A16z is a venture-capital firm based out of Menlo Park in California. It has investments in the early stages of mobile communications and e-commerce. The firm is also a significant shareholder in Facebook, Twitter, Airbnb.

A16z is a prominent venture capital firm. Marc Andreessen & Ben Horowitz started it in 2009. It has been a success story with many of the biggest and most profitable investments in the past few years, including Skype and GitHub.

A16z led the $57 million Series B round for Optimizely in 2014, which is a cloud-based enterprise SaaS. A16z also led a Series B round of $21 million in Figma, which is a web3 platform that allows team collaboration and a $50m Series D round at Roblox, a virtual-reality game developer. Other notable investments include $450 million in a seed round for Yuga Labs, a cloud CAD software company, and $80 million in Onshape, a cloud computing infrastructure company.

A16z has invested in several companies involved in developing crypto/blockchain technology. a16z Crypto Investments was one of the most recent investments. It invests in startups and infrastructure. Its portfolio includes CryptoKitties and Dfinity as well as PeerStreet.

One of the first cryptocurrency companies to receive venture investment was OpenCoin, which is based in San Francisco. OpenCoin is one of the largest players in crypto. In April 2013, a16z made an investment in the company.

As many other venture capitalists, a16z also made several other crypto investments. BuzzFeed (Onshape), Medium, and Databricks are some other notable companies that a16z have invested in. A16z also invested in companies such as uBiome, Stack Exchange, Honor, Inc., Okta.

A16z is a prominent investor in blockchain companies. They are also the co-founder of Paradigm Venture Capital, which is a firm focused on investing in encryption technologies. Their most recent investments include a $300 million crypto fund and Entropy, a new decentralized cryptocurrency custodian.

Polychain Capital is another firm on a16z’s list of investment firms. This fund was the first cryptocurrency hedge to manage over a billion dollars of assets. It is supported by Sequoia Capital and Tiger Global Management.

A16z has invested in many other crypto/blockchain businesses, such as Dfinity, Imply and Smartcar. The company recently announced the launch of a fourth cryptocurrency fund. It will be worth $4.5 trillion. The majority of this money will be used in seed investments. Layer 1 infrastructure and layer 2 infrastructure will get the rest.

As crypto and blockchain technology continues to grow in popularity, Andreessen Horowitz (or "a16z"), one of the largest investors in the world, continues to make its mark in the industry. A16z also invests in crypto startups, such as Netflix and Airbnb. A16z is a major investor in startups and consumer fintech companies like Coinbase, Facebook and Uber.

FAQ

Is Cryptocurrency a Good Investing Option?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Where can I find ways to earn daily, and invest?

While investing can be a great way of making money, it is important to understand your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

