Market chameleon is an online trading research platform that offers a wide variety of tools for both stock and options traders. The tool allows traders to create watch lists and set up alert triggers that target specific stocks or options.

Option traders who want to optimize their strategies can also use the platform's unusual options volume scanner. This scanner automatically detects stocks for which options are being traded at a higher rate than usual. This could be a sign of potential catalysts or a trading opportunity that could bring in profits.

Market Chameleon also has an Earnings calendar. This calendar shows price reactions to stocks in the days before, during and after earnings releases. This helps you stay informed about market movements and trends so that your investments are well-informed.

Additionally, traders can view order imbalances. These imbalances can occur when large fund traders place order at the end of a trade day based upon closing prices. Investors have an insight into market sentiment by institutional money.

Financial analysts often use historical data to evaluate stock performance and stock movements. It is important to have a reliable database with years of historical data.

Market Chameleon offers a free trial account that will allow you to access this information. This will allow you to test the service and decide whether it's worth the price tag.

The company offers several plan options, which can all be customized to meet your needs and financial budget. The free plan gives you access to basic tools. The paid plans give you more advanced features.

If you want to see how the system works, you can try it out for free with a 7-day trial. If you aren't satisfied with the service, it is possible to cancel your subscription.

Market Chameleon features a variety of features that can be used by traders of any experience level. Market Chameleon's stock screeners make it easy to search through thousands of trade options. Additionally, you can set up custom watchlist filters to zero in on stocks that are ideal for your investment strategies.

Market Chameleon offers a flexible options screener, which allows you monitor changes in bullish/bearish activity over time. You can also zero in on stocks that are in your watchlist. This screener displays the top stocks that are bullish and bearish based on recent options activity.

The options strategy screener in Market Chameleon is designed to help investors define their strategies and trading rules based on extensive data. This can be especially helpful for newer options traders. It allows users to backtest their strategies and see how they perform in a real-life environment before making any decisions about buying or selling the underlying security.

FAQ

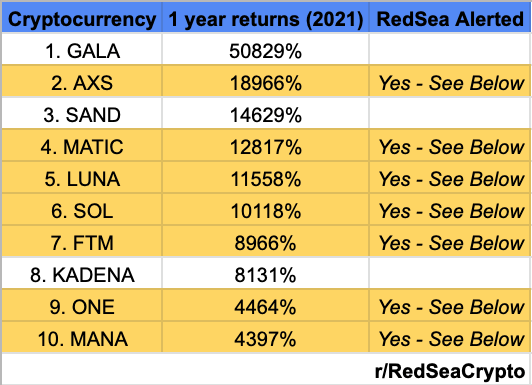

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

Knowing how to spot price patterns can help you predict where the market will go. Also, you should only trade with money that is within your means.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Where can I earn daily and invest my money?

Although investing can be a great investment, it's important that you know your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. Property investments can yield steady returns, long-term appreciation, and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which trading platform is best?

Many traders find it difficult to choose the right trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also offer an intuitive and user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Is Cryptocurrency Good for Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

How Can I Invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need are the right tools and knowledge to get started.

You need to be aware that there are many investment options. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which is better forex trading or crypto trading.

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it's important to understand both the risks and the benefits.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I ensure security for my online investment accounts?

Safety is a must when it comes to online investment accounts. Protecting your assets and data from unwanted intrusion is essential.

First, you want to make sure the platform you're using is secure. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. You should also regularly review your account activity to ensure you are aware of any suspicious links or downloading unfamiliar software. This will allow you to quickly detect possible threats and take appropriate action.

Thirdly, make sure you understand your investment platform's terms and conditions. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Finally, you should be aware of tax implications for investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.