JM Bullion provides consumers an easy way to purchase precious metallics online. You can find a variety of precious metals on the website, including palladium, silver, copper, and palladium. JM Bullion, unlike many other dealers is dedicated to keeping prices low.

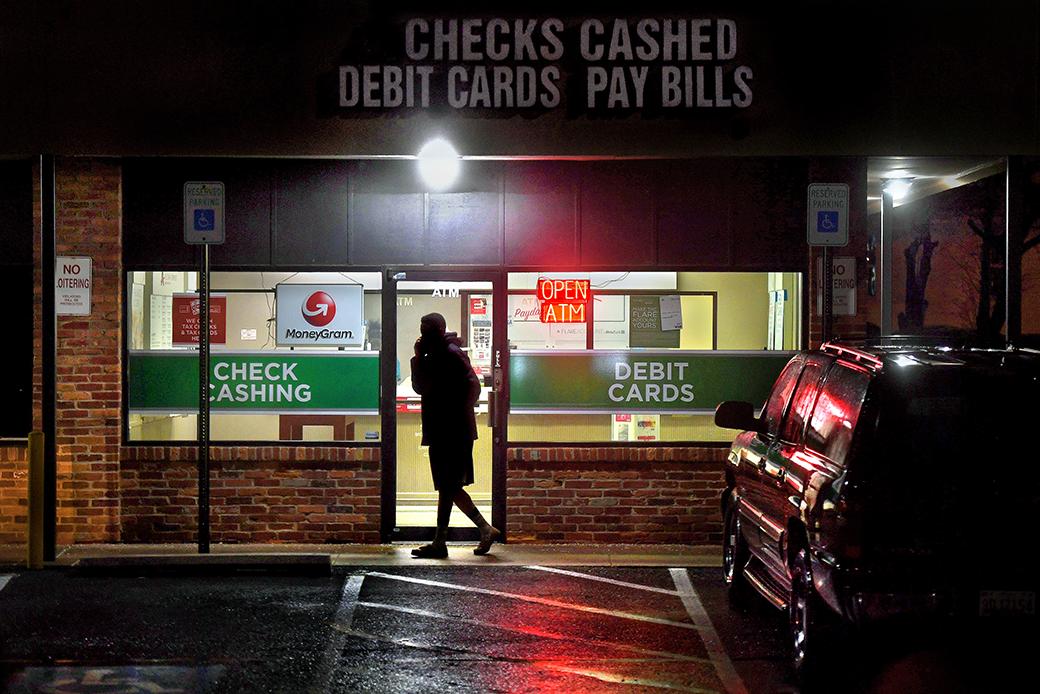

Customers can pay by credit card or personal cheque. There is a minimum payment amount of $1,000 for bank wire transfers and up to $25,000 for cash payments. Those who prefer to avoid paying fees may choose to purchase from local retailers. Purchasing from a company with a physical location eliminates shipping expenses and ensures safety.

JM Bullion claims to be able to ship gold or silver within one working day. There have been reports that customers are waiting up to seven business days for their orders. Customers who order from JM Bullion must complete the 8300 form. This form includes information about how to proceed with the transaction. These forms are confidential, and JM Bullion will keep them for 30 days. Customers have the right to cancel an order and receive a full refund or a reduction in price.

JM Bullion also features an automatic buy-back system. This allows customers to buy silver or gold for a small fee. A claim can be made for damages to the company by requesting insurance.

Most of the negative reviews are related to the fact that they did not receive their orders. JM Bullion's products are criticized for being of poor quality. Another complaint is the lack of customer service.

Although the company is backed by the Better Business Bureau, there are a few complaints about its customer service. Most consumers are happy with the product or service, however.

JM Bullion is easy to navigate and makes it simple for new investors. Another advantage is its price guarantee. The site also offers a price guarantee and allows customers to track their orders.

The company does NOT offer storage services. However, the website is available only during business hours. A 4% surcharge is charged to customers who wish to pay by credit card or debit card. This helps to cover merchant processing fees.

Customers purchasing their first order from the site should sign up for a free info kit. Tax guides can be obtained for precious metals investments. Investing in gold is a good option for diversifying your portfolio. A precious metals IRA can be a great way to store your assets.

JM Bullion currently holds an A+ rating with the BBB. TrustLink, a website that promotes integrity and high standards, is also a member. The company is solidly reputed and is legitimate. However, there are still some areas where it needs to improve. There has been controversy over the market loss fees charged by the company.

FAQ

Is it possible to make a lot of money trading forex and cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Knowing how to spot price patterns can help you predict where the market will go. It is important to trade only with money you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which is more difficult, forex or crypto?

Forex and crypto both have unique levels of complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Which trading site for beginners is the best?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

How do I invest in Bitcoin

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. You just need the right knowledge, tools, and resources to get started.

It is important to realize that there are several ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Some options may be better suited than others depending on your risk tolerance and goals.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. To stay on top of crypto trends, keep an eye out for market developments and news.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Frequently Asked Questions

What are the 4 types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

There are two types of stock: preferred stock and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

What are the pros and cons of investing online?

Online investing has the main advantage of being convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing comes with its own set of disadvantages. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

You should also be aware of the different investment options available to you when investing online. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. There may be restrictions on investments such as minimum deposits or other requirements.

Statistics

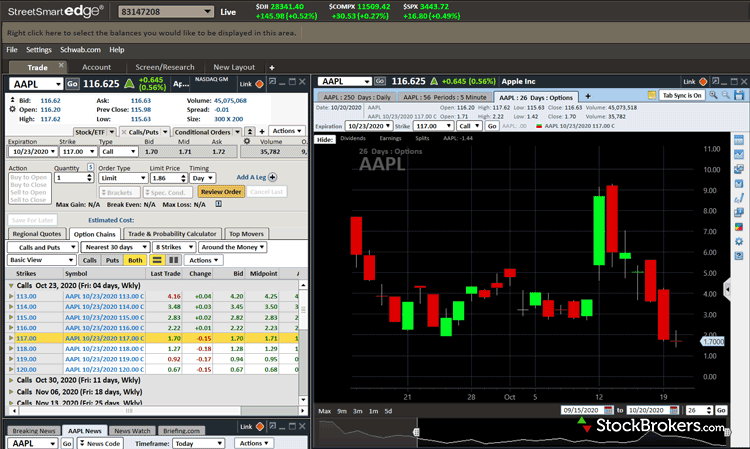

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

Online investments require security. Online investments pose risks to your financial and personal data. Take steps to reduce them.

Be mindful of whom you are dealing with when using any investment app. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer funds or provide any personal information, it is important to check the background of each company or individual that you are considering.

For all accounts, use strong passwords with two-factor authentication. You should also regularly test for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Avoid phishing attacks by not clicking on links from unknown senders and never downloading attachments unless they are familiar to you. Also, ensure that you double-check the website's security certificate before you submit any personal information.

It is important to ensure that only trustworthy people have financial access to your accounts. Make sure you delete old bank apps from all devices, and change passwords every few weeks if necessary. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. To prevent a breach of one account, it's smart to have different passwords for each account. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!