NFT art is an exciting new form of digital art that allows artists to sell their work as a non-fungible token, which means that it can be traded on the blockchain. It's an innovative way to make money and express your creativity, and it could be a long-term market.

To trade nft, you must set up a digital wallet and connect it the NFT platform. Some NFT marketplaces take cryptocurrency, while others do not. Some platforms will charge fees to make transactions, while others may offer gas free of cost.

SuperRare is KnownOrigin's top NFT art marketplace, as well as Foundation. These platforms are limited edition and only accept NFTs from curated artists. They have their own cryptocurrency, RARI, as well as a curatorial system that allows users to vote for the artworks they would like to see.

NiftyGateway, which allows buyers and sellers to trade NFTs with fiat currency, is another great platform. These tokens are now available to non-crypto users. It also offers escrow services which can help you avoid scamming.

Before you can start trading nft artwork, there are some things you should do. These include creating original work and building your online presence. These steps will enable you to trade your work on an NFT platform and create a successful business.

Make original artwork - This is an obvious point, but it's important to mention because NFTs can be sold as digital assets. It is important to ensure that the art you sell is authentic and in your own style.

Don't be afraid to experiment - NFTs are a relatively new form of art, so you need to be open-minded and try new things. It's also a good idea to have fun while you create your pieces of art.

Build your online presence - This will help you get noticed by NFT art traders and collectors. You can do this by building a website or updating your existing one, posting process videos of your work, and using hashtags that will attract the right audience.

Phishing scams: While this is not an issue with NFT artwork, it can occur to crypto users who use the technology for other purposes. Phishing scams that target crypto keys and other valuable information should be avoided.

You must identify your crypto art identity to avoid being scammed and protect yourself from fraud. You must claim your crypto art identity to ensure it isn't being used by anyone else.

You should have a digital wallet. This is essential for purchasing and selling NFTs as well as paying gas fees. You must create a cryptocurrency wallet that can be used on both your desktop and mobile devices.

Locate a community of crypto art enthusiasts - This will let you connect with people who share your passion. These people can give advice and help you get going.

FAQ

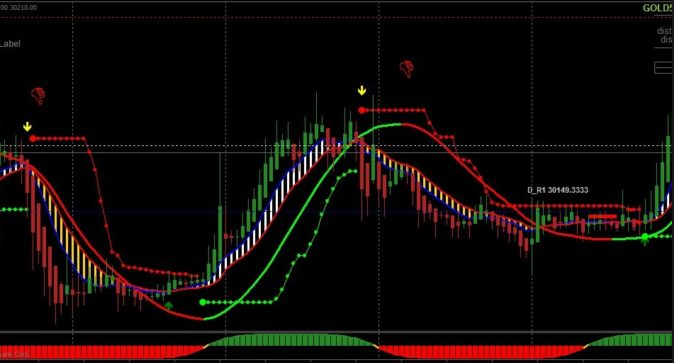

Which is better forex trading or crypto trading.

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. Diversification of assets and managing your risk will make trading easier.

It is important to be familiar with the various types of trading strategies that are available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it's important to understand both the risks and the benefits.

How can I invest bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You only need the right information and tools to get started.

The first thing to understand is that there are different ways of investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. Keep an eye on market developments and news to stay current with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

What are the pros and cons of investing online?

The main advantage of online investing is convenience. Online investing allows you to manage your investments anywhere with an internet connection. Online trading is a great way to get real-time market data. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing has its limitations. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important to understand the different types of investments available when considering online investing. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment comes with its own risks. You should research all options before you decide on the right one. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Which is harder crypto or forex?

Crypto and forex have their own unique levels of difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Is Cryptocurrency a Good Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

You can also make a profit if your risk is taken and you do your research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Where can I earn daily and invest my money?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is investing in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I protect my financial and personal information when I invest online?

Security is essential when investing online. Online investments are a risky way to protect your financial and personal information.

Start by being mindful of who you're dealing with on any investment app or platform. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer funds to them or give out personal information, do your research.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. To prevent a breach of one account, it's smart to have different passwords for each account. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!