Forex trading profit can be described as the amount you make when investing in foreign exchange markets. This involves buying one currency then selling the other. You can do this in either a short-term, or long-term manner.

You can trade currencies worldwide in the forex market to earn a profit. This is currency trading. You can do it yourself or with the help and guidance of a forex broker.

To invest in forex trading, you need to know how to identify profitable opportunities. There are many strategies and methods that you can use to increase your chances at making a profit trading forex.

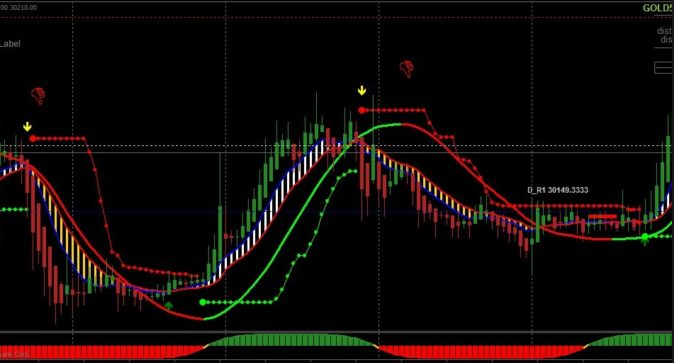

Understanding forex trading basics is the first step. Understanding the concept of a bid price and an ask price is important, as is understanding how to read currency charts.

Technical analysis is another way to decide when to buy or hold a currency. This method involves looking at different currency charts and analysing them to determine trends in the market. Some of these patterns can help you predict where a currency is going to go.

Risk Management

It is important to note that Forex trading profit is a high-risk game and you should not put all of your money on the line. If a trade does not go according to plan, you should always make a plan to get out of it.

Leverage

If you want to make a forex trading profit, you need to have the proper leverage in place. You can take larger positions in a currency, which can increase or decrease your profits. Excessive leverage can cause huge losses and it is not always a good idea.

Talking to traders and brokers who have been around for a while can help you learn about leverage. They can help you understand how leverage works and why you should avoid using too much.

Stable earnings

It is essential to make accurate predictions in order to ensure steady forex earnings. This can be done by using technical analysis, reading charts, and using a number of other tools provided by your forex broker.

Stability in your mental health is another key aspect of forex earnings. Often, a trader can get too caught up in the day-to-day news that can lead to rash decisions. This is why it is important to have a solid strategy and to make sure that your mind is not constantly distracted from this by other activities.

Compound Growth

Compounded growth is the best way to make forex trading profit. If you can achieve 50% cumulative growth each year, you can increase your initial $20,000 account to more than $1,000,000 in just 10 years.

FAQ

Which is harder, forex or crypto.

Crypto and forex have their own unique levels of difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. A good understanding of technical indicators is essential to identify buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Which is the best trading platform?

Many traders can find choosing the best trading platform difficult. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. The interface should be intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. This information will help you narrow down your search and find the best trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Where can you invest and make daily income?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

One option is investing in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which is more safe, crypto or forex

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

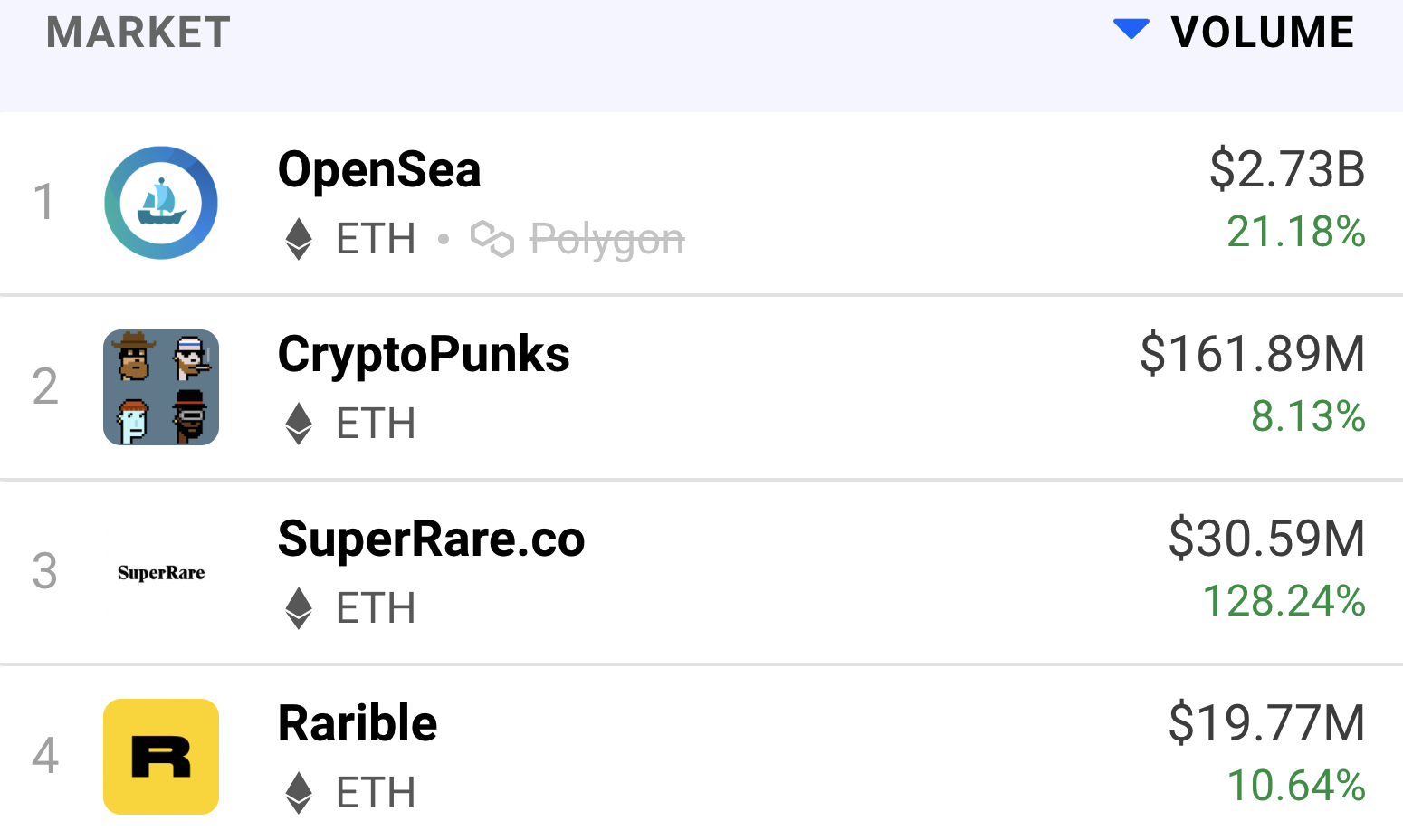

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Cryptocurrency: Is it a good investment?

It's complicated. It is complicated. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

How can I invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need are the right tools and knowledge to get started.

It is important to realize that there are several ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. You may choose one option or another depending on your goals and risk appetite.

Next, you should research any additional information necessary to feel confident in your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protection starts with you. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Do not respond to unsolicited emails or phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Don't forget to remember that "Scammers will attempt anything to get personal information." Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

You should also use safe online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.