Before you decide to buy stocks online, you need to be clear about what you are doing. You should choose the right brokerage for your needs.

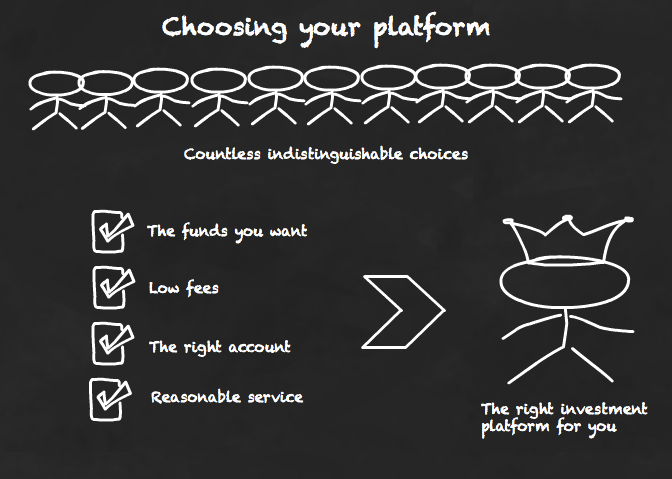

There are many companies that offer brokerage services. These platforms let you trade without having to pay fees. These are also known as direct stock purchases plans. Some plans require minimum investments. The broker should also be able to provide you with information about the services they offer. Many brokers offer a wide range of features, such as options for ETFs or bonds.

It is easy to buy stocks online using a brokerage account. In just minutes, you can create a brokerage account. The basic steps are as follows: you need to provide your contact information and decide how you want to fund your account. Depending on the brokerage you choose, you may be able to fund your account via electronic transfer, check deposit, or account transfers from other brokerages.

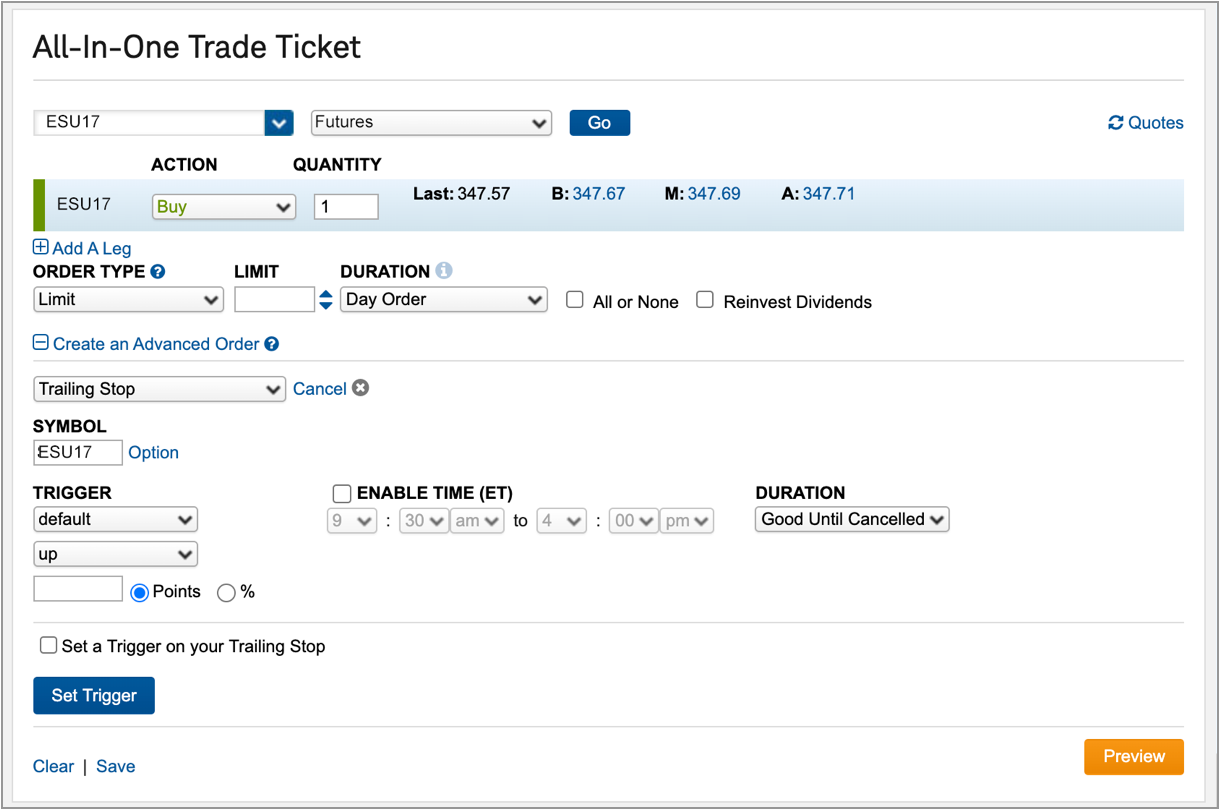

After your account has been funded you can place an Order to Purchase a Certain Number of Shares of a Stock. A transfer agent will process you order. A transfer agent will process your order. You will receive a summary detailing the details of your order. In some cases, real-time updates may be available. Other times, you will have to wait until the order has been filled.

Online ordering stock offers many benefits. The online ordering process is more convenient than the traditional method. You can place orders at any hour of the night or day. This allows you to take advantage of the most lucrative trading opportunities for a company. Moreover, you can research your desired companies' financials, company announcements and news coverage from trusted sources. Similarly, you can use a company's website or annual report to learn about its current and future prospects.

Stock prices can fluctuate over time. A stock that sold five years ago for $50 may now be worth $30. Stocks at a discounted price are a good option for someone who is new to investing. But, before buying any stocks, make sure you read the financial reports of all companies you are interested in.

It is possible to invest by using an online broker to purchase stocks. It eliminates the need for intermediaries. It offers commission-free trades. There are many online brokers that you can choose from. Each broker has its own set of features and customer support. Compare fees and services to find the right fit.

For both beginners and more experienced investors, online/discount brokerages are a great option. They are usually less expensive than full services brokers and do not need to have certified advisors. While they don't offer a ton of technical support, they are usually very easy to use and often feature low fees for trades. Also, some have no minimum investments to open an account.

FAQ

Which is harder, forex or crypto.

Crypto and forex have their own unique levels of difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Can you make it big trading Forex or Cryptocurrencies?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You need to be aware of the market trends so you can make the most of them.

Knowing how to spot price patterns can help you predict where the market will go. Trading with money you can afford is a good way to reduce your risk.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Can forex traders make any money?

Yes, forex traders are able to make money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. Property investments can yield steady returns, long-term appreciation, and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

How can I invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! To get started, you only need to have the right knowledge and tools.

First, you need to know that there are many ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, research any additional information you may need to feel confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

Online investing is a risky venture. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

Start by being mindful of who you're dealing with on any investment app or platform. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Last but not least, make sure to use VPNs when investing online. They're often free and easy!