A call stock option can be a good way for you to hedge your investment in the stock markets. These options allow you 100 shares to be purchased or sold at a fixed cost. This is basically a way to bet on the stock price going up. You can lose money, but the risk is small because you will only be charged the premium if the option expires.

There are many options, including index or call. There are also long calls which are different from short puts. You can bet that the stock price will fall in a long-term put. The call stock option lets you bet on the stock price going up.

A call option allows you to sell or buy 100 shares of XYZ stock at a certain price. A call option allows you to sell 100 shares of stock for a specified price. A profit of about $3 per shares plus your premium would result.

Do your research to get the best return on your investment. There are many factors to consider, including the type of options you are purchasing and the amount of time until they expire. Some options are limited in expiry, while others can last for weeks. This is vital because the options are more valuable the longer they last.

One of the most important features of a call stock option is its "strategy". The option's worth is determined by its underlying asset. However the option buyer can also earn the option’s reward for correctly forecasting the asset.

A stock option expires and the buyer cannot exercise their rights. But, the buyer still has the option of exercising the option or selling it. Depending on the terms in your contract you might have to pay a fee to your broker.

The best thing to call stock options is their virtually unlimitable potential profit. The best thing about call stock options is that you don't have any legal restrictions to prevent you owning it. It is about knowing your options. You should compare the market leaders to make an informed decision.

As with any form of trading, there are risks involved, but a good brokerage should be able to help you minimize those. Check out the reputation of local brokers before you buy a call. They should be able guide you through this process and explain their methods in detail. Make sure you keep current with all the latest developments within the industry. This includes regulatory restrictions that can make it easier creating a synthetic position with options.

FAQ

Which trading site is best suited for beginners?

Your level of experience with online trading will determine your ability to trade. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

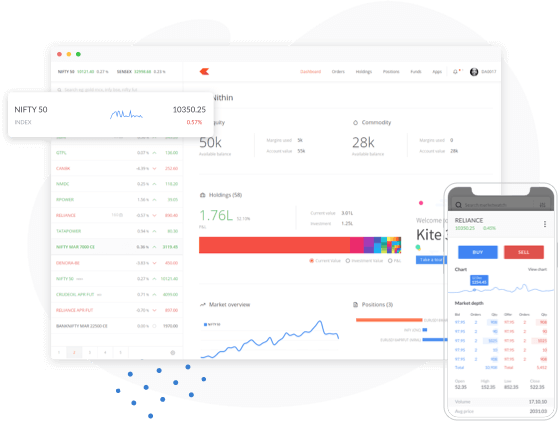

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

How Can I Invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. To get started, you only need to have the right knowledge and tools.

You need to be aware that there are many investment options. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, research any additional information you may need to feel confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. Keep an eye on market developments and news to stay current with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex is a well-established currency with a stable trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

What are the advantages and disadvantages of online investing?

Online investing offers convenience as its main benefit. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing has its limitations. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Is it possible to make a lot of money trading forex and cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investing is a risky venture. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

Begin by paying attention to who you are dealing on investment platforms and apps. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. To ensure your account security, disable auto-login on all devices. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

It is important to ensure that only trustworthy people have financial access to your accounts. Make sure you delete old bank apps from all devices, and change passwords every few weeks if necessary. Keep track of account changes that might alert identity thieves such as account closure notices or unexpected emails asking to verify information. To prevent a breach of one account, it's smart to have different passwords for each account. Finally, invest online using VPNs whenever possible. They are usually free and simple to set up.