Learn Stocks

The stock market is a great place to invest your hard-earned cash. It can help you increase your retirement income and build wealth. You need to be familiar with the market in order to trade stocks.

Investing in stocks and learning how to trade them can be addictive. It is best to start small and build your portfolio over time. This will allow you to learn how to cut losses and never risk more than you can afford to lose.

Understanding the market

You can learn the most about the stockmarket by reading as much as you like. Read articles, news stories, or watch videos. This will give you an understanding of the terminology and jargon in the market.

This information will help you make better investment choices based on real-world information relevant to the company that you are investing in. This information could include the company's sales growth, profit margins or overall financial health.

Understanding your goals

You don't have to decide if you invest in stocks just for the fun of it or for retirement. This will enable you to choose the best companies and industries for your needs so you can trade more successfully.

Fundamental analysis is the process by which a company's financial and performance are analyzed in order to predict future stock market movements. Earnings reports are often used to do this.

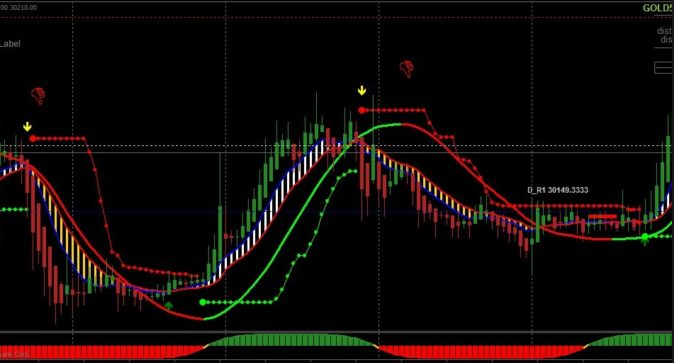

Candlesticks are another tool that traders use to track the direction of a stock. Patterns are also important to traders, such as bullish homing patterns, evening star patterns and bear pennants. These patterns give traders an excellent idea of where a stock might be headed. Therefore, it is important to understand how to interpret these patterns.

All of these patterns are available in any trading book. But it is better to learn them in detail to be ready for when trading begins.

Picking the right stock to invest

It is always a good idea that stocks have a history of success. This will give you confidence when trading begins and make it easier to choose which stocks to purchase.

Learn how to trade many stocks

It is a good idea to diversify your portfolio with various types of stocks. This will lower your risk and help you avoid being too invested in one industry or company.

You should also learn how to trade stock market using multiple strategies. This will help you become more familiar with the process and allow you to develop your own style of trading.

FAQ

Which forex or crypto trading strategy is best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases, it's important to do your research before making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to know the types of trading strategies you can use for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading platforms or bots are also available to assist traders in managing their investments. It is important to understand the risks and rewards associated with each strategy before investing.

What are the disadvantages and advantages of online investing?

Online investing has the main advantage of being convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

You should also be aware of the different investment options available to you when investing online. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Which is safe crypto or forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Which trading site for beginners is the best?

It all depends upon your comfort level in online trading. You can start by going through an experienced broker with advisors if this is your first time.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Cryptocurrency: Is it a good investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protect yourself. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Unsolicited email or phone calls should not be answered. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. Before making any commitments, thoroughly research investment opportunities independently.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Lastly, always remember "Scammers will try anything to get your personal information". Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

It's also important to use secure online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before you make any investment, read and understand the terms of any website or app that you use.