You can also invest in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

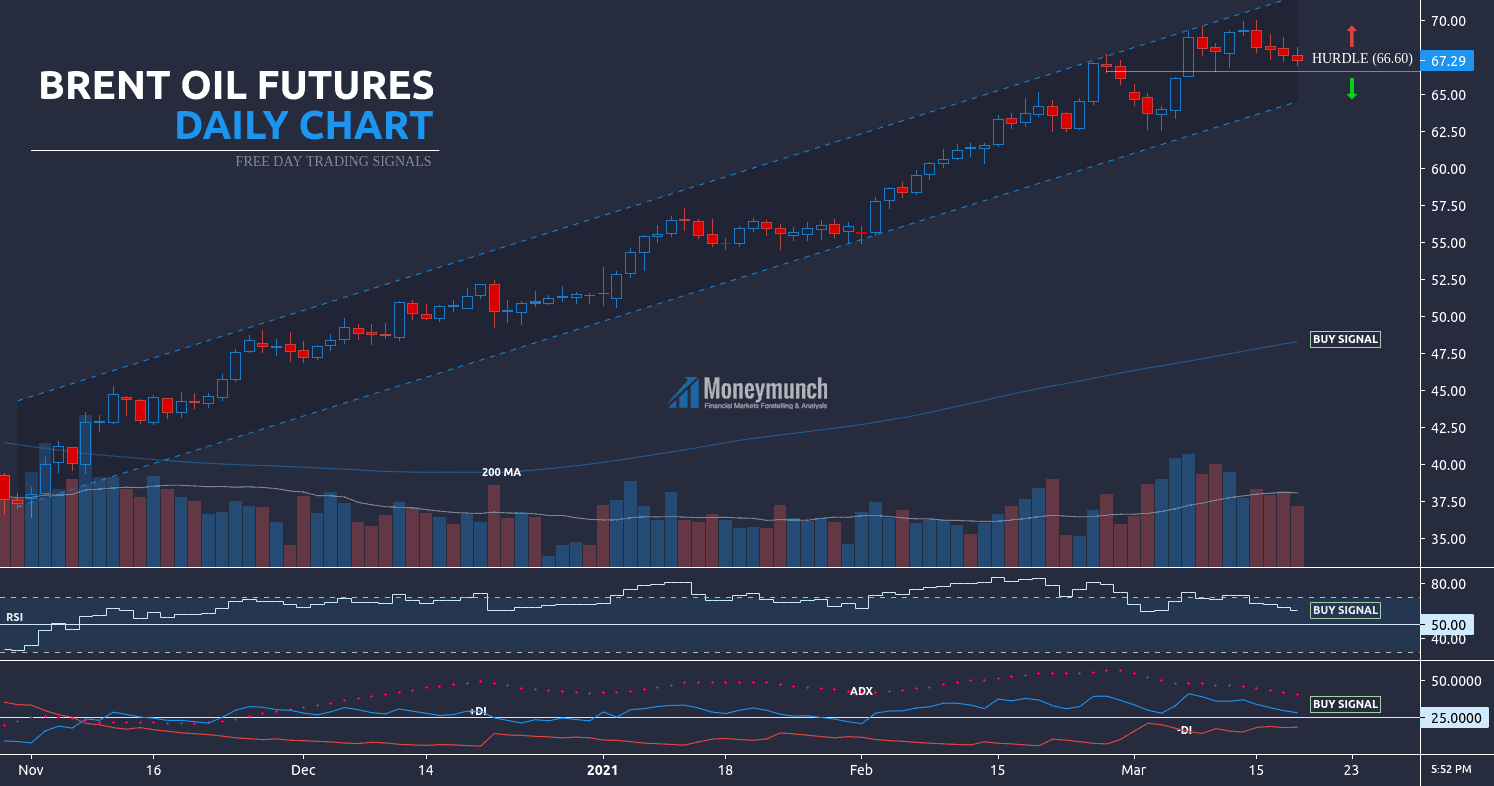

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Which is harder, forex or crypto.

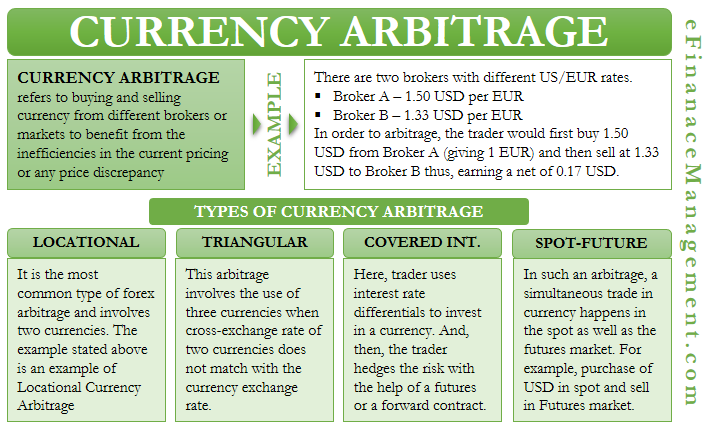

Both forex and crypto have their own levels of complexity and difficulty. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Which platform is the best for trading?

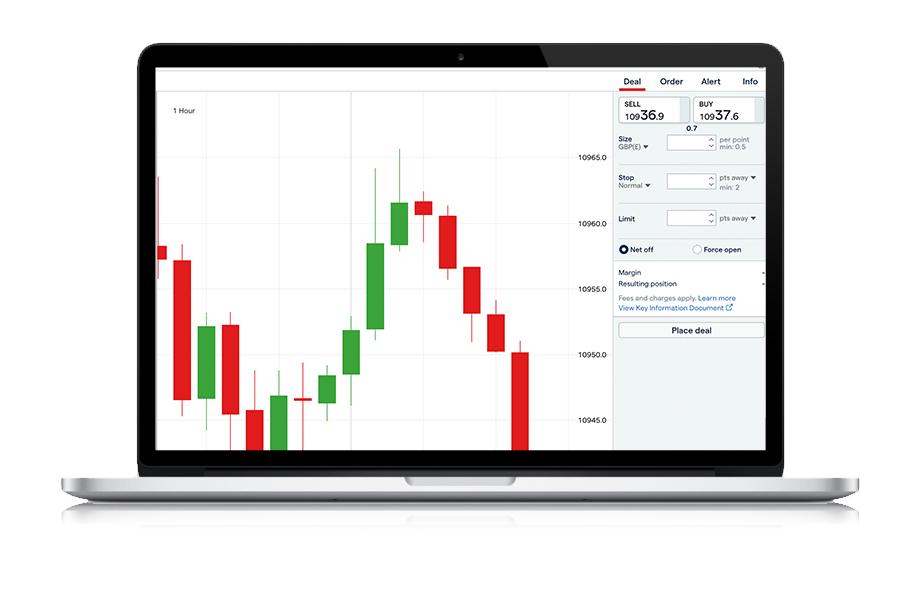

Many traders may find it challenging to choose the best trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down your search to find the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure your platform has the right security protocols to protect your data against theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Frequently Asked Questions

What are the 4 types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four main types of investing: stocks, bonds and mutual funds.

There are two kinds of stock: common stock and preferred stocks. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Online investment accounts require security. Protecting your assets and data from unwanted intrusion is essential.

First, ensure the platform you are using is secure. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. Also, a policy should be created that describes how the sharing of personal information with them will go.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

It's also important to fully understand the terms, conditions and fees associated with your online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, be sure to research the company where you plan on investing. Look at user reviews to get a feel for how the platform works. Finally, be sure to know about any tax implications that investing online can have.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.