Buying and trading nfts can be a great way to get involved in the cryptocurrency community. It is also risky in a new space that hasn’t been well regulated. You need to be able to understand how to buy and trade NFTs. Also, which places are best to buy them?

NFT trading is selling non-fungible tokens. These digital assets don't exist physically. These include emojis, music tracks, game items and even basketball cards.

NFT marketplaces let people buy and sell NFTs. This portfolio can be used for investments, or any other activity. NFTs may be used to support musicians and artists, access private Discord servers, make purchases on gaming sites, and other online stores.

There are many options for buying and selling NFTs. However, the most popular is to use a cryptocurrency exchange. These exchanges accept multiple cryptocurrency types, including Bitcoins and Ethereum.

Some exchanges won't show you NFTs backed only by certain currencies. Others allow you trade with all sorts of cryptos. It's important to understand which type of coin your NFT is backed by so you can avoid getting scammed or having your money stolen.

Before you purchase an NFT, make sure to read the license terms of the seller. These terms can vary between exchanges so it is important to understand the rights and obligations of both the buyer and seller.

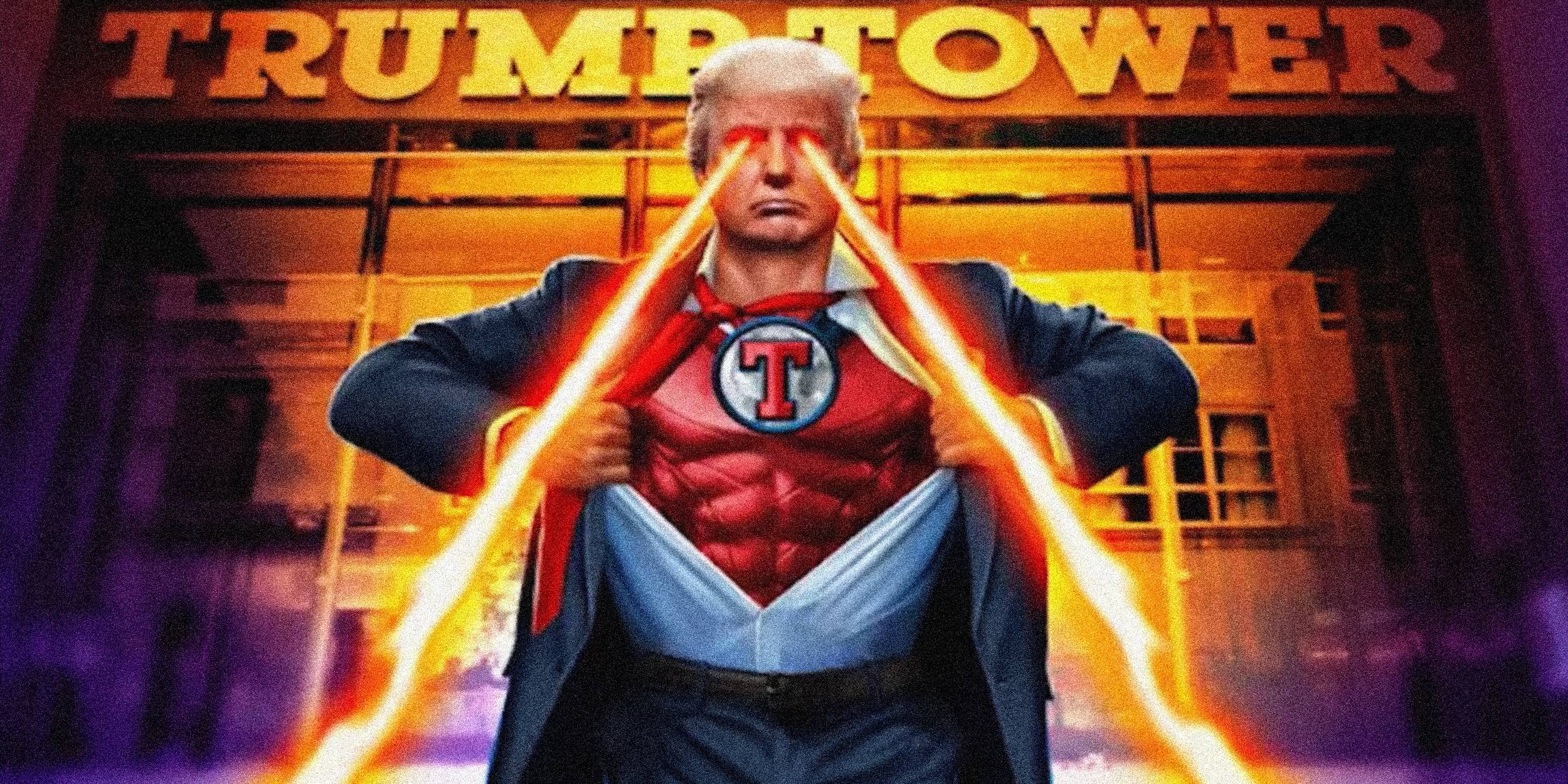

NFT trading is big business. Many celebrities and brands have entered the market to capitalize on this new source. Some are even using NFTs to promote their products and services.

Taco Bell (and Coca-Cola) have both created NFTs for their customers to increase sales. They have also partnered to NFT marketplaces to help customers find and collect the NFTs they desire.

These NFTs are very popular and can fetch a lot of money. The initial price of these NFTs can go up to 5-10 times, depending on how popular they are. However, they have the potential to increase in resale value with time.

These NFTs are often created by the artist, or licensed to companies. These NFTs could be very valuable. You should make sure that you're dealing with a legal artist or company before buying an NFT.

It's easy to buy NFTs, but it is important to keep in mind that they are not the same thing as physical artwork. They don't come with a physical object and are available online for anyone to use. It's worth looking at the artist's websites or social media pages to see how their NFTs are being promoted.

FAQ

Is Cryptocurrency Good for Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

How do forex traders make their money?

Forex traders can make good money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

How can I invest Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need are the right tools and knowledge to get started.

The first thing to understand is that there are different ways of investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, find any additional information that may be necessary to make confident investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which trading website is best for beginners

It all depends on how comfortable you are with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Can you make it big trading Forex or Cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

You can also invest in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

When investing online, security is crucial. Protecting your financial and personal information online is essential.

Begin by paying attention to who you are dealing on investment platforms and apps. You want to work with a company that has positive customer reviews and ratings. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. Also, you should use different passwords on each account to ensure that any breach in one doesn't cause others to be compromised. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!