Coursera, an online learning platform, lets you stream lectures from top universities in order to complete online courses. You can get technical certifications and full degrees. In recent years, Coursera's user base has grown at an explosive rate. Coursera is a world leader in online education.

Coursera has multiple streams of revenue. It has a consumer segment, which provides online classes, as well as a degree segment. In the third quarter, Coursera generated $66.5 million in revenue. The majority revenue came from the consumer division.

Coursera holds a lot of cash. Coursera had more $800million in cash as of the end-of the third quarter. Coursera still has plenty of money to expand its offering. Coursera may have to make it more difficult for them to raise additional capital, due to the rising interest rates. Coursera may need to cut down on its growth.

Coursera is highly valued. Coursera's stock trades at more than 11 times its twelve-month trailing revenue. There is little margin for error in this quarter. Coursera has been profitable for some time, but the company isn't yet able to demonstrate operating leverage from its higher sales.

Coursera's revenue is split into three categories: the consumer division, the degree segment, and the enterprise segment. Coursera's universities segment makes fees from university partners based upon each student's tuition payments. Subscriptions to original video content make up a large portion of Coursera’s revenue. Each year, the average user growth is between 20 and 25 percent.

Coursera's recent growth has slowed. The company still expects to grow in the future. In addition, Coursera has taken a number of steps to improve its conversion rate. The company uses social media platforms for performance marketing to attract more students.

Its attractive valuation makes it an attractive buy-and hold investment. However, the stock may see a decline in consumer interest when the company hits its peak. Coursera will struggle to sustain its growth rate if there are no consumers interested in the company’s products.

Coursera's worth is determined by many factors. These factors include the earnings of investors, sales and profits. To make informed investing decisions, it is important to select the right benchmark Coursera. Investors must be familiar with the concept of risk-adjusted Return, which is calculated using both alpha and beta measures.

Coursera can also be compared to other companies in terms of its valuation. Coursera's gross profit margin is relatively low compared with other Software/SaaS-based businesses. Its margins are now 60% rather than 80%.

Coursera's financial statements are updated quarterly. It has a strong balance sheet and has raised Venture Capital funding in excess of $460 million.

Coursera has a strong user base, which is its most important revenue source. Coursera's conversion rate has not been as high as expected. This could make it possible for the stock to rebound by optimizing its platform.

Coursera was the first major Edtech IPO. The stock has struggled in the first year following the IPO. Despite a third quarter that was disappointing, the company still trades at or near its IPO stock price. Still, Coursera's potential to become a great stock is high, and the company's financials are sound.

FAQ

Which is more difficult, forex or crypto?

Each currency and crypto are different in their difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Do forex traders make money?

Yes, forex traders are able to make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing is a way for you to grow your money and possibly make more long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two types of stock: preferred stock and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which is the best trading platform?

For many traders, choosing the best platform to trade on can be difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

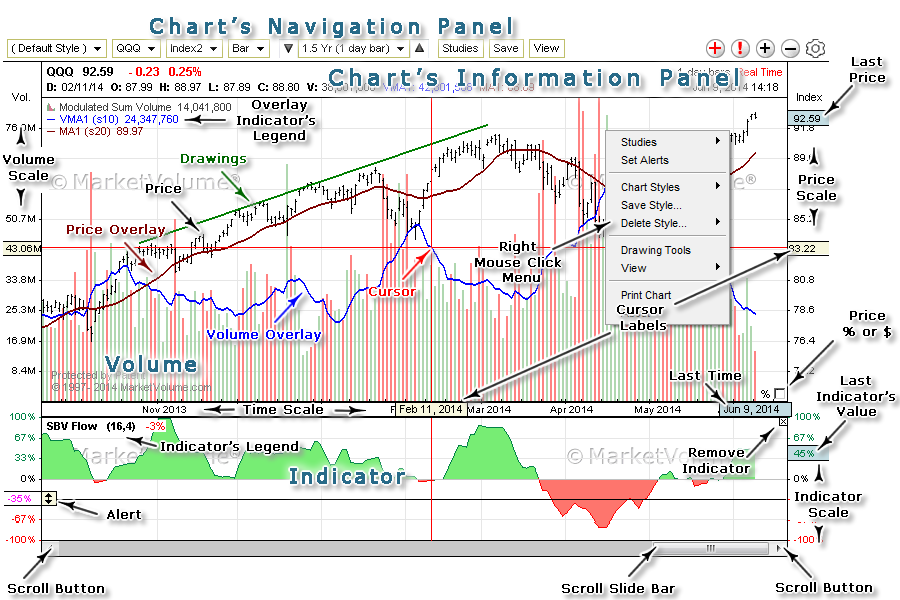

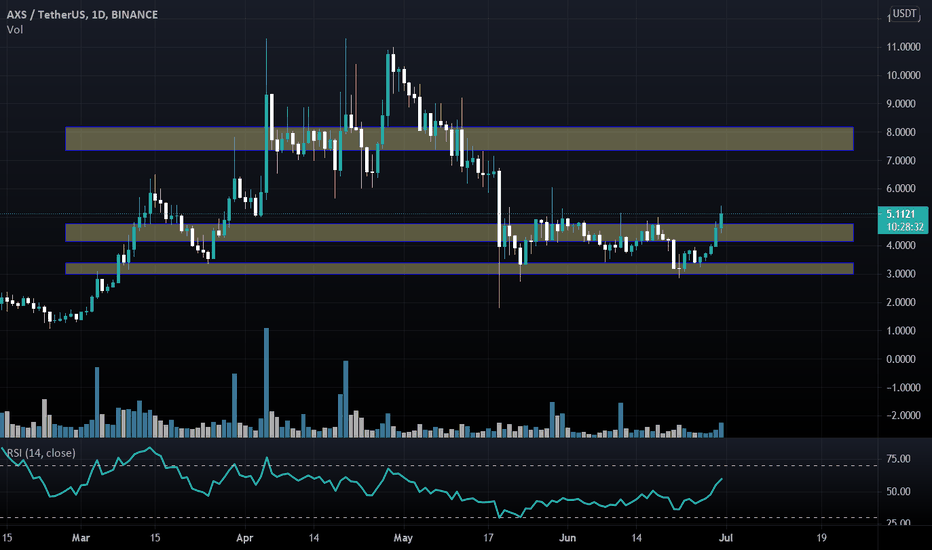

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. This information will help you narrow down your search and find the best trading platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Where can I invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are many options.

One option is to buy real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

Security is essential when investing online. Online investments can be dangerous. You need to know the risks and how to mitigate them.

Start by being mindful of who you're dealing with on any investment app or platform. Make sure you're working with a reputable company that has good customer reviews and ratings. Before you transfer funds to them or give out personal information, do your research.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. Auto-login settings should be disabled on all your devices to make sure that your accounts are protected from unauthorized access. Avoid phishing attacks by not clicking on links from unknown senders and never downloading attachments unless they are familiar to you. Also, ensure that you double-check the website's security certificate before you submit any personal information.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. To prevent a breach of one account, it's smart to have different passwords for each account. Last but not least, make sure to use VPNs when investing online. They're often free and easy!