Commodities can be defined as commodities that are essential to daily life for individuals or companies. The supply and need for commodities is affected by exchange rates, inflation and overall economic health.

The best way for you to invest in commodities, is to buy commodity ETFs. These ETFs can also be bought like stocks. They provide diversification and low expense ratios with no margin trades. These ETFs can be used to hedge against inflation and can therefore be a great investment option.

It is crucial to find a reliable broker who can help you trade commodities. A good broker will make sure you trade on a reliable, secure, and efficient platform. The company will also have experienced, professional traders that can assist you with any question you might have.

A commodities broker list may include brokers who specialize in one particular commodity or industry. Brokers may also offer a wide variety of other products, including Forex, cryptocurrencies shares and indexes to meet the needs all investors.

You can find many of these commodity broker lists online. These lists can help you find the right commodity broker for your needs.

Skilling, CMC Markets CMC Markets, IG and Alpari are some of top commodity brokers. These brokers are well-known for their reliability, ease of use, as they can be used by both novice and experienced investors.

A great reputation for excellent customer service, competitive fees, and high-quality brokers in commodity trading are some of the best. These brokers offer both short-term trades and long-term options.

Investing is risky. Before investing in commodity stocks, you should do your research. You should consult an expert if in doubt about which type of investment you should choose.

Agriculture Stocks

These stocks offer the best commodities. These stocks are known for their high dividend yields and strong track record in increasing their dividends.

Archer-Daniels-Midland (NYSE:ADM) is an agribusiness that offers everything from animal nutrition to food processing and commodities trading. It is one of the most desirable commodity stocks to purchase in 2023 because of its reliability and track record.

Nutrien, NYSE:NTR, is an international fertilizer/potash manufacturer that has seen some remarkable pricing and production results in recent years. This boom cycle saw the company achieve exceptional profitability as well as cash flow margins.

BHP Group (NYSE:BHP) is a mining and resources company that specializes in iron ore, coal, and copper. It has several exploration and production plans in different parts of the world. The company has been able to make steady profits over the past few years.

Rio Tinto (NYSE.RIO), is an international, diversified mineral corporation that operates several mines around the globe. It owns a quality portfolio of mines in Brazil, China and Australia.

FAQ

Where can you invest and make daily income?

However, investing can be an excellent way to make money. It's important to know all of your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

It is important to research both sides of the coin before you make any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important that you understand the different trading strategies available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. To help manage their investments, traders may use automated trading systems or bots. Before you invest, it is important to fully understand the risks and benefits of each strategy.

How can I invest Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. You just need the right knowledge, tools, and resources to get started.

First, you need to know that there are many ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, you should research any additional information necessary to feel confident in your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which is the best trading platform?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down the search for the right platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure your platform has the right security protocols to protect your data against theft or breaches.

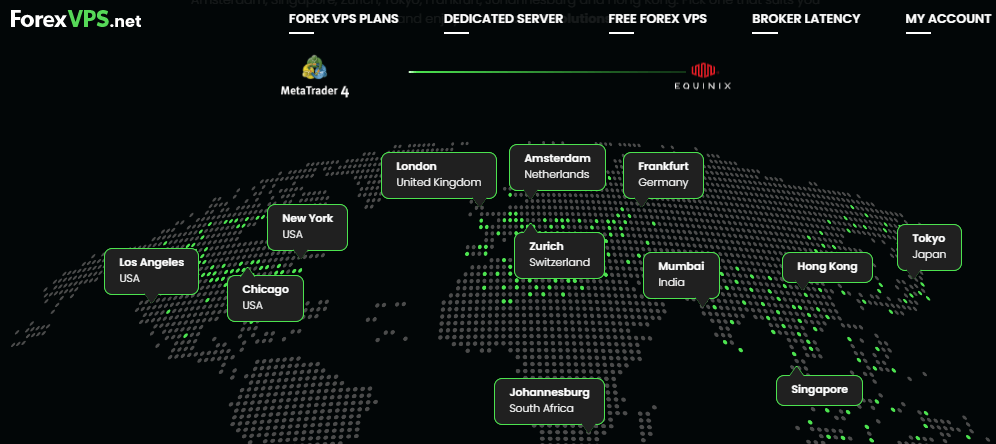

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Frequently Asked questions

What are the 4 types?

Investing can be a great way to build your finances and earn long-term income. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Which trading site is best for beginners?

It all depends on how comfortable you are with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protection starts with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Do not answer unsolicited emails and phone calls. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Lastly, always remember "Scammers will try anything to get your personal information". Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

Also, it is important to invest online using secure platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.