The commodities market is a broad term that refers to many different markets and products. Futures, swaps, options are just a few of the many. These products have become very popular as investment tools. This has been a popular investment area for both individuals as well as institutions.

Commodities trading has been around for centuries. It is a wide-ranging field. Prices can be affected by a variety of factors, such as weather, politics, and natural disasters. As an example, drought in the mid-west can drive up the price of wheat. It can also be affected by tensions in the middle east. Tensions in this region can lead to an increase in oil prices.

Oil, silver, gold, and copper are some of the most traded commodities on the market. These commodities' prices are highly volatile. Investors will often trade these commodities based upon technical analysis and fundamental supply-demand information. Other investors focus on the speculative side of the market, betting on the outcome of the commodity's price. This group includes individual investors, institutions, and speculators.

Most commodities market traders use intermediaries, or brokers, to facilitate their transactions. These intermediaries might have special knowledge or may be independent professionals.

A few companies also provide brokerage services. Some have specialized trading operations. They may have a proprietary quote distribution system and a trading desk that serves a specific market.

Investing institutions are looking for ways to diversify their portfolios. One way to invest in commodities is through Exchange-Traded Funds. ETFs give investors exposure to a particular asset class but on a leveraged basis. These ETFs can often be listed on stock exchanges.

Commodities have been a preferred financial asset for investors for centuries. Despite the fact that their prices can vary dramatically, they offer an alternative to stocks. Additionally, the volatility of these assets can provide opportunities to make trades. These investments can be a security risk because they are tangible. However, you can mitigate these risks by using derivatives.

The primary customers for the commodities markets have historically been the producers or consumers of the underlying commodities. Although trading is mainly between these two groups, there have been exceptions. Retail customers rarely participate in trading. To this end, speculators, such as institutions, tend to focus on trading oil, precious metals, and gas. Speculators bring liquidity to the markets, and can cause an artificial shortage by causing a spike in prices.

With the advancement of technology, the market has become increasingly sophisticated. Large trading organizations trade in many commodities. Currently, there are more small investors in the United States markets. Small businesses and individuals trade through commodity trading advisors and commission houses.

As technology has become more integrated into trading, the commodity markets have changed. While they are less liquid than other fungible instruments such as stocks, these markets offer liquidity that is dependent on the commodity.

FAQ

Cryptocurrency: Is it a good investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

What is the best trading platform for you?

Choosing the best trading platform can be a daunting task for many traders. It can be confusing to choose the right one, with so many options.

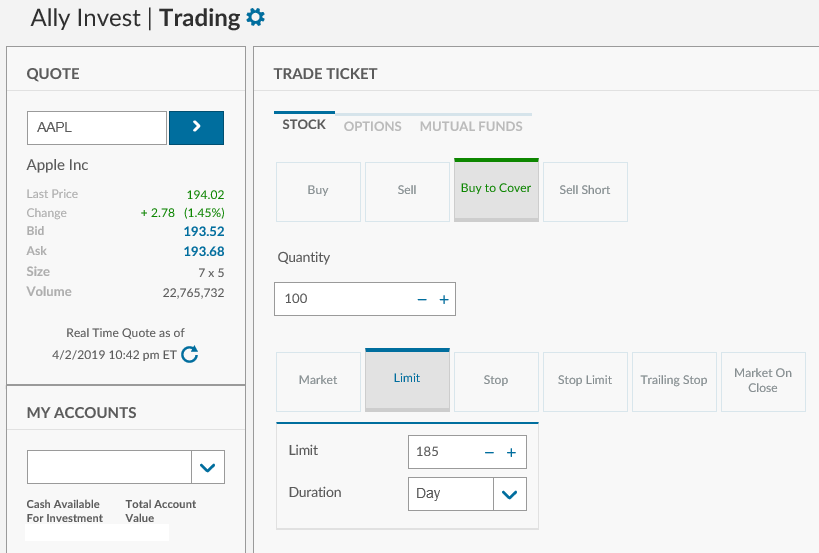

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. This information will help you narrow down your search and find the best trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is harder, forex or crypto.

Crypto and forex have their own unique levels of difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

How Can I Invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need is the right knowledge and tools to get started.

The first thing to understand is that there are different ways of investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. You may choose one option or another depending on your goals and risk appetite.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which forex or crypto trading strategy is best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

Both cases require that you do extensive research before investing. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading systems and bots may also be used by some traders to help them manage investments. It is important to understand the risks and rewards associated with each strategy before investing.

Which trading website is best for beginners

It all depends on your level of comfort with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many offer interactive tools to help you understand how trades work.

You can also trade independently if your knowledge is good enough. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Online investing is a risky venture. Online investments are a risky way to protect your financial and personal information.

Start by being mindful of who you're dealing with on any investment app or platform. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. To ensure your account security, disable auto-login on all devices. You can protect yourself against phishing by not clicking on emails from unknown senders, never downloading attachments, and always checking the security certificate of a website before entering any private information.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. You should keep track of any account changes that could alert an identity theftist such as account closure notifications and unexpected emails asking for additional information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Finally, invest online using VPNs whenever possible. They are usually free and simple to set up.