Futures trading in agricultural commodities can be used as a way to manage risk and give farmers the opportunity to sell their produce at a specific price in the future. These markets provide liquidity for traders who can place trades 24 hours a day. Farmers can increase their income through this market.

The National Commodity and Derivatives Exchange Limited (NCDEX) is the sole Indian exchange for trading commodity derivatives. It is managed by an independent board and has offices all over India. The exchange traded 27 commodity contract, including 25 Agri-futures contracts, as of March 2018.

Agricultural commodities refer to the primary livestock and produce essential for our daily lives. These include grains, dairy products, and lean hogs. These products often have an annual supply-demand cycle. You can also use many of the byproducts in your daily life. The most widely used agri commodities are wheat, crude palm oil, soya oil, and crude palm oil.

Agri-futures can also be used to increase the marketing performance of farmers. They can also help to minimize harvest season risks. Farmers can hedge their risk by selling a futures contract before the harvest date. They can also sell their produce at the best price possible. They can even change their cropping plan based on the futures market prices.

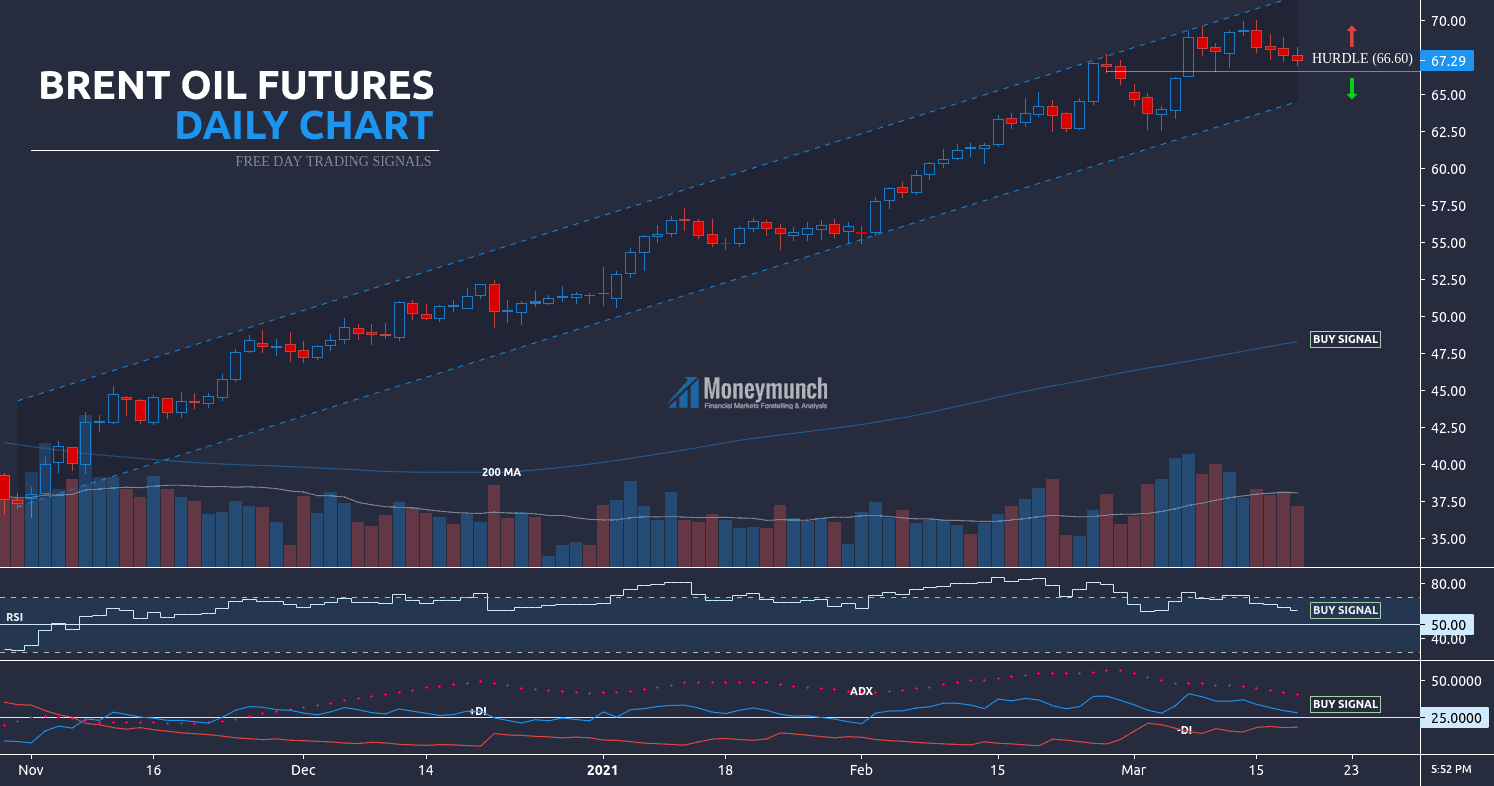

Futures trading in agriculture is a very profitable business, especially for farmers. But, there are risks. These risks must be considered by traders. There are many strategies out there, but it is important that traders do their research before making any investment in agrifutures. Traders may be interested in historical charts that show the price history of specific commodities.

Setting up an online trading platform is quick and easy. If you are ready to trade, then you can offer or buy a futures agreement. Since these contracts are standardized, they don't have to be settled by delivery. It is possible to hedge against a long position, or to offset a short one.

Futures trading in agricultural commodities has another advantage: it frees middlemen from their grip. This is especially true for small farmers. They are heavily dependent on traditional marketing channels and pay high commissions. These individuals can trade in futures to reduce their dependence and make more by trading in futures.

There are many online resources that provide information about agricultural futures trade. It's best to check out historic charts to determine the current price and trends. It is important to understand the agricultural production cycle before making a decision. Know the differences in feed and food commodities.

Agri commodities and food commodities are different in that they can't be produced all year. Most crops are planted only during specific times of the year. Weather can play a major role in affecting supply and demand.

FAQ

How do forex traders make their money?

Forex traders can make good money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading is not an easy task, but it can be done with the right knowledge. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

What is the best forex trading system or crypto trading system?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

Both cases require that you do extensive research before investing. Any type of trading can be managed by diversifying your assets.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading systems and bots may also be used by some traders to help them manage investments. It is important to understand the risks and rewards associated with each strategy before investing.

How can I invest Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. To get started, you only need to have the right knowledge and tools.

The first thing to understand is that there are different ways of investing. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Forex and Cryptocurrencies are great investments.

You can make a fortune trading forex and crypto if you take a strategic approach. You need to be aware of the market trends so you can make the most of them.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. It is important to trade only with money you can afford to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Understanding the different currency conditions is crucial.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which trading website is best for beginners

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many offer interactive tools to help you understand how trades work.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

Research is critical when investing online. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Conduct due diligence checks to make sure that you're receiving what you paid for. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!