DappRadar is an open-source application aggregator that provides community and decentralization. It provides insight and actionable intelligence for market players. There are over 9,000 dapps available across 30 protocols. Portfolio Tracker is one of the featured. In addition, it offers a variety of token utilities.

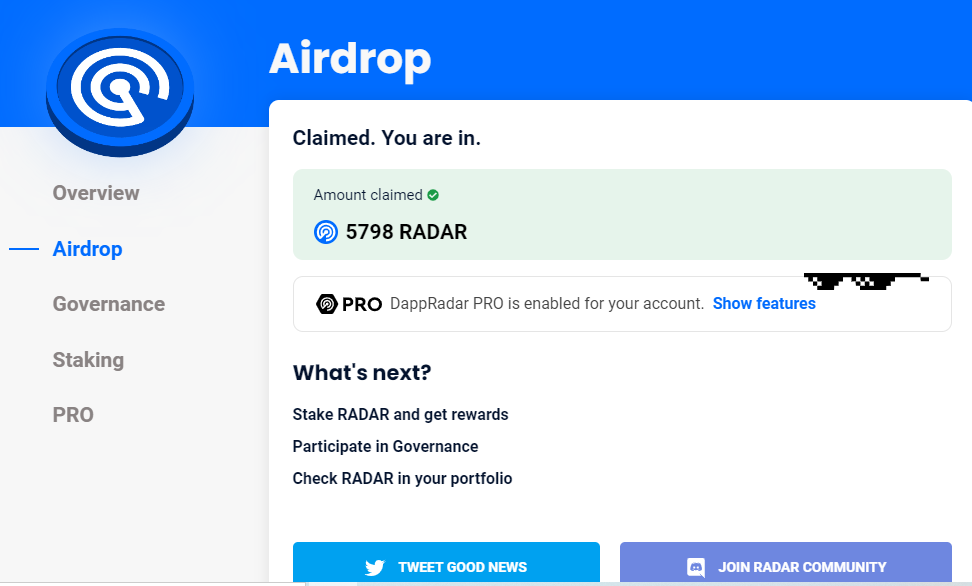

DappRadar has introduced the RADAR token as one of its new tokens. The DappRadar platform offers premium access to the RADAR token, which is based on Ethereum blockchain. RADAR aims to reward users for curating and participating in the ecosystem.

DappRadar is a platform that offers many services, such as payments and governance. It is envisioned to be the leading store for dapps. DappRadar boasts over 1,000,000 users since its inception.

The company hopes to make the app ecosystem transparent. This will result in a better user experience as well as better understanding of the dapp system. DappRadar implemented a "contribute-to-earn" mechanism where users can earn tokens by submitting reviews, participating in conversations and curating content. Smart contracts are responsible for claims and withdrawals. This will allow the platform's coverage to be expanded and users to have better portfolio tools.

The NFT Collection Explorer is another feature that will be added to the site. This tool contains data about NFTs most in demand and their creators. Additionally, it tracks the evolution of collections. Digital asset collectors can combine the data to see the entire dapp ecosystem from one location.

DappRadar websites have an SSL certificate that encrypts data while it is being transmitted from the user's browser through the server. It also hosts a active community that monitors Twitter or Discord servers to identify abusive or malicious actors.

The DappRadar platform has also partnered with LayerZero, an omnichain interoperability protocol that enables cross-chain staking across EVM-compatible networks. A token known as the proxy has been introduced to reduce fees associated with staking.

DappRadar will also be introducing a smart-contract that will enable it to broaden its reach and help it pursue quicker listings for emerging projects. Users will also have the ability to vote and suggest recommendations. The company is also planning to create a token rewards program in the future.

It is possible that the RADAR token will be airdropped to some loyal, long-term Dapp users. Furthermore, it will be available for purchase through DappRadar's token wallet. There are a total of 10 billion tokens in the system, with a circulating supply of 576,191,039.

It is important to remember that crypto investing can be volatile. Analysts for DappRadar predict that the token will lose its value within a year. But, price predictions can be wrong. Never invest money you can't afford. Always do your research.

Experts predict that the DappRadar platform will continue to decline over the next few years, despite its significant growth. The Wallet Investor predicts that the DappRadar token's price will drop to $0.160 within the next year. However, DappRadar's current position indicates that it has a bright outlook.

FAQ

How do forex traders make their money?

Yes, forex traders can earn money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which is safe crypto or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Is it possible to make a lot of money trading forex and cryptocurrencies?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Understanding the different currency conditions is crucial.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Cryptocurrency: Is it a good investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading is easier than investing in foreign currencies upfront.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. Diversification of assets and managing your risk will make trading easier.

It is important that you understand the different trading strategies available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it's important to understand both the risks and the benefits.

Which is harder crypto or forex?

Both forex and crypto have their own levels of complexity and difficulty. Crypto is more complex because it is newer and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

When investing online, research is essential. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before you open an account, check what fees and commissions might be taxed. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!