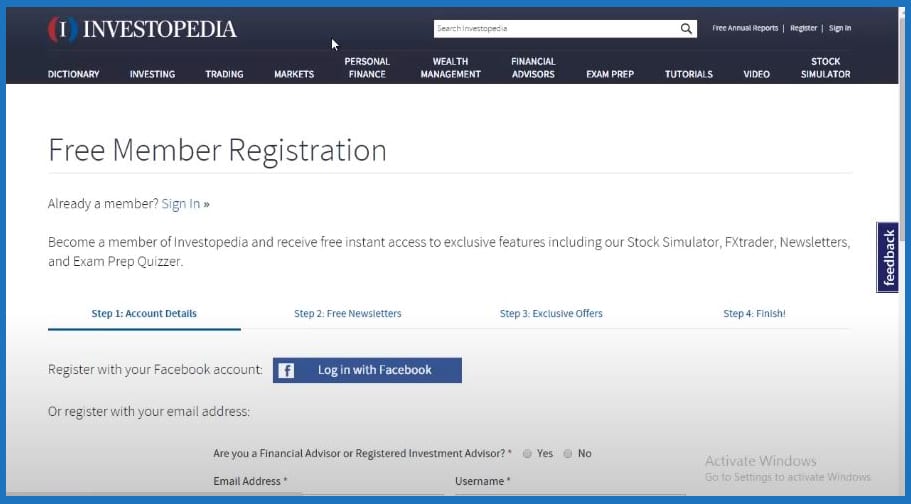

A broker or cryptocurrency exchange that provides security and transparency is the best way to invest cryptocurrency. Many brokers offer many payment options. You can deposit money from your bank account or wire transfer money.

Before making a purchase, you should read all terms and conditions. It is also important to be aware of any fees these companies might charge. Often, these fees can add up to 5% of your total transaction amount.

Do not load your portfolio with crypto unless it has a clear exit strategy. You should also be able to afford to lose it all in the event of a price drop. This is because cryptocurrencies aren't backed by any government or precious metals, which means they can lose a lot of value quickly and you could end up losing money if you have too much in them at one time.

It is best to buy a crypto ETF. These products will expose you to companies that could benefit from the rise of cryptocurrency and the blockchain technology. ETFs are safer to use than actual cryptocurrency, and they are also more tightly regulated.

It's best if you only choose a handful of cryptocurrencies that you will stick with for the long term. You can do this by buying them outright, or you can use a crypto wallet to store your coins and trade them with other people.

Futures allow you to bet on the price movement for a specific cryptocurrency. Bitcoin futures is the most popular. These contracts let users bet on Bitcoin's future prices.

Despite its volatility and potential for big returns, cryptocurrency is an emerging market that offers high returns. It is still unclear which currencies are the best investments.

For beginners, you might want to start with larger cryptocurrencies such as Ethereum and Bitcoin. These cryptocurrencies have a solid track record and are more well-known in the crypto community. But even the largest cryptos can experience massive swings in value, so you'll want to do your research before making a decision about which ones to invest in.

It is a smart idea to save a portion of your monthly profits so that you don't get emotionally attached. This will prevent you from being tempted to sell too early when prices are high and regret selling later when they've dropped.

FAQ

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

You can also make a profit if your risk is taken and you do your research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which trading site is best for beginners?

It all depends upon your comfort level in online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers provide interactive tools to show you how trades function without risking any money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

How do I invest in Bitcoin

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need is the right knowledge and tools to get started.

First, you need to know that there are many ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Can you make it big trading Forex or Cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Understanding the different currency conditions is crucial.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can my online account be secured?

Online investment accounts are a matter of safety. It's vital that you protect your data, assets and information from unwelcome intrusion.

First, you want to make sure the platform you're using is secure. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. You should also regularly review your account activity to ensure you are aware of any suspicious links or downloading unfamiliar software. This will allow you to quickly detect possible threats and take appropriate action.

Thirdly, make sure you understand your investment platform's terms and conditions. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, be sure to research the company where you plan on investing. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Make sure to understand the tax implications of investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.