A nft market app is a digital marketplace for non-fungible tokens (NFTs). These virtual items can be created, traded and stored with blockchain technology. These digital items could be art, music or gaming materials. These digital assets are in high demand and have the potential to grow rapidly.

NFTs are a relatively recent concept that has been noticed by investors. They are a good way to invest in the crypto economy, as they offer a number of benefits. These include:

Authenticity - NFT platforms store immutable records on their blockchains, ensuring that only vetted sellers can sell their products. This allows buyers to be certain that they are purchasing genuine assets, and not counterfeit copies.

Variety – NFT platforms have a growing number of new and innovative creators. Users can now purchase everything from artworks to virtual real estate with ease.

Signing up - NFT platforms can vary from one site or another. Most require you either to register an address or connect a wallet. You can do this either directly on the platform or through a mobile application.

Wallet Support – Many NFT platforms support various blockchain wallets like MetaMask (WalletConnect), which will allow you to safely store your NFTs once they have been purchased.

Best NFT Trading Platform - Binance

Binance NFT Marketplace allows users to trade, buy, and sell NFTs. The platform uses a smart-contract system and supports multiple currencies, including ETH.

You can also purchase NFTs completely randomised at a lower cost by using the "Mystery Box" feature.

Binance NFT marketplace can be connected to the main Binance stock exchange. You can deposit and withdraw fiat currency from it with ease. You can deposit funds using credit cards, debit cards, and PayPal, and the exchange offers a number of features to make trading easy.

Top NFT creators - Makersplace

NFT sites allow digital artists to showcase their works. These sites are a great way to reach a global audience and increase your visibility on the internet.

These platforms can help increase exposure to potential buyers worldwide and collectibles lovers around the globe. These platforms allow you to edit, publish, and create your NFTs.

These platforms can also be used to help you build a wealth of NFTs that will appreciate in value over the years. These platforms offer an easy-to use interface that makes selling, editing, creating and creating NFTs simple.

Apart from NFTs, these marketplaces also offer many other digital collectibles or gaming items. These include weapons and costumes as well as pets, which you can buy through Axie Infinity.

FAQ

Frequently Asked questions

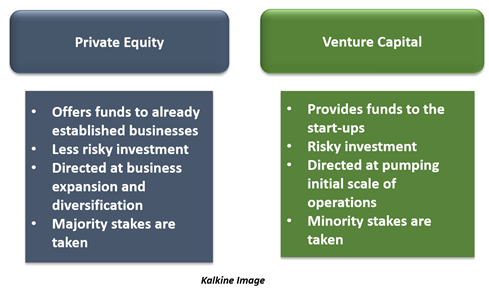

What are the different types of investing you can do?

Investing is a way for you to grow your money and possibly make more long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Which trading site is best for beginners?

All depends on your comfort level with online trades. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

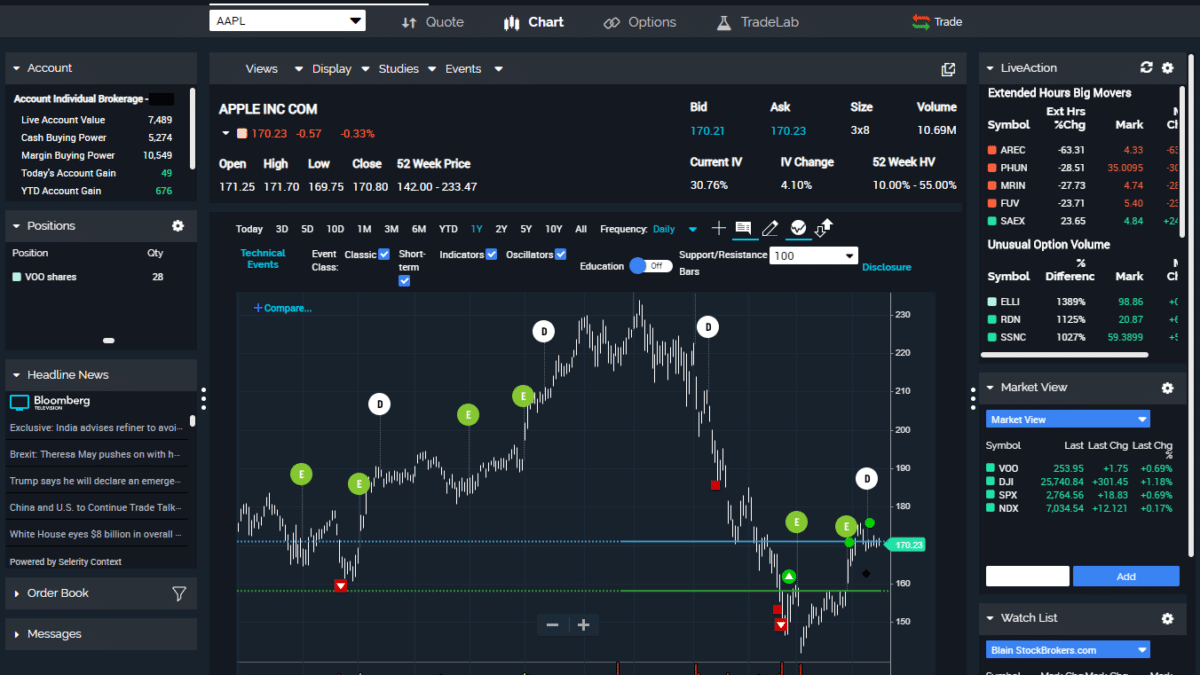

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Can forex traders make any money?

Yes, forex traders can earn money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Can you make it big trading Forex or Cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. You need to be aware of the market trends so you can make the most of them.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. You should also trade with only the money you have the ability to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are other ways to make money than investing in the stock market.

One option is to invest in real property. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Cryptocurrency: Is it a good investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

There are also potential gains if one is willing to risk their investment and do some research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

When investing online, research is essential. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

Learn about the investment's risk profile and review the terms and condition. Before you open an account, check what fees and commissions might be taxed. Do your due diligence and make sure you get what you pay for. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.