Automated forex trading allows you to trade forex without the need to manually monitor price movements. This can reduce your risk of losing cash, which is a frequent problem for retail traders.

There are many options available for automated forex trading. These include expert advisors and robots. Both programs have pros and cons so it is important to understand what to look for in an automated program.

How to choose a trading system

Before you start investing in an automated forex trading system, make sure that it has been backtested and has a proven track record of success. This will give you the foundation to make your decision and help ensure it can deal with live market conditions.

To see what others have to say about different systems, you can also look at online customer reviews. Request screenshots and video walksthroughs of the software in action, such as when it is buying or selling currencies.

The best ways to select an EA are to test it in a demo account and learn about its features before committing to the software. It will help you identify the best strategies that suit your trading style. You can even adapt the software to meet your requirements.

Forex Expert Advisors is a computer program that generates forex signals. The program is based in a complex mathematical model with many yes/no rules. It uses these rules to make trading decisions.

An expert advisor can be a valuable tool for forex traders that want to maximize their profits and keep their losses to an absolute minimum. They can even manage your account and make decisions about how much to risk for each trade.

Some EAs can be used as full-time trading assistants. Others provide signals to help you manage your strategy and allow you to do the rest. There are also hedging and breakout EAs, which will open opposing positions to reduce your risk.

Adaptive EAs, another type of expert adviser, react in different ways depending on the moment's volatility. Their ability to react quicker than a trader is a major advantage for busy traders.

No matter which trading method you use, it is important to be open with yourself about what your level of knowledge and experience are. This will prevent you from becoming overconfident about your ability to trade profitably and help you stay on track with your strategies.

FAQ

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Frequently Asked Question

What are the four types of investing?

Investing is a way for you to grow your money and possibly make more long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into preferred and common stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Can one get rich trading Cryptocurrencies or forex?

Yes, you can get rich trading crypto and forex if you use a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Knowing how to spot price patterns can help you predict where the market will go. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Where can I earn daily and invest my money?

Investing can be a great way to make some money, but it's important to know what your options are. There are other ways to make money than investing in the stock market.

You can also invest in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Forex traders can make money

Yes, forex traders can make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading is not an easy task, but it can be done with the right knowledge. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

What is the best forex trading system or crypto trading system?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

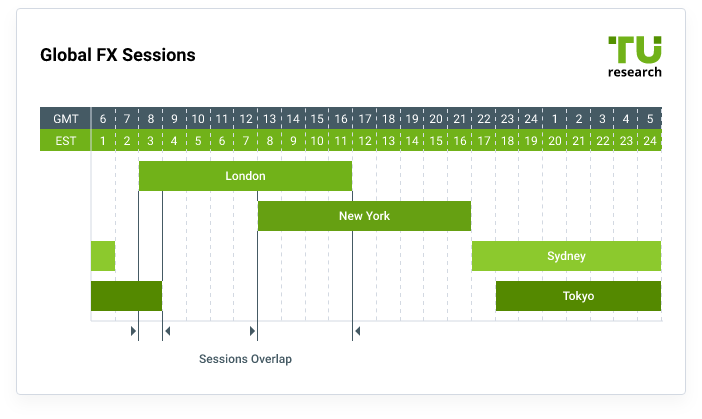

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both instances, it is crucial to do your research prior to making any investments. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

It is important to do your research before investing online. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Learn about the investment's risk profile and review the terms and condition. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.