Stock trading websites can prove to be an invaluable resource for novice investors as well as experienced traders. These sites have everything, from stock market research and news to trading signals, options traders, and cryptocurrency. Some sites even offer virtual trading accounts that allow you to practice before investing real money.

These stock research sites are the best for helping you to find the right stocks. These sites offer ratings and research reports as well as screening tools, which will make it easier to identify stocks that you like.

E*Trade

E*Trade is one the most trusted and oldest stock trading websites. It is a digital brokerage which makes online trades starting in 1983.

It also has a physical branch network, so you can meet with financial advisors in person to talk about your goals and strategies. To take advantage of their services, however, you will need to open an account.

Investing in stocks can be a complicated and rewarding process, but it doesn't have to be intimidating. These stock trading websites were created to help beginners learn about investing and build a strong portfolio.

WallStreetZen

This stock research website is for both beginners and experienced traders. This website uses simple screens and charts to give you all the information that you need to make informed decisions about a stock.

You can also find educational articles, podcasts, or other resources to help you in your journey. These articles have been written by an expert team and aim to help you better understand the stock markets and make informed investment decisions.

Motley Fool

The Motley Fool is a top-tier stock market research and advice site that has been providing products and services to investors since 1993. Its CAPS community lets you track stocks, communicate with other investors and build a portfolio.

Webull

Webull is a commission-free online stock broker with extended hours trading, real-time market quotes, customizable charts, multiple technical indicators, and analysis tools. Its mobile app makes placing orders easy and allows you to access your account from any location.

You can also deposit or withdraw money with ACH verification.

Mindful Trader

It doesn't really matter if your goal is to start investing online, or if it's to advance your trading skills. This means ensuring that the site offers up-to-date, accurate information and updates its service as frequently as possible.

In fact, many of the research websites on our list of top stock trading sites provide trade alerts to customers several times per day. This feature is important for your success in the stock markets, even though it is often forgotten by traders.

FAQ

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Which trading platform is the best?

Many traders can find choosing the best trading platform difficult. It can be overwhelming to pick the right platform for you when there are so many options.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

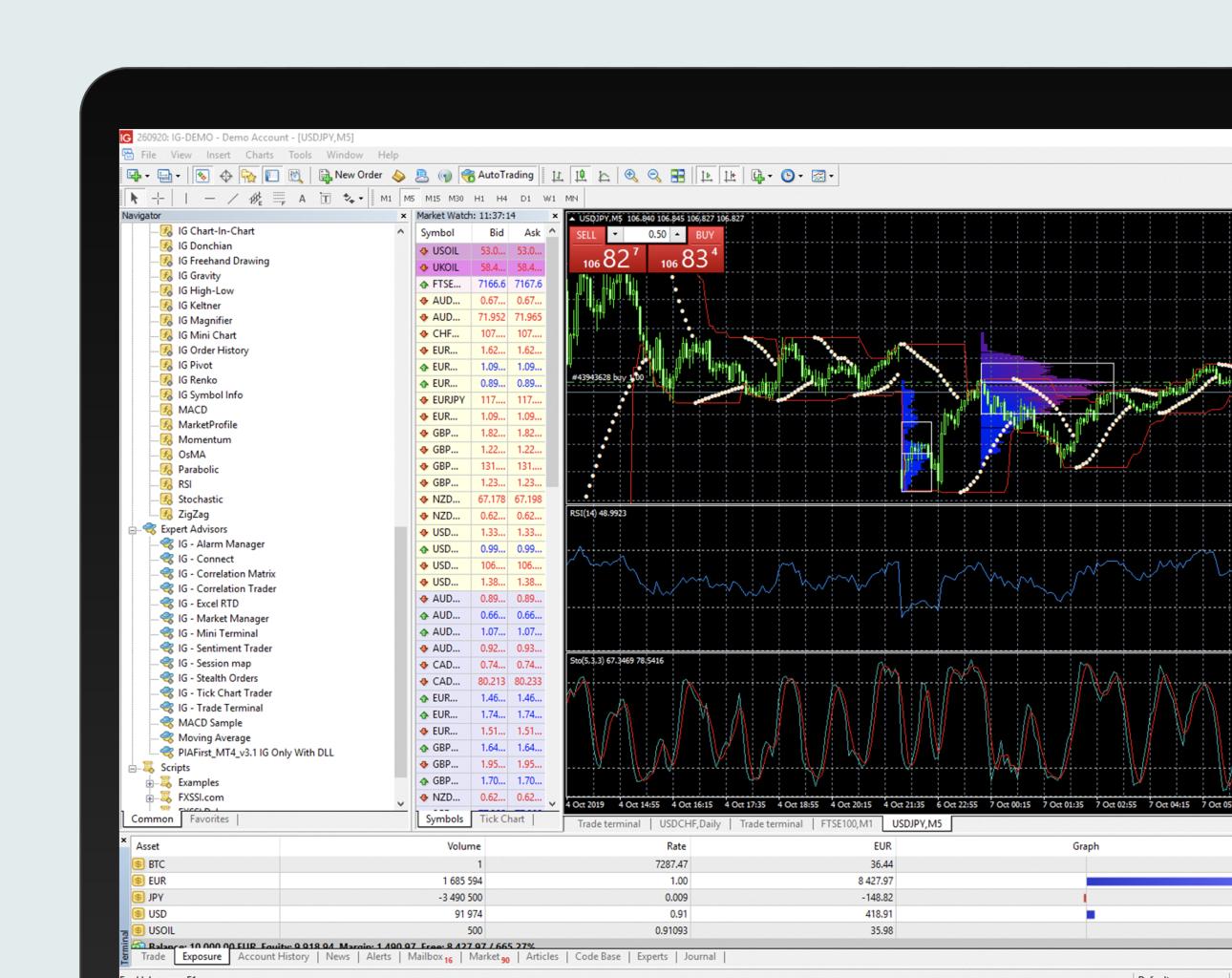

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Can one get rich trading Cryptocurrencies or forex?

You can make a fortune trading forex and crypto if you take a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Knowing how to spot price patterns can help you predict where the market will go. Also, you should only trade with money that is within your means.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Understanding the different currency conditions is crucial.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

How do I invest in Bitcoin

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need are the right tools and knowledge to get started.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which trading site for beginners is the best?

Your level of experience with online trading will determine your ability to trade. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Safety is a must when it comes to online investment accounts. It's vital that you protect your data, assets and information from unwelcome intrusion.

First, make sure that your platform is secure. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. You should also regularly review your account activity to ensure you are aware of any suspicious links or downloading unfamiliar software. This will allow you to quickly detect possible threats and take appropriate action.

Thirdly, make sure you understand your investment platform's terms and conditions. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, be sure to research the company where you plan on investing. Look at user reviews to get a feel for how the platform works. Make sure to understand the tax implications of investing online.

By following these steps, you can ensure that your online investment account is secure and protected from any potential threats